1099 Form Bank

Form 1099-INT is an income statement used to report interest you received during the tax year. You can elect to be removed from the next years mailing by signing up for email notification.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Financial institutions are required to provide complete 1099-INT forms to account holders who receive ten dollars or more in taxable interest income.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

1099 form bank. If the amount is less than 10 the bank does not have to send you a 1099-INT but you are required to report the income. Information on the 1099-B. Its an essential document for every individual who pays taxes.

Any amount of income that is more than 49 cents is reportable and taxable. If you earned more than 10 in interest from a bank brokerage or. Thats why you should be on the lookout for 1099 forms in the months leading up to the tax filing deadline.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. We think INT is the possible answer on this clue. The amount reported on form 1099-INT is likely income for federal tax purposes.

If you have any other question or need extra help please feel free to. You should get a 1099 any time you receive interest from a bank dividend income or. This clue was last seen on February 15 2021 on New York Timess Crossword.

The crossword clue possible answer is available in 3 letters. Individuals should see the Instructions for Schedule SE Form 1040. See the Instructions for Form 8938.

You will be asked to enter the basic information describe the reason for the form on the screen Does one of these uncommon situations apply select None and indicate the amount didnt involve your job or intent to make money. If you sell stocks bonds derivatives or other securities through a broker you can expect to receive one or more copies of Form 1099-B in January. Youll receive this 1099 if.

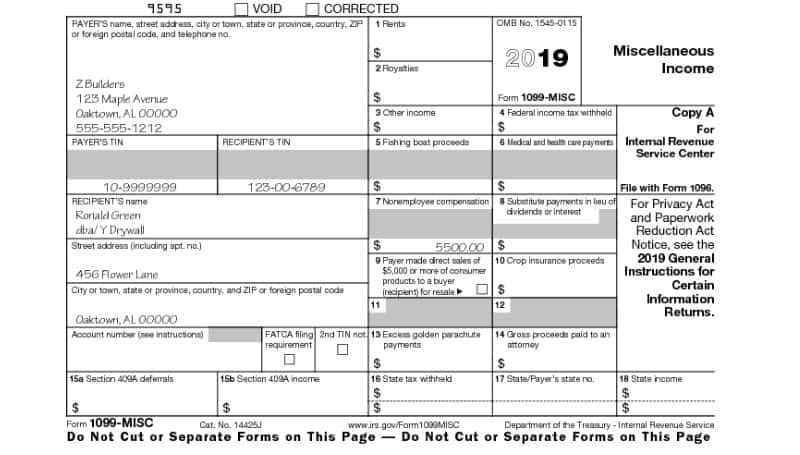

Form 1099-MISC is used to report rents royalties prizes and awards and other fixed determinable income. People who participate in formal bartering networks may get a copy of the form too. Generally the Department issues a 1099-INT if you received a refund during the tax year which included interest.

You report it as if the bank had sent you a 1099-INT. This form is used to report gains or losses from such transactions in the preceding year. If you have or had a Chime Savings Account and earned a yearly total of 10 or more in interest andor bonuses for account openings.

Type 1099-mis c in the search box select Jump to 1099-mis c and follow interview questions. A 1099-INT is an official tax form from the Internal Revenue Service that banks and other financial institutions use to report annual income from interest-bearing accounts. You may also have a filing requirement.

What is a 1099-C form. The lender is also required to send you a. A 1099-INT tax form is a record that someone a bank or other entity paid you interest.

Information about Form 1099-MISC Miscellaneous Income including recent updates related forms and instructions on how to file. November 30 2020 Others Us Bank 1099 INT Form A 1099 Form is definitely an annual statement issued from the Internal Revenue Service andor the Internal Revenue Services Bureau of Taxation for business owners individuals and small companies. This answers first letter of which starts with I and can be found at the end of T.

This form is used to denote income received through dividends and other stock distributions of 10 or more. On this page you will find the solution to 1099-___ bank-issued tax form crossword clue crossword clue. Amounts shown may be subject to self-employment SE tax.

The clue 1099-___ bank-issued tax form was last spotted by us at the New York Times Crossword on February 15 2021. Payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code. If you have a taxable debt of 600 or more that is canceled by the lender that lender is required to file Form 1099-C with the IRS.

The most common 1099s are the 1099-INT for interest and the 1099-MISC for miscellaneous payments like prizes or referral bonuses. This crossword clue 1099-___ bank-issued tax form was discovered last seen in the February 15 2021 at the New York Times Crossword. Just put the bank name as the payer and put the interest in Box 1.

1099Gs are available to view and print online through our Individual Online Services.

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Breaking Down Form 1099 Div Novel Investor

Breaking Down Form 1099 Div Novel Investor

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

What Is A 1099 Int Tax Form How Do I File It

What Is A 1099 Int Tax Form How Do I File It