What Is Not An Advantage Of The Corporate Form Of Business Organization

It has limited life. Disadvantages of a corporation.

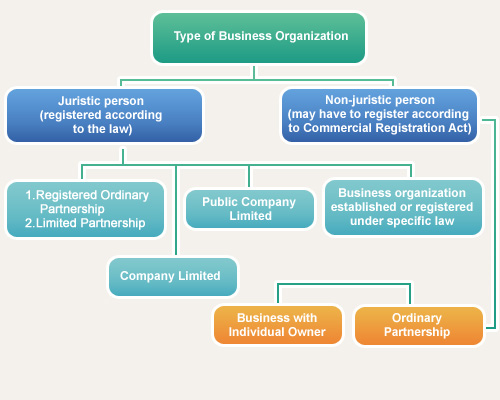

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

- No personal liability.

What is not an advantage of the corporate form of business organization. License fees and franchise taxes are not assessed against corporations. Some advantages of an LLC include. - Favorable tax treatment.

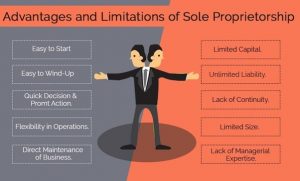

Its ownership is easily transferable via the sale of shares of stock. Its owners personal resources are at stake. As the name states owners and managers have limited personal liability for business debts whereas individuals assume full responsibility in a sole proprietorship or partnership.

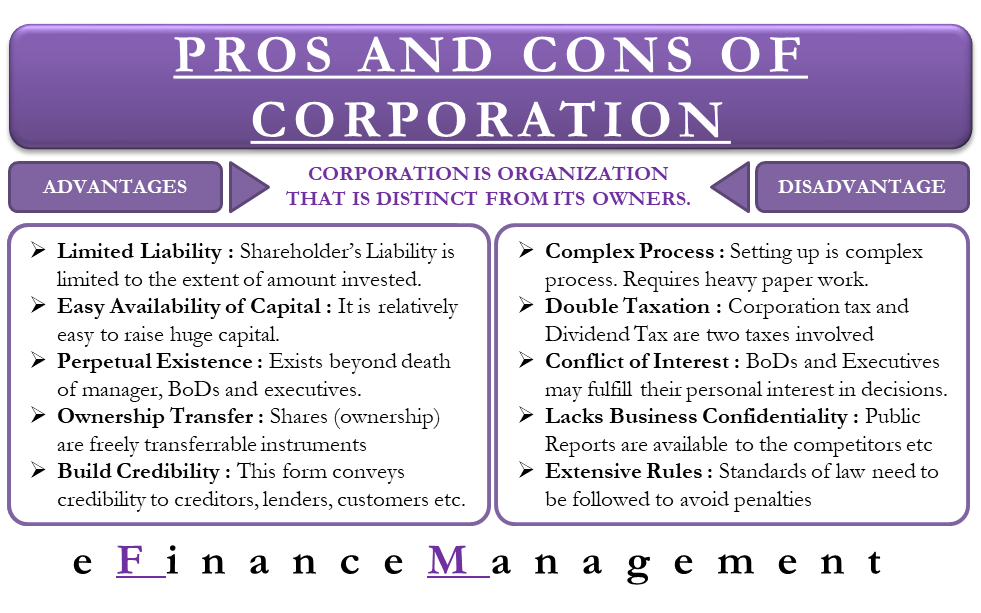

Extensive Rules to Follow. The cost of forming and maintaining a corporation is minimal. Out of all business forms corporations are the most complex to form and operate.

Organizing a business in. Limited liability of stockholders c. All important decisions are taken either by the Board of Directors or are referred to general house.

If some business opportunity arises and a quick decision is needed it will not be possible to arrange meetings all of a sudden. Corporations Lack Business Confidentiality. The shareholders of a corporation are only liable up to the amount of their investments.

The corporate form of organization has an advantage over its two rivals in at least three respects. The biggest advantage for Tom and Tim is the limited liability that a corporation provides for its shareholders. Corporations enjoy most of the rights and responsibilities that an individual has.

The corporate entity shields them from any further liability so their personal assets are protected. Its owners personal resources are at stake. - Easy to transfer ownership.

Additionally establishing a corporation can be time consuming and more expensive than other business structures. Before deciding to form a corporation however consider the following disadvantages that might overshadow any benefits. 1 it diffuses financial responsibility 2 it survives the death of its owners and 3 it permits of larger accumulations of capital.

Decision-taking process is time consuming. The corporate form of organization presents some advantages for Tom and Tim. Which of the following is not an advantage of the corporate form of business organization.

It is restricted by more regulations more closely monitored by governmental agencies and are more costly to incorporate than other forms of the organizations. Its ownership is easily transferable via the sale of shares of stock. It is simple to establish.

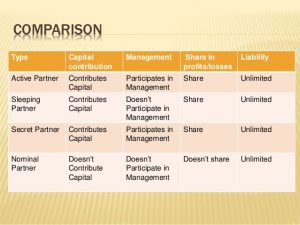

An advantage of the corporate form of business is that a. Individual owner liability is limited to the value of stock they are holding in the corporation. Control of a corporation may be held by those with a minority of the investment.

An advantage of the corporate form of business is that a. Which of the following is not an advantage of the corporate form of business organization. Which of the following is an advantage of corporations relative to partnerships and sole proprietorships.

A single enterpriser as we have seen must assume all of the financial risks of his business. This objective can be accomplished in other ways like a partnership but the corporate form of organization is arguably one of the better vehicles. Which of the following is an advantage of the corporate form of organization.

Likewise in a partnership each partner is financially liable for the entire indebtedness of. A disadvantage of the corporate form of organization is that corporate stockholders are more exposed to personal liability in the event of bankruptcy than are investors in a typical partnership. The Advantages of the Corporate Form of Business Organization.

Some refer to a corporation as a legal person. They can enter into contracts take a loan sue and be sued own assets pay taxes hire employees etc. - Easy to raise funds.

One advantage of the corporate form of organization is that it permits otherwise unaffiliated persons to join together in mutual ownership of a business entity. Unlimited personal liability for stockholders U d. In company form of organization no single individual can make a policy decision.

There are a number of financial and legal advantages gained by operating an organization in corporate form. This form of business is a hybrid of other forms because it has some characteristics of a corporation as well as a partnership so its structure is more flexible. The advantages of the corporation structure are as follows.

It has limited life.

C Corporation Formation Services Ez Incorporate C Corporation Corporate Legal Separation

C Corporation Formation Services Ez Incorporate C Corporation Corporate Legal Separation

What Is Difference Between Corporation Llc Limited Partnership And Sole Proprietorship In C Sole Proprietorship Limited Partnership Limited Liability Company

What Is Difference Between Corporation Llc Limited Partnership And Sole Proprietorship In C Sole Proprietorship Limited Partnership Limited Liability Company

Forms Of Business Units Form 2 Business Studies Notes Knec Kasneb Kism Ebooks Kenya Business Studies Study Notes Business

Forms Of Business Units Form 2 Business Studies Notes Knec Kasneb Kism Ebooks Kenya Business Studies Study Notes Business

Cs Foundation Detailed Explanation Of Forms Of Business Organization Business Organization Business Sole Proprietorship

Cs Foundation Detailed Explanation Of Forms Of Business Organization Business Organization Business Sole Proprietorship

Advantages And Disadvantages Of The Corporate Form Of Business

Advantages And Disadvantages Of The Corporate Form Of Business

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Great Activity For Introduction To Business And Marketing Course Through This Activity Stude Business Ownership Importance Of Time Management Online Education

Great Activity For Introduction To Business And Marketing Course Through This Activity Stude Business Ownership Importance Of Time Management Online Education

C Corporation Formation Services Ez Incorporate C Corporation Corporate Investing

C Corporation Formation Services Ez Incorporate C Corporation Corporate Investing

Advantages And Disadvantages Of Corporations Efinancemanagement

Advantages And Disadvantages Of Corporations Efinancemanagement

Partnership Vs Corporation Vs Sole Proprietorship Pesquisa Google Sole Proprietorship Starting A Business Corporate

Partnership Vs Corporation Vs Sole Proprietorship Pesquisa Google Sole Proprietorship Starting A Business Corporate

Benefits Of Incorporating Business Law Small Business Deductions Business

Benefits Of Incorporating Business Law Small Business Deductions Business

Joint Stock Company Meaning Types Kinds Features Merits Demerits Characteristics Advantages Disavantages Pros And Cons

Joint Stock Company Meaning Types Kinds Features Merits Demerits Characteristics Advantages Disavantages Pros And Cons

Comparable Company Analysis Business And Financial Profile Fourweekmba Analysis Financial Financial Analysis

Comparable Company Analysis Business And Financial Profile Fourweekmba Analysis Financial Financial Analysis

3 Drivers To A Sustainable Competitive Advantage Corporate Strategy Change Management Strategies

3 Drivers To A Sustainable Competitive Advantage Corporate Strategy Change Management Strategies

C Corporation Bookkeeping Business Business Notes C Corporation

C Corporation Bookkeeping Business Business Notes C Corporation

Comparison Chart Of Business Entities Startingyourbusiness Com Sole Proprietorship Business Comparison

Comparison Chart Of Business Entities Startingyourbusiness Com Sole Proprietorship Business Comparison

Advantages And Disadvantages Of Limited Liability Company

Advantages And Disadvantages Of Limited Liability Company

How To Take Money Out Of An S Corporation Amy Northard Cpa The Accountant For Creatives S Corporation Take Money Small Business Tax

How To Take Money Out Of An S Corporation Amy Northard Cpa The Accountant For Creatives S Corporation Take Money Small Business Tax