Whats A W8 Form

This is called backup withholding. The W-8BEN form is applicable to foreign individuals and sole proprietors who earn money or income from US.

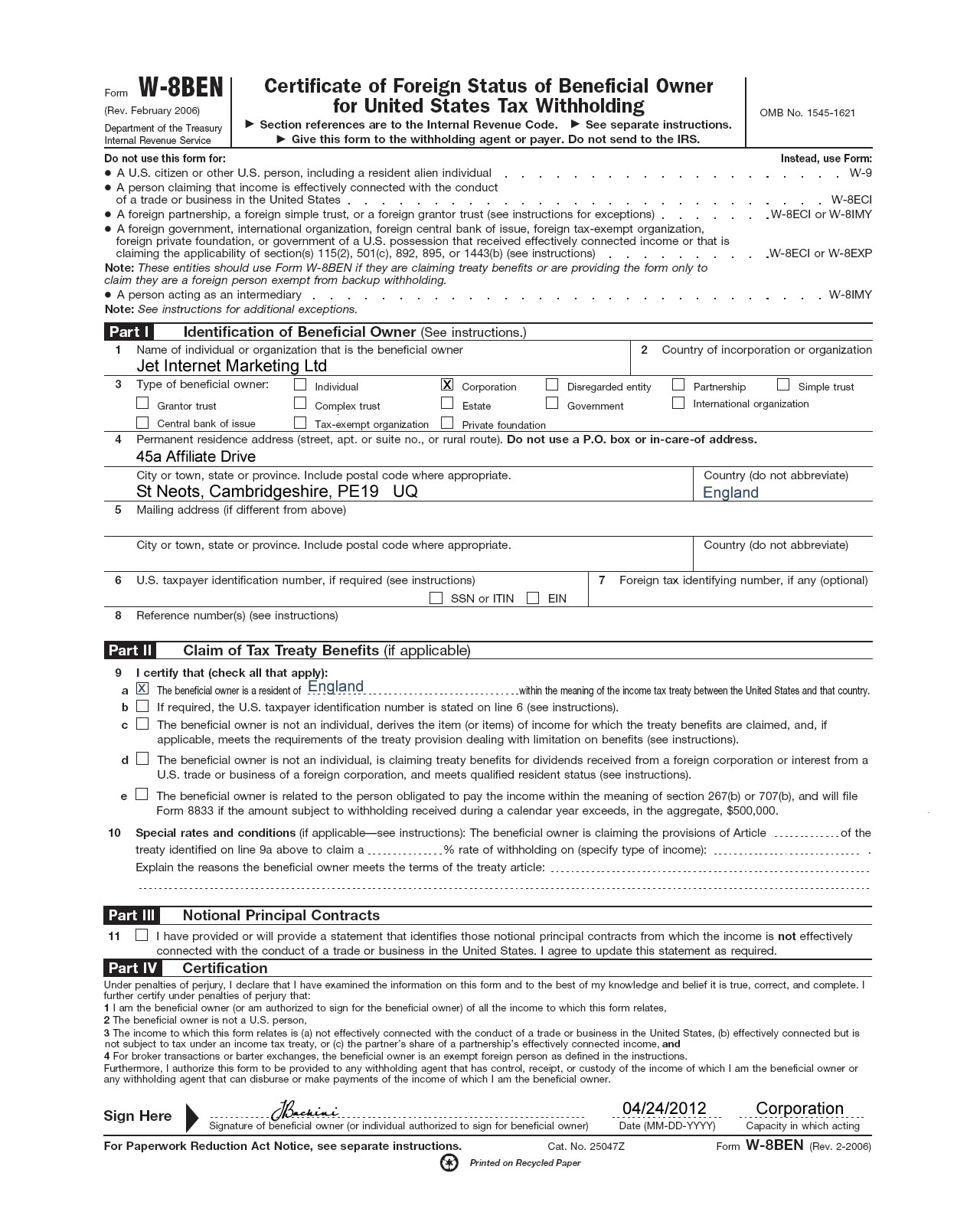

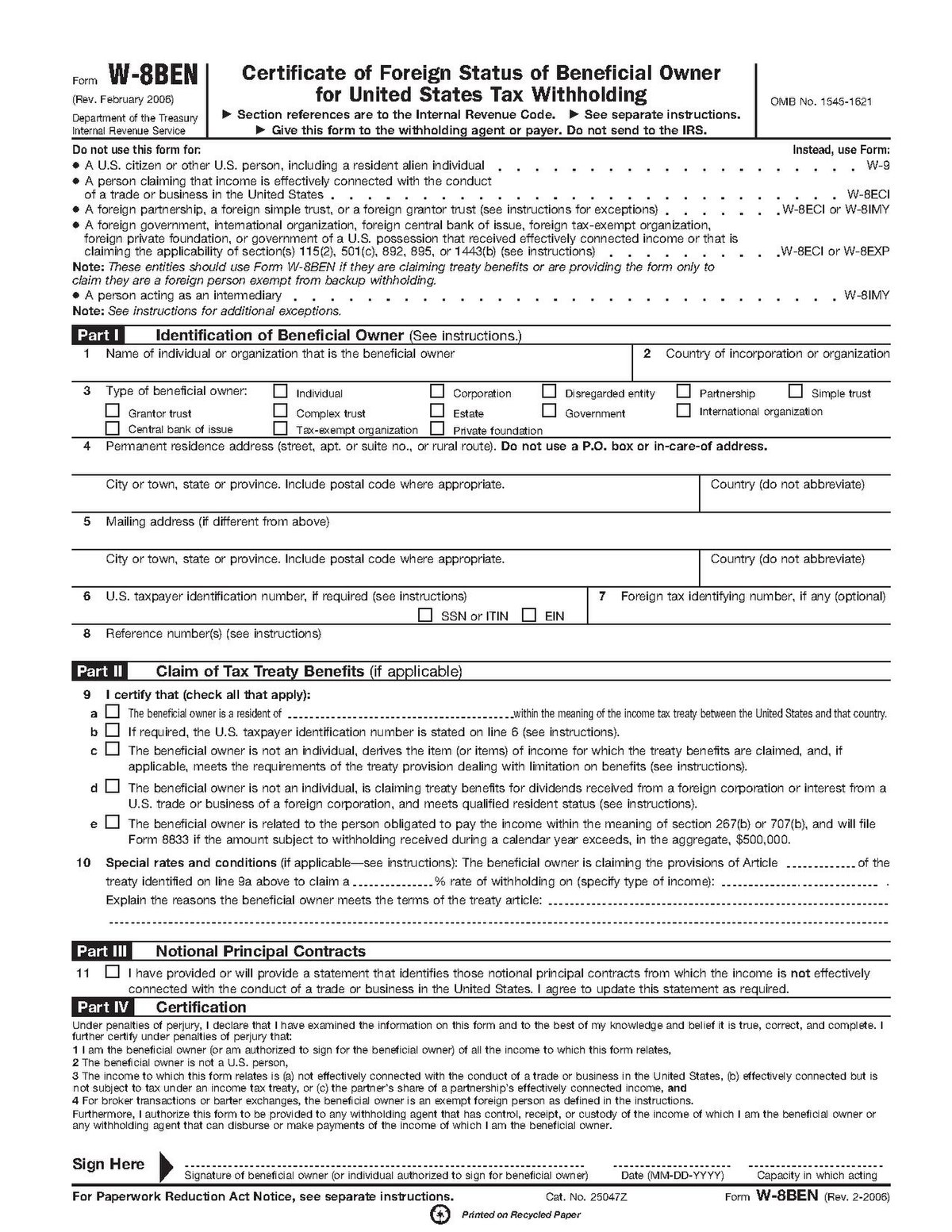

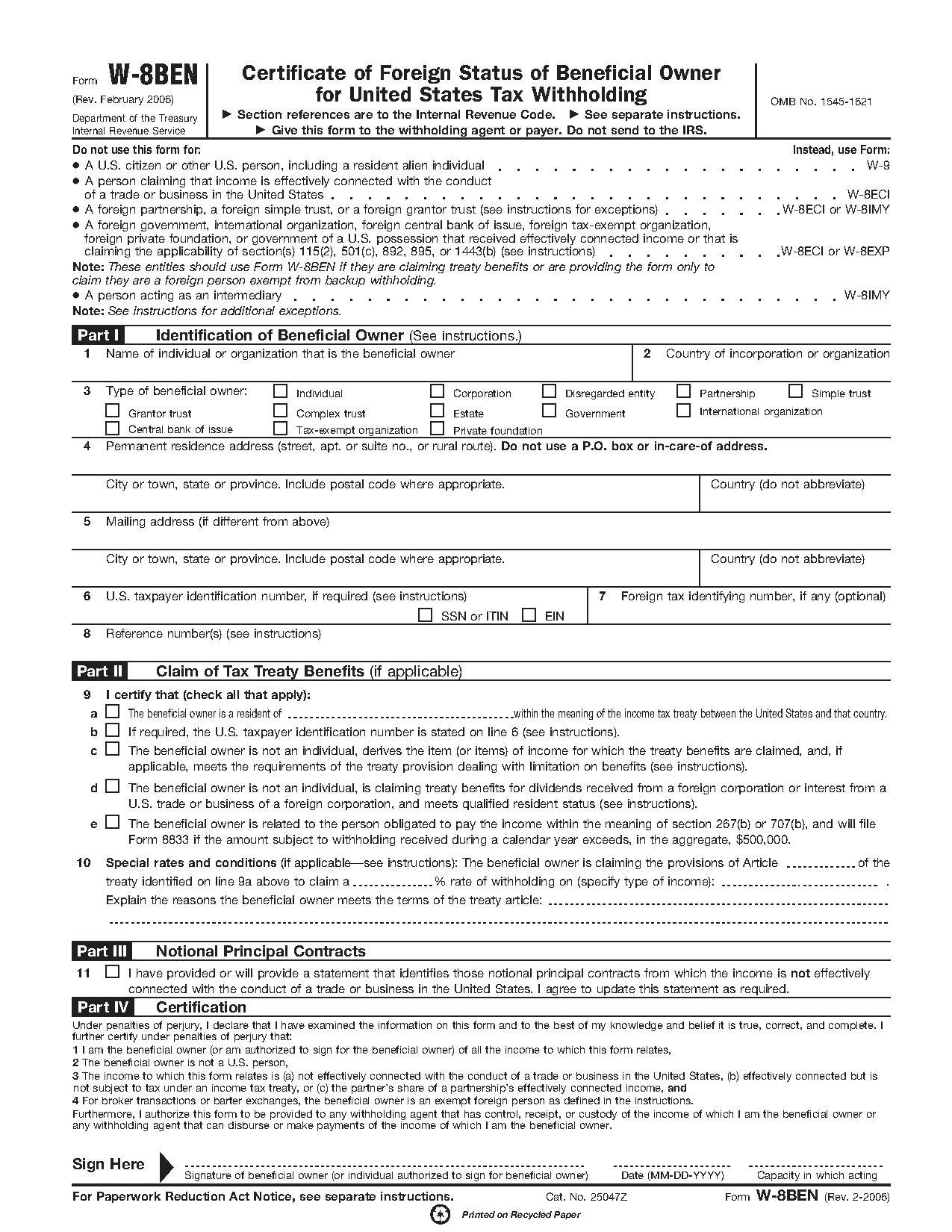

File Form W8 Ben 2006 Pdf Wikimedia Commons

File Form W8 Ben 2006 Pdf Wikimedia Commons

A Form W-8 is an Internal Revenue Service IRS form that grants a foreigner exemption from certain United States information return reporting as well as backup withholding regulations.

Whats a w8 form. Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. A W-8BEN form is a tax document used to certify that your country of residence for tax purposes is outside of the United States. The US has an income tax treaty in place and FORM W-8BEN will establish your eligibility of treaty benefits.

About Form W-8 BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. A Requirement for Non-US Companies Selling Services to US Entities If you are a non-US SMB that is selling services to US entities these US entities will most likely ask you to fill out a. It is required because of an intergovernmental agreement between Canada and the US.

Form W-8 is filled out by foreign entities citizens and corporations in order to claim exempt status from certain tax withholdings. Form W-8 or substitute form must be given to the payers of certain income. If a taxpayer identification number or Form W-8 or substitute form is not provided or the wrong taxpayer identification number is provided these payers may have to withhold 20 of each payment or transaction.

Form W8 W 8BEN or W8 form is used by non-resident aliens who do work andor make income in the US. W-8BEN is used by foreign individuals who acquire various types of income from US. Form W-8BEN The W-8BEN Form is a tax form used by foreign persons and corporations to certify they are not citizens of the United States and establish their taxpayers status.

Branches for United States Tax Withholding and Reporting. Or by foreign business entities who make income in the US. You can send a copy of the form to your non-resident alien employees but theyll need to fill it out themselves.

The W-8BEN is a form required by the Internal Revenue Service IRS the United States tax agency. W-9 forms are used to provide a companys federal Taxpayer Identification Number TIN to an entity that makes taxable payments to said company. While the W-8BEN form and the W-8BEN-E require very similar information the W-8BEN-E form is a bit lengthier and requires a detailed description about the foreign business entity.

Which obligates Canadian Financial Institutions to provide this information. If you are a non-US person that does business in the US Form W-8BEN will establish your foreign status and allow you to claim tax exemption or reduced tax rates on US-sourced income. About Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

A completed W-8BEN form confirms that. The form exempts the foreign resident from certain US. Each is used under particular circumstances.

Branches for United States Tax Withholding and Reporting 0617. A W-8 form is a tax form that tells organizations and people doing business within the United States that the person they are doing business with is not a US. Whats a W 8 form In a nutshell a W 8 form is used by foreign businesses and non-resident aliens earning income from US.

W-8BEN forms are used to certify that foreign individuals not businesses have been paid with the appropriate withholding rate. Four different forms fall under the heading of a W-8 form. Client in order to avoid paying tax to the IRS.

This is an important piece of paper as it ensures you dont need to pay tax twice on US sourced income. Submit Form W-8 BEN when requested by the withholding agent or payer whether or. This would include disregarded entities owned by foreign individuals.

The difference between a W-9 or W-8 forms is that the W-9 tax form is only required to be used by companies or associations that are created or organised in the US under the United States laws. A W-8 form is a grouping of tax forms specifically for non-resident aliens and foreign businesses who have either worked in or earned income in the US. If youre a legal citizen of the United States at no point will you have to worry about filling out the form.

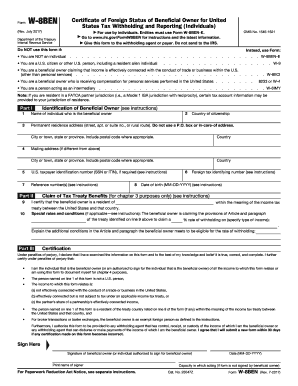

It declares the applicants status as a non-resident alien or foreign national and informs financial companies that they will be taxed differently than a resident. If youre a freelancer or sole proprietor and have started working with clients or customers in the US you might have been asked to complete a W8-BEN form. The official name for the W-8BEN form is the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals.

These individuals must provide a completed W-8BEN form to their US. Its purpose is mainly to.

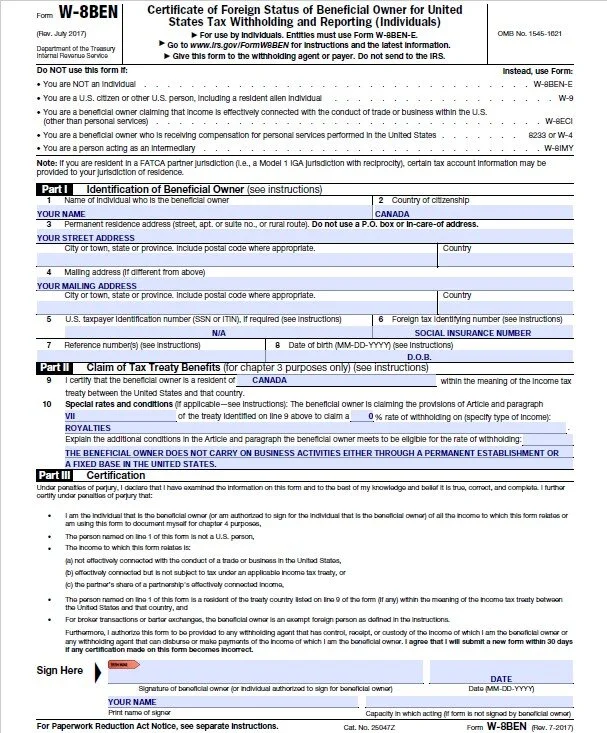

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

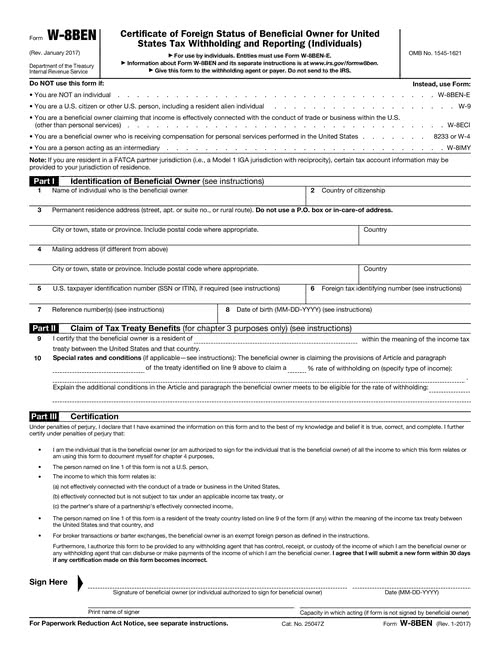

What Is A W 8 Form The Dough Roller

What Is A W 8 Form The Dough Roller

W 8ben Form Instructions For Canadians Cansumer

W 8ben Form Instructions For Canadians Cansumer

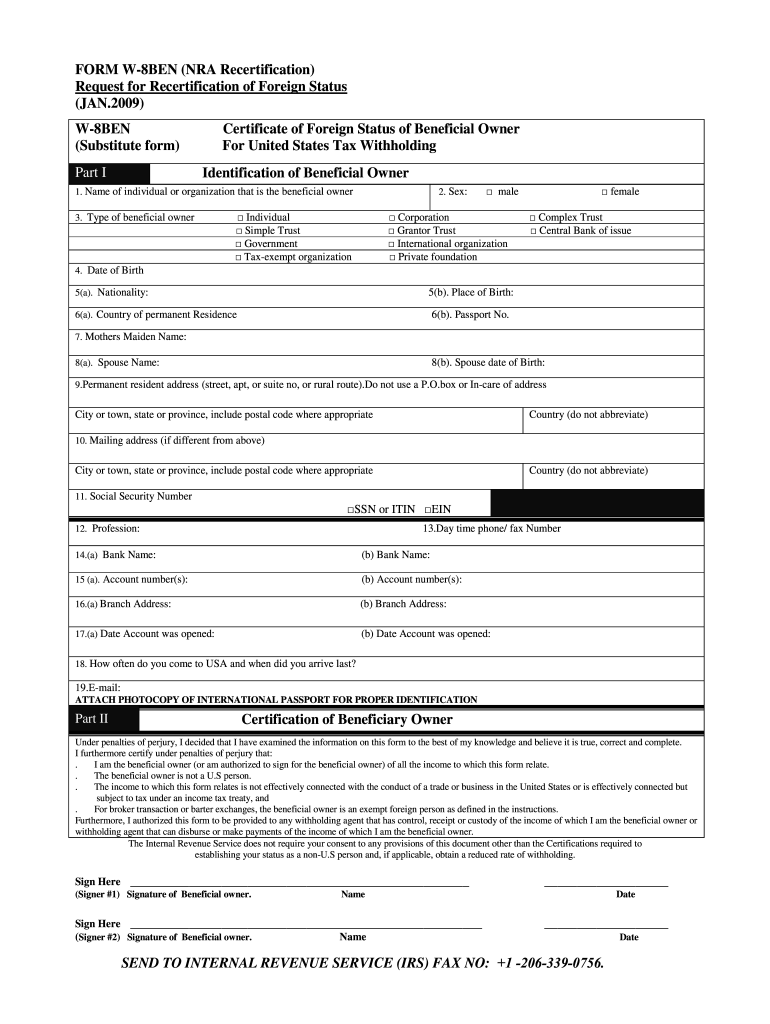

Fake Form W 8ben Used In Irs Tax Scams Don T Get Hooked

Irs W 8ben Form Template Fill Download Online Free Pdf

Irs W 8ben Form Template Fill Download Online Free Pdf

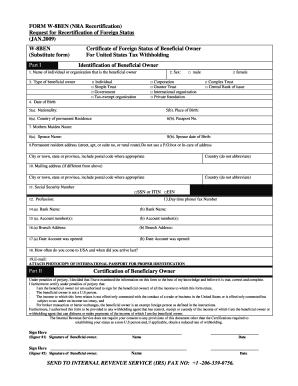

Irs W 8ben Substitute Form 2009 Fill Out Tax Template Online Us Legal Forms

Irs W 8ben Substitute Form 2009 Fill Out Tax Template Online Us Legal Forms

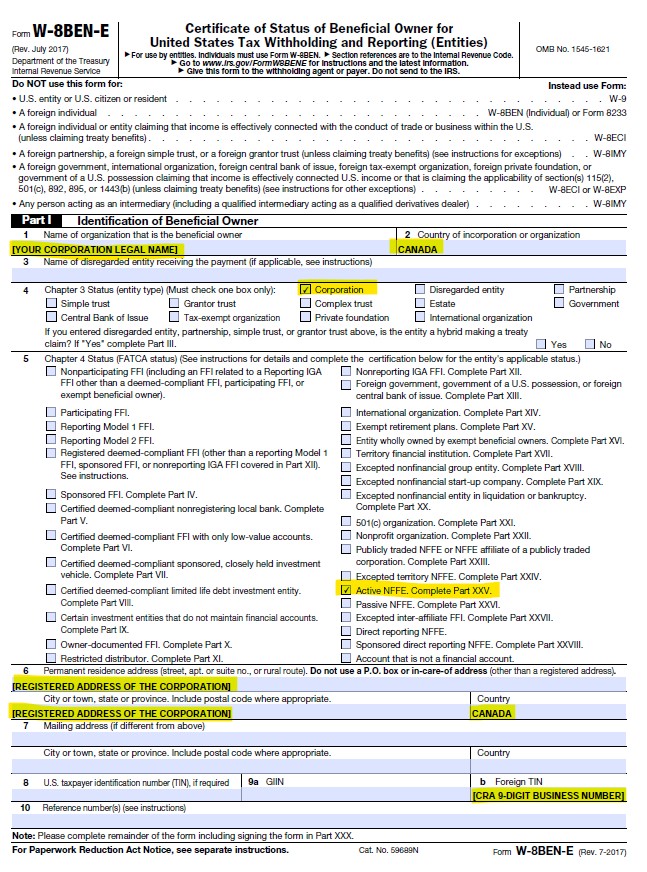

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

File Form W8 Ben 2006 Pdf Wikimedia Commons

File Form W8 Ben 2006 Pdf Wikimedia Commons

W 8ben Fill Out And Sign Printable Pdf Template Signnow

W 8ben Fill Out And Sign Printable Pdf Template Signnow

What Is A W 8 Form The Dough Roller

What Is A W 8 Form The Dough Roller

W8ben Fill Out And Sign Printable Pdf Template Signnow

W8ben Fill Out And Sign Printable Pdf Template Signnow

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Criminal Tax Considerations Tax Expatriation

Criminal Tax Considerations Tax Expatriation