What Does Writing Something Off As A Business Expense Mean

If you earned 50000 and deducted a. Although youll often see the term used to refer to business expenses individuals may also be able to write off certain deductible expenses to reduce the amount of income they have to pay tax on.

How To Retire Early As A Millionaire In 7 Simple Steps Budgeting Money Management Business Expense

How To Retire Early As A Millionaire In 7 Simple Steps Budgeting Money Management Business Expense

That is you must use the item you buy for your business in some way.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

What does writing something off as a business expense mean. A write-off primarily refers to a business accounting expense reported to account for unreceived payments or losses on assets. For many this is the trickiest part of filing their income tax particularly because there is a fine line between which expenses are deductible and which ones are not. When an the owner writes off costs or expenses for his LLC the owner deducts the cost or expense from the gross income of the business.

Mar 23 2021 You can write off the cost of your home office if it is your principal place of business. This means its the place you work every day. A write-off is also called a tax deduction.

Jun 24 2017 An expense must be related to your business to be deductible. For example the cost of a personal computer is a deductible business expense if you use the computer to write business reports. An inventory write-off may be recorded in one of two ways.

These expenses are subtracted from revenue to figure out total taxable income for a company. Basically lets say you made 75000 last year and have 15000 in write-offs. Feb 25 2019 Before you can determine if you should do so you may wonder what it means to write something off on your taxes.

The IRS not only acknowledges the practice of write-offs but encourages them referring to them as tax deductions. Business write offs are expenses that are essential to running your business and can be claimed as tax deductions. If you are a person who works for a company it typically means submitting for reimbursement.

You cannot deduct purely personal expenses as business expenses. Direct being a form of payment that the company pays directly or indirectly being you pay and they write you a check. The tax code allows self-employed workers to write off various.

But you can deduct the rent on your other office space. Jan 11 2017 How does a write-off work lowering taxable income. Well a write-off is any legitimate expense that can be deducted from your taxable income on your tax return.

The purpose of a write-off in business is to reduce tax liability. Jan 17 2020 Any expenses you incur that are necessary for your business trip like registration for an event renting equipment for a presentation or dry cleaning and laundry for your business apparel all qualify for tax deduction. A write-off also known as a deduction is generally any expense that you can use.

An inventory write-off is an accounting term for the formal recognition of a portion of a companys inventory that no longer has value. Its seen people try to claim all sorts of strange things as business expenses. Expenses that arent tax-deductible.

Theres no getting one over on the IRS. Whether it is direct or indirect. Three common scenarios requiring a business write-off include unpaid.

Oct 23 2020 Tax write-off is an unofficial term for expenses that you may be able to deduct on your federal income tax return. What does it mean to write off a business expense. This lowers the amount of taxable income you have during tax time.

The more expenses a small business owner can claim as write offs the less tax they likely have to pay. Dec 11 2010 Have you ever wondered just exactly what a write-off is. If you have an office space nearby that you work out of and use the home office on other days the home office does not qualify as a deduction.

That means you calculate your gross income for the year and then subtract expenses before figuring your taxes. That means your taxable income for the year would be 60000.

/accounting1-43190f28e3de426a9130cf4e47d22e6e.jpg) The Difference Between Write Offs And Write Downs

The Difference Between Write Offs And Write Downs

/GettyImages-953844116-dfba5a0cc61043f49cd25960e371bae9.jpg) Writing Off The Expenses Of Starting Your Own Business

Writing Off The Expenses Of Starting Your Own Business

Write Off Repayment Of A Business Loan Bankrate

Write Off Repayment Of A Business Loan Bankrate

Are You Unsure What Expenses Are Deductible For You Business This Infographic List The Most Business Expense Bookkeeping Business Small Business Bookkeeping

Are You Unsure What Expenses Are Deductible For You Business This Infographic List The Most Business Expense Bookkeeping Business Small Business Bookkeeping

.svg)

Can You Write Off Work Clothes Bench Accounting

Can You Write Off Work Clothes Bench Accounting

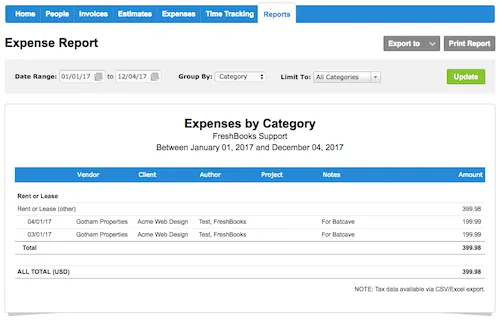

What Is An Expense Report And Why They Re Important For Small Businesses

What Is An Expense Report And Why They Re Important For Small Businesses

Business Gross Investment Definition Its Home Business Ideas For Ladies At Home Business Tax Obligations Redes Sociales Cocteles Con Tequila Jugo De Arandanos

Business Gross Investment Definition Its Home Business Ideas For Ladies At Home Business Tax Obligations Redes Sociales Cocteles Con Tequila Jugo De Arandanos

What Is A Tax Write Off Tax Deductions Explained The Turbotax Blog

Taxes You Can Write Off When You Work From Home Infographic Bookkeeping Business Small Business Tax Business Tax Deductions

Taxes You Can Write Off When You Work From Home Infographic Bookkeeping Business Small Business Tax Business Tax Deductions

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

What Is A Tax Write Off Tax Deductions Explained The Turbotax Blog

What Are Some Tax Write Offs For An Llc Legalzoom Com

:max_bytes(150000):strip_icc()/shutterstock_138342692-5bfc367dc9e77c0058795bd2.jpg)

:max_bytes(150000):strip_icc()/taxes-5bfc3576c9e77c0026b6dba1.jpg)

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/cityscapes-architecture-1026403956-e56d008c78494883a19e2fe793493d06.jpg)