Business Mileage Form 2106

This form is used by Armed Forces reservists qualified performing artists fee-basis state or local. Qualified performing artists can deduct mileage and other business expenses by completing Form 2106 and Schedule 1.

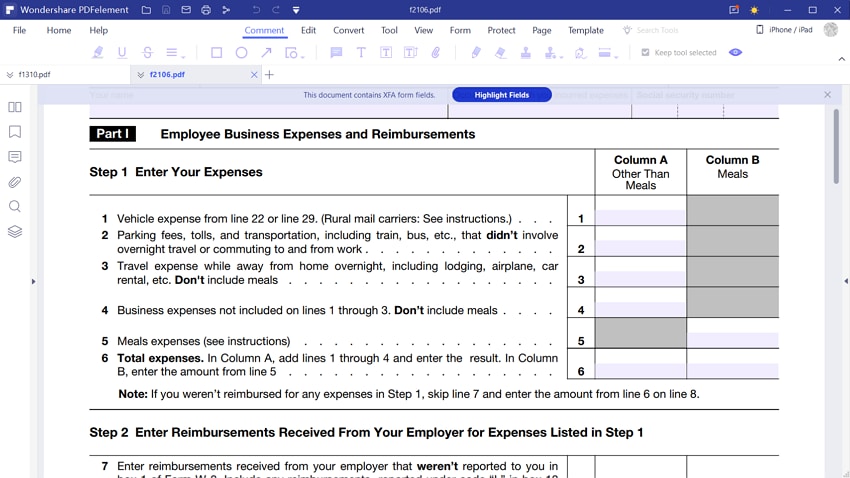

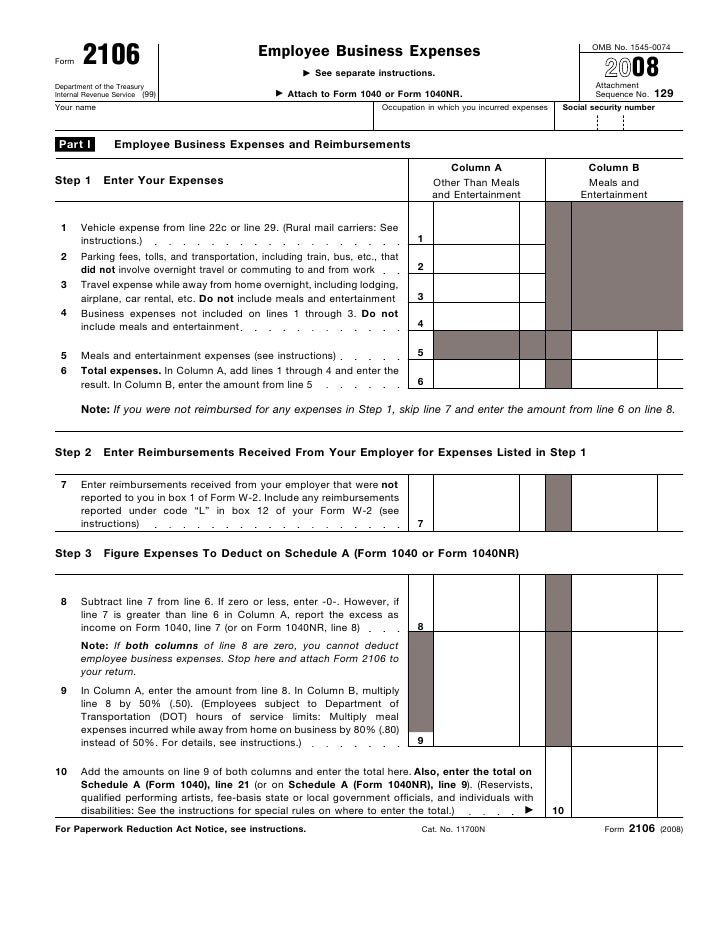

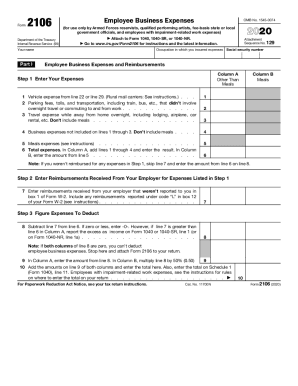

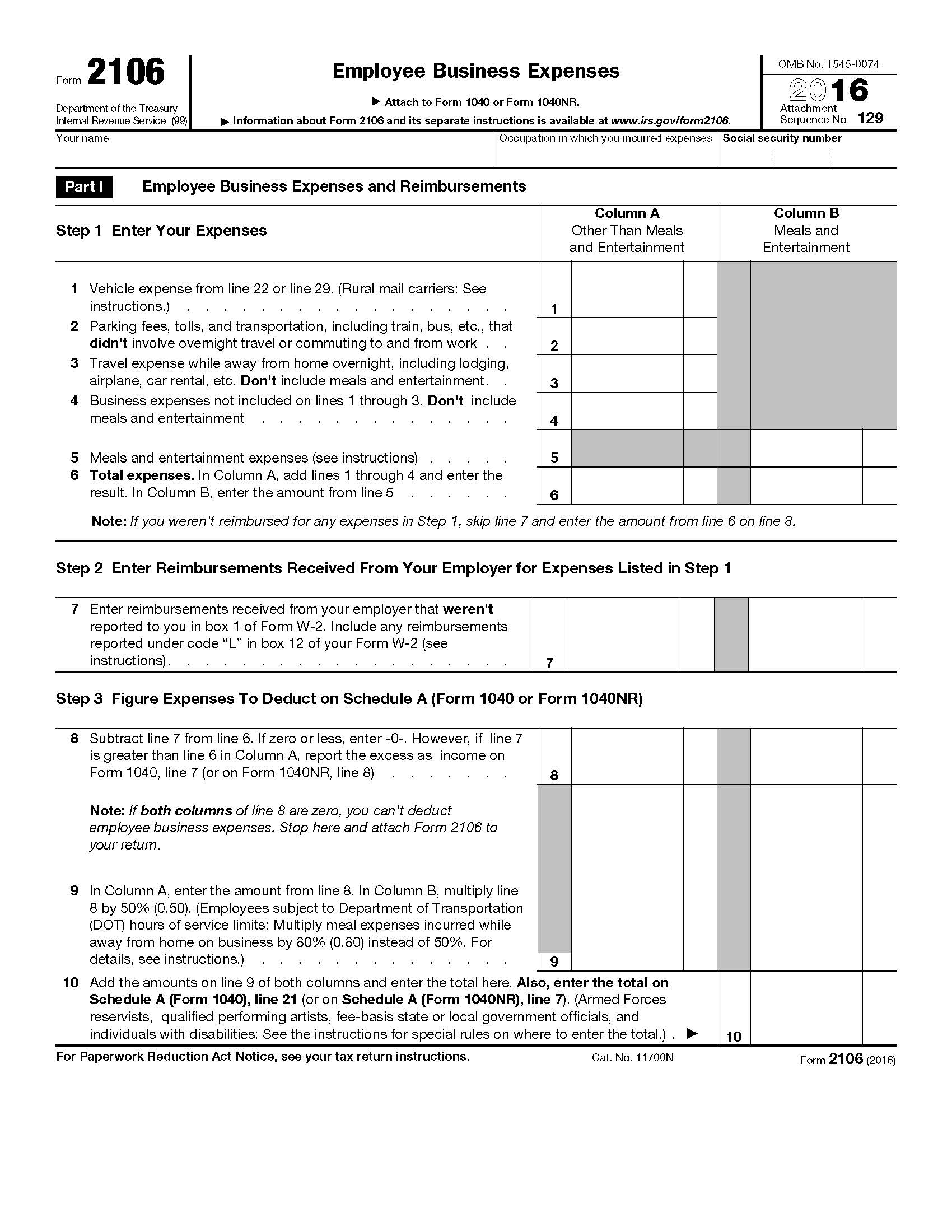

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

If mileage is used on Form 2106 it already includes a depreciation component.

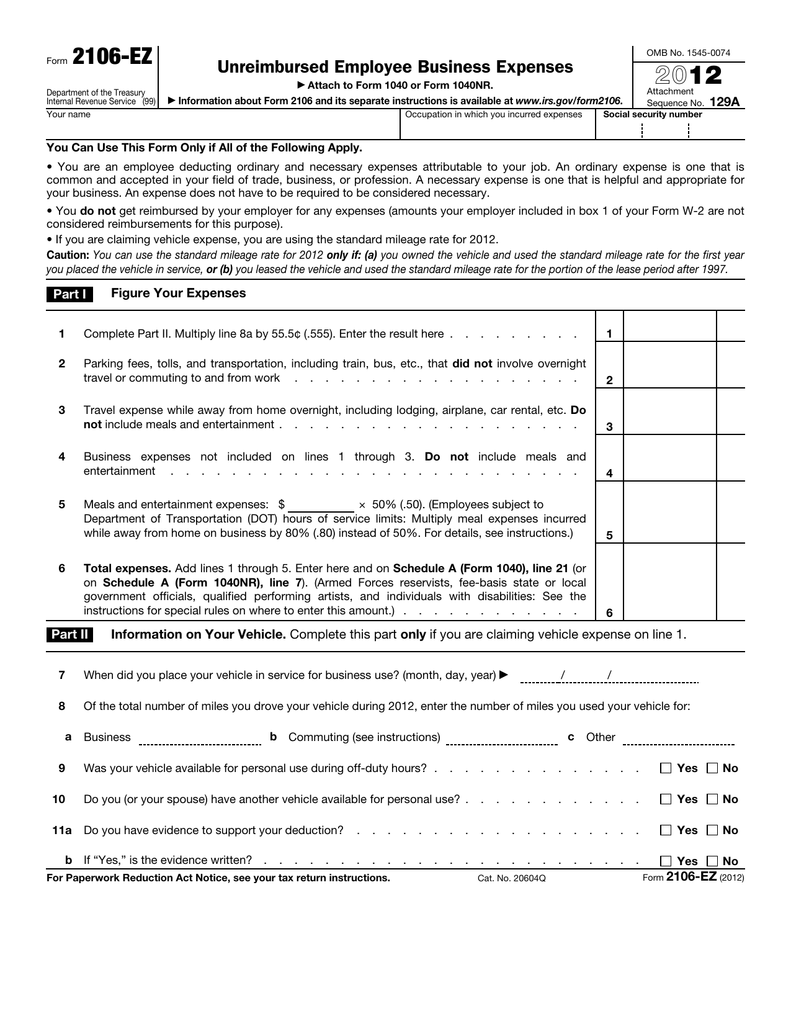

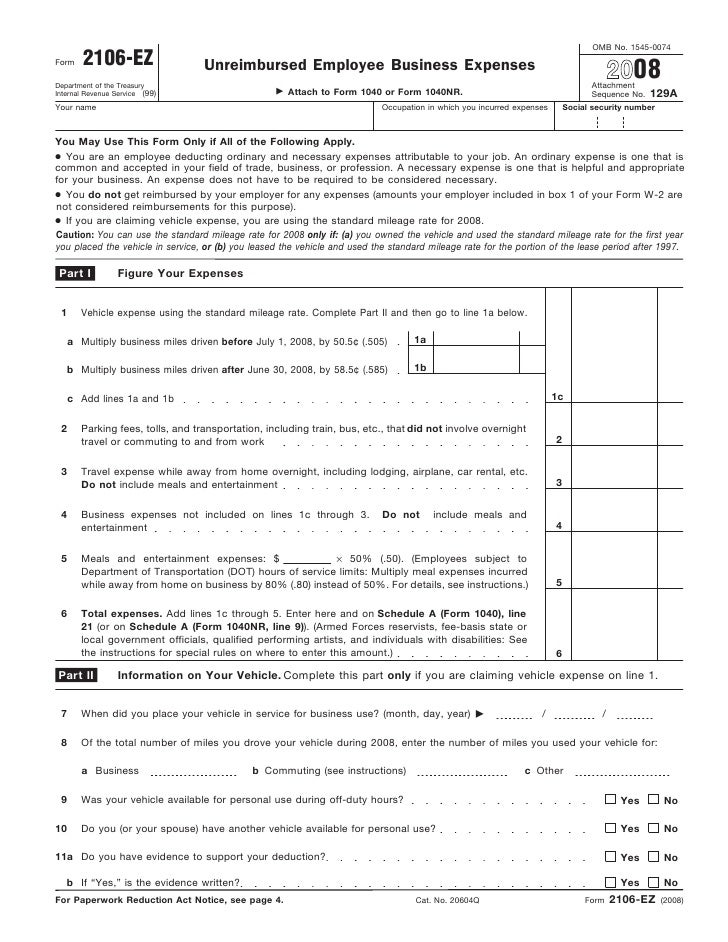

Business mileage form 2106. You can use Form 2106-EZ if you received absolutely no reimbursement but you must use Form 2106 if you received a partial reimbursement and want to claim the remaining non-reimbursed portion of your expenses. Youll report your miles and also answer a few questions about the vehicle on Form 2106. Form 2106 2020 Employee Business Expenses for use only by Armed Forces reservists qualified performing artists fee-basis state or local government officials and employees with impairment-related work expenses Department of the Treasury Internal Revenue Service 99 Attach to Form 1040 1040-SR or 1040-NR.

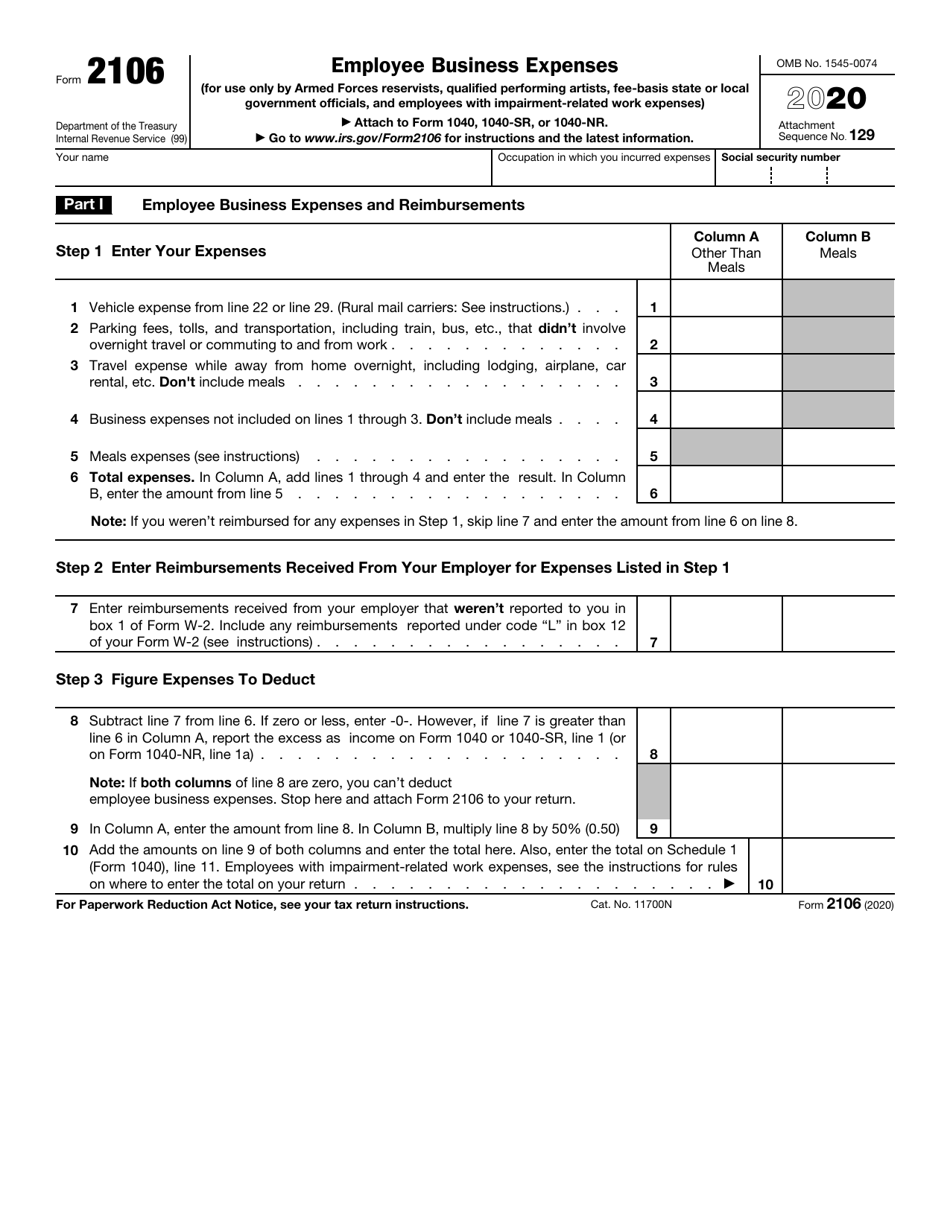

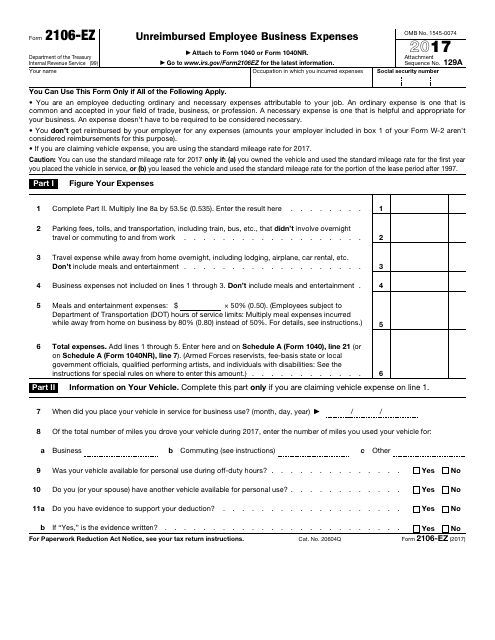

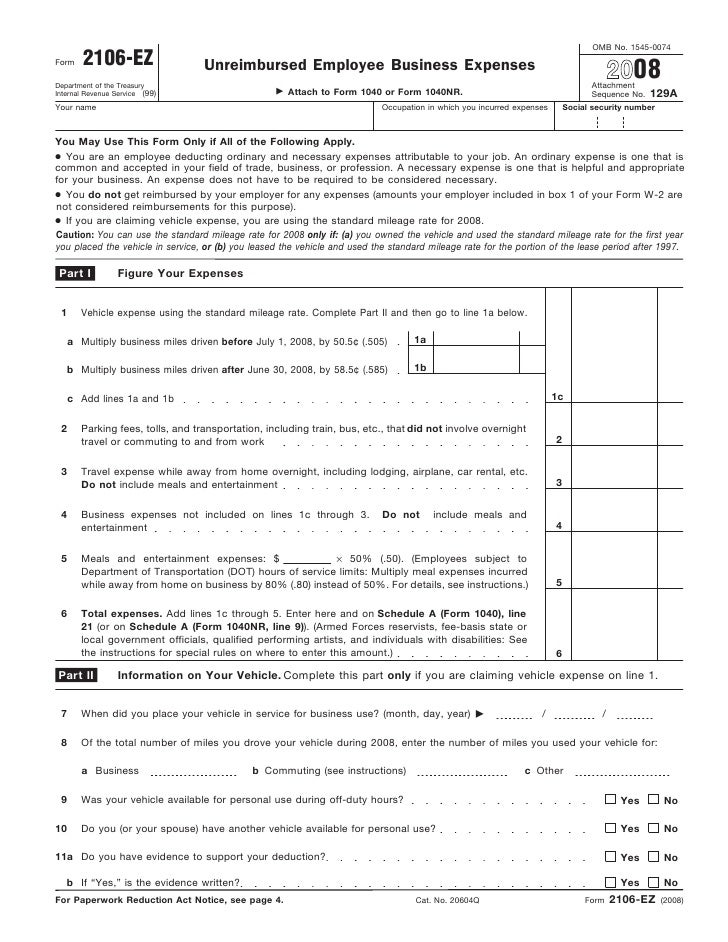

One benefit to using the standard mileage rate is that you can report your expenses on the simpler Form 2106-EZ. A partial reimbursement occurs when your employer pays you back some but not all of your cost for the expense. Go to Federal Interview Form A-10 - Form 2106 - Employee Business ExpenseStatement SBE.

Form 2106 is used by employees to deduct ordinary and necessary expenses related to their jobs. You do not need to itemize. If actual expenses are more favorable to the taxpayer than mileage or if actual expenses are forced on screen 2106 depreciation from screen 4562 is reported on Form 2106 even though Form 4562 is not produced in View.

An ordinary expense is one that is common and accepted in. The shorter Form 2106-EZ can be used if you want to claim the standard mileage rate instead. You may be a qualified performing artist if you meet the following.

Unreimbursed Employee Business Expenses was a tax form issued by the Internal Revenue Service IRS for use by employees who wished to. In Box 31 - TS use the lookup feature double-click or click F4 to select the either Taxpayer Spouse or Joint. If youre one of the types of employees listed above youll also be able to claim mileage on your individual tax return at the rate of 0575 in 2020.

If you are an employee deducting job-related vehicle expenses using either the standard mileage rate or actual expenses use Form 2106 Employee Business Expenses or Form 2106-EZ Unreimbursed Employee Business Expenses for this purpose. The program calculates and prints Form 2106 when Form 2106 or Form 2106 Schedule SE is indicated in the Form CtrlT field. If you qualify complete Form 2106 and include the part of the line 10 amount attributable to the expenses for travel more than 100 miles away from home in connection with your performance of services as a member of the reserves on Schedule 1 Form 1040 line 11 and attach Form 2106 to your return.

For vehicles the program calculates the most beneficial method actual expenses or the standard mileage rate. You can claim them if your total miscellaneous deductions exceed 2 percent of your adjusted gross income. Work-related travel expenses When you travel for work whether it is local or long-distance you can claim a deduction for your transportation costs such as taxi fare train tickets and airfare.

Sequence No Information about Form 2106 and its separate instructions is available at wwwirsgovform2106. You can then enter the deduction youve calculated on line 16 of the 2020 Schedule A the form you must use to itemize your deductions beginning with the 2018 tax year. Form 2106 is an IRS form that is used to itemize and tally ordinary and necessary business expenses that arent reimbursed by your employer.

Form 4562 is not needed and does not generate. Form 2106 Department of the Treasury Internal Revenue Service 99 Employee Business Expenses Attach to Form 1040 or Form 1040NR. In Box 43 - Attach.

In Box 42 - Attachment Code use the lookup feature double-click or click F4 to select the appropriate option. Employees must follow the same rules that business owners and other self-employed workers follow. Business miles are considered a miscellaneous deduction.

Youre a performing artist with at least two W-2 forms each with at least 200 from an entertainment company. Since the Form 2106 is not available in the S corporation or Partnership modules the standard mileage rate or actual expenses for a vehicle will not be. The IRS defines such expenses as follows.

Occupation in which you incurred expenses. You use the standard mileage rate.

Form 2106 Employee Business Expenses

Form 2106 Employee Business Expenses

Irs Form 2106 Page 4 Line 17qq Com

Irs Form 2106 Page 4 Line 17qq Com

2020 Form Irs 2106 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 2106 Fill Online Printable Fillable Blank Pdffiller

Form 2106 Instructions Information On Irs Form 2106

Form 2106 Instructions Information On Irs Form 2106

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

How To Do Spreadsheets Spreadsheet Excel Formula Eat Breakfast

How To Do Spreadsheets Spreadsheet Excel Formula Eat Breakfast

Credit Tips And Tricks Why You Should Avoid Paying Income Taxes With A Cr Credit Card Design Discover Credit Card Card Design

Credit Tips And Tricks Why You Should Avoid Paying Income Taxes With A Cr Credit Card Design Discover Credit Card Card Design

Https Www Irs Gov Pub Irs Prior I2106 2014 Pdf

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Https Www Irs Gov Pub Irs Prior F2106 1990 Pdf

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

The 8 Best Receipt Scanners Of 2021 Neat Receipts Digital Filing System Business Card Scanner

The 8 Best Receipt Scanners Of 2021 Neat Receipts Digital Filing System Business Card Scanner

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Form 2106ez Unreimbursed Employee Business Expenses

Form 2106ez Unreimbursed Employee Business Expenses

Form 2106 Employee Business Expenses