How To Register For Mtd Vat With Hmrc

Reconnect your FreeAgent account to HMRC. From the Making Tax Digital section select Authenticate.

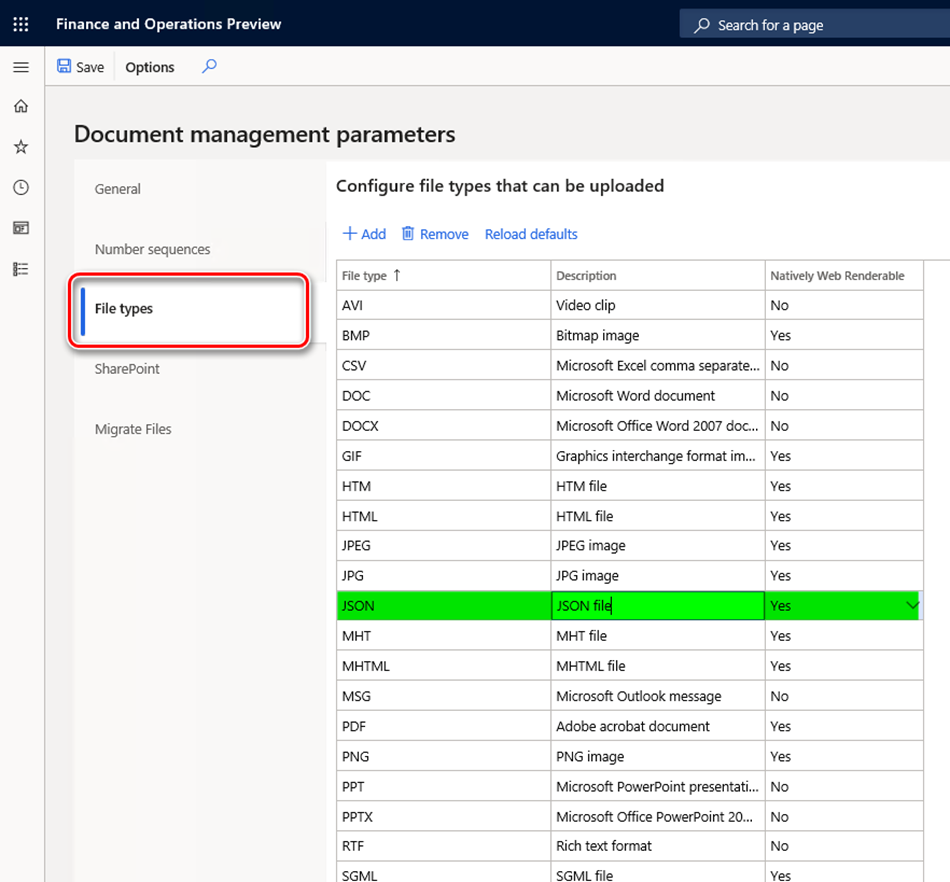

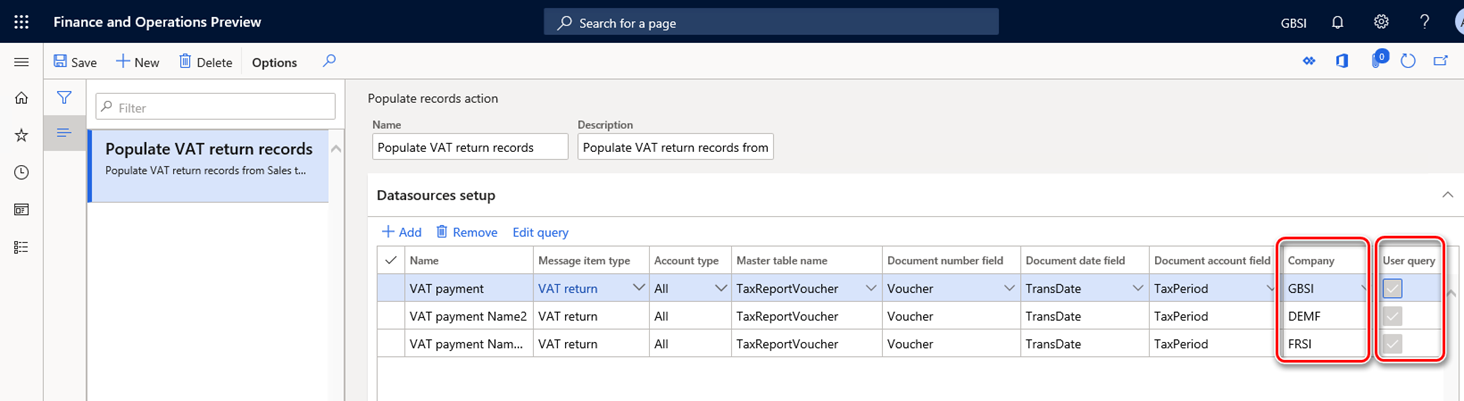

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

My question is about the software to be used to submit your VAT to be compatible with the MTD - HMRC is it a condition to be a paid software or does free software do the trick if it is only needed for submitting the VAT.

How to register for mtd vat with hmrc. Select I am signed up with HMRC for Making Tax Digital then select Authenticate. Watch this video to learn How to sign up for Making Tax Digital MTD for VAT ReturnsHMRCs new mandate comes into effect 1 April 2019. Details of how you currently file your VAT Return.

HMRC is encouraging businesses with a taxable turnover below the VAT threshold to sign up so they can also benefit from MTD. Have a closer look at FreeAgents features and take a 30-day free trial to get the preparation for your first MTD VAT return off to a flying start. Its possible to manually make VAT submissions using HMRCs website portal using your companys Business Tax Account and your VAT online account.

Delaying MTD for VAT registration. Register free My home. Businesses can also sign up for MTD for Income Tax.

Your VAT registration number. From the HMRC Connections page select Disconnect. This avoids the immediate need to register for MTD for VAT.

Theres a second solution to be aware of following April 2021. Check if you need to follow HMRCs rules for Making Tax Digital for VAT find software and sign up. In order to file VAT through the MTD.

Where taxable turnover is below the VAT threshold they can voluntarily join the MTD service now but from April 2022 all VAT returns will need to be completed and submitted using compatible MTD software. If your business hasnt yet made arrangements to sort out MTD registration its time to get it done. Voluntary VAT changes.

Select either Authorise full access or Authorise for VAT only. Select Continue when prompted and sign in with your Government Gateway credentials. There is another option if you are not ready for MTD or if you are under the threshold or part of a VAT Group.

To apply call or write to HMRC. If theyve made any other payments to their VAT bill. Keeping records for VAT - invoices VAT account signing up for Making Tax Digital for VAT sales and purchase records for reclaiming VAT.

Have a closer look at FreeAgents features and take a 30-day free trial to get the preparation for your first MTD for VAT return off to a flying start. Alternatively navigate to your company name at the top-right hand of your screen in FreeAgent select Connections and then choose Manage HMRC Connections. The Azets MTD for VAT bridging tool in our CoZone client portal can be used to complete and submit VAT returns to HMRC and is fully compliant with the new rules.

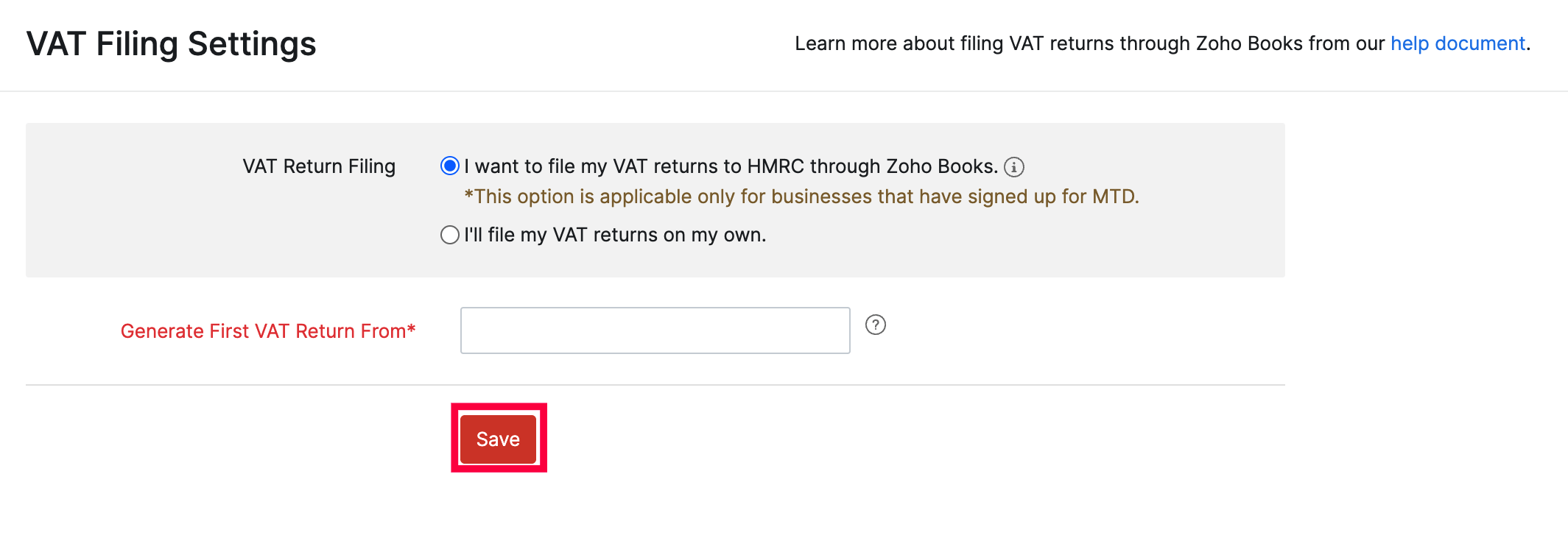

Your client will get an email and message in their VAT online account at least 3 days before HMRC takes the payment from their account. Sign into HMRC using your goverment gateway credentials. Enable MTD in QuickBooks.

It promises to revol. If you have dismissed the MTD message follow the steps to enable MTD. To enter your Agent Services Account number and password to Taxfiler.

Value Added Tax HMRC has tested all. Register for MTD for VAT with HMRC allow around seven working days While Wednesday 7th August 2019 is the first hard deadline for some quarterly VAT filers the amount of time it takes to sign up and register for MTD for VAT with HMRC. HMRC recommends businesses make their MTD registration as soon as their previous Direct Debit payment has been collected.

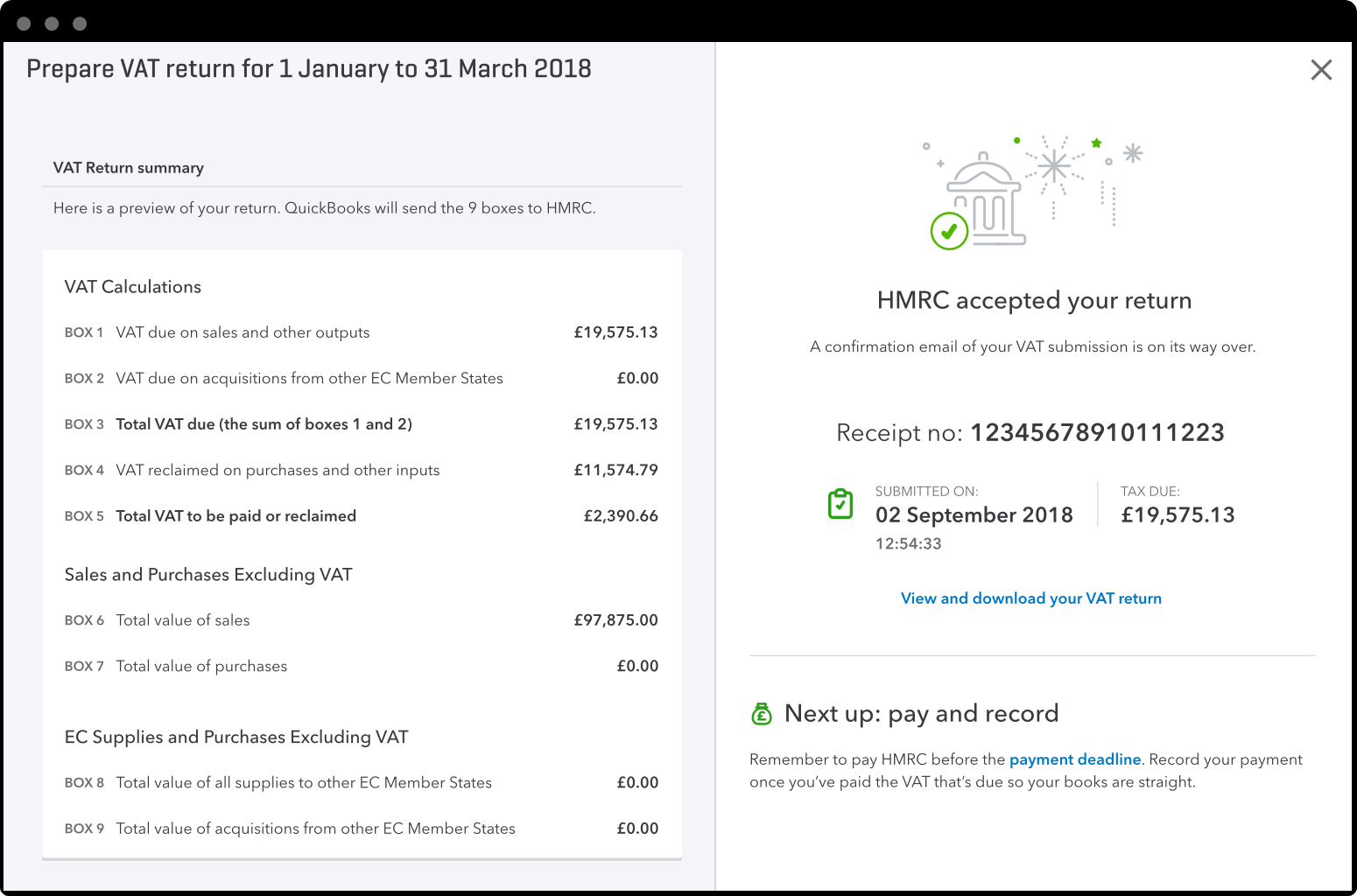

Agree to the declaration and click File Return. Review your return and click File Return. You should receive confirmation within 72 hours but do.

Go to the CONNECTIONS icon Choose the HMRC VATMTD tab. Once you have disconnected you will then be invited to select Connect FreeAgent to HMRC. In order to submit VAT returns to HMRC for MTD youll have to first authorise QuickBooks to interact with HMRC.

The first option is to register for MTD VAT with HMRC and then file VAT returns through the MTD VAT function in Xero you will need to do this from April 2022. Your business name and address. Go to Taxes and select Lets go.

Register for MTD for VAT with HMRC allow around seven working days While Wednesday 7th August is the first hard deadline for some quarterly VAT filers the amount of time it takes to sign up and register for MTD for VAT with HMRC. From Settings select Accounting Dates VAT. Register for VAT using the current VAT registration service complete the sign-up process and provide information about the business and the person running it After signing up the business will.

Please make sure that you enter your Agent Services ID and not. Click on the Gear icon then Account and Settings. Click the relevant VAT return and click Proceed.

Grant authority to interact with HMRC on your behalf. Click File VAT Small Businesses Sign up for MTD for VAT. You can register via HMRCs website which has a great step-by-step guide to help you with the process.

You will be taken to a GOVUK page where you will need to log in to give permission to Taxfiler to interact with HMRC on your behalf. This takes you to the Govuk website.

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Vitaltax Making Tax Digital Mtd For Vat

Vitaltax Making Tax Digital Mtd For Vat

Shopping For Software Ahead Of Making Tax Digital Tax Software Freelance Writing Digital Tax

Shopping For Software Ahead Of Making Tax Digital Tax Software Freelance Writing Digital Tax

How To Set Up Vat Online Read Tutorial Quickbooks Uk

How To Set Up Vat Online Read Tutorial Quickbooks Uk

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Prepare For Integration With Mtd For Vat United Kingdom Finance Dynamics 365 Microsoft Docs

Vat Automation Software Probovat Hmrc Approved

Vat Automation Software Probovat Hmrc Approved

Importance Of Professional Bookkeeping Services For Your Small Business Bookkeeping Services Bookkeeping Success Business

Importance Of Professional Bookkeeping Services For Your Small Business Bookkeeping Services Bookkeeping Success Business

How To Do An Online Vat Return With Hmrc Quickbooks Uk

How To Do An Online Vat Return With Hmrc Quickbooks Uk

How To Do An Online Vat Return With Hmrc Quickbooks Uk

How To Do An Online Vat Return With Hmrc Quickbooks Uk

Making Tax Digital Vat Returns How To Make Sure You Comply Quickbooks Uk Blog

Making Tax Digital Vat Returns How To Make Sure You Comply Quickbooks Uk Blog

Vat Return Services Bookkeeping Peterborough Business

Vat Return Services Bookkeeping Peterborough Business

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Does Mtd For Vat Makes Business Life Easier Homeowners Insurance Property Tax Make Business

Does Mtd For Vat Makes Business Life Easier Homeowners Insurance Property Tax Make Business

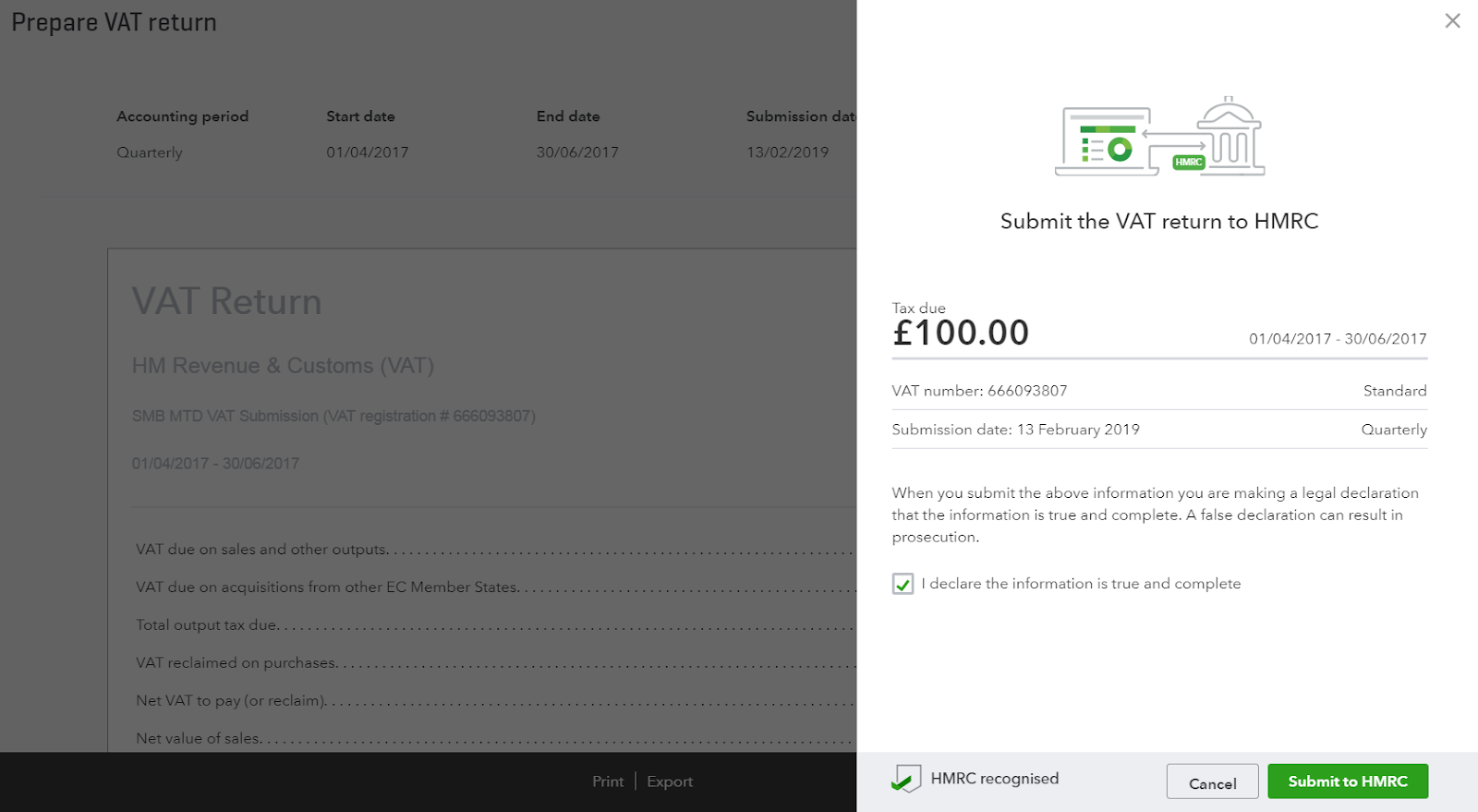

Submit A Vat Return To Hmrc Mtd For Small Busine

Submit A Vat Return To Hmrc Mtd For Small Busine

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

Hmrc Integration For Making Tax Digital Mtd Brightpearl Help Center

What Is Making Tax Digital Mtd Freshbooks

What Is Making Tax Digital Mtd Freshbooks

Submit A Vat Return In A Making Tax Digital Mtd Compliant Way In Quickbooks Youtube

Submit A Vat Return In A Making Tax Digital Mtd Compliant Way In Quickbooks Youtube