Do Business Grant Recipients Receive 1099

You are correct that you do need to pay income taxes on your grant income as reported to you on Form 1099-MISC. They reported it on a 1099-MISC.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Yes you will receive a Form 1099 if you received and retained within the calendar year 2020 a total net payment from either or both of the Provider Relief Fund and COVID-19 Claims Reimbursement to Health Care Providers and Facilities for Testing Treatment and Vaccine Administration for the Uninsured that is in excess of 600.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Do business grant recipients receive 1099. Generally payments to a corporation although there are always exceptions. You dont need to issue 1099s for payment made for personal purposes. Updated 01-26-2021 to provide additional information to recipients of Nebraska Coronavirus Relief Fund grants.

When the beneficiary enrolls in school and starts taking distributions to pay school expenses he will begin receiving a Form 1099-Q each year. CRF aid was provided as part of the federal Coronavirus Aid Relief and Economic Security CARES Act. These payments are entered on the individuals tax return and may be considered taxable income.

These are due to recipients by Jan. Other payments for which a Form 1099-MISC is not required include. This is because these funding sources are considered wages and are reported on a IRS Form W-2.

Earners can calculate what they should ask for by adding up all 1099 revenue for 2019 up to 100000 divide that number by 12 months and then multiply that by 25 months. The citation contained in the question is not from IRS literature on the taxation of grants to the recipient its from IRS. Not sure what to do.

The grant program was initiated to reduce nitrogen loading in Suffolk County bays and ponds and as a result improve the water quality. Does KFW withhold taxes on grant awards or taxable income. Cities that used Coronavirus Relief Funds CRF to provide grants and forgivable loans will need to issue Form 1099-G to qualifying recipients.

For example in the case of scholarships or fellowship grants you wont need to issue a 1099. And as long as the distributions are used to pay only qualified education expenses the beneficiary doesnt pay income tax on the distributions. For example if an independent contractor earned 100000 in 1099 revenue in 2019 then that individual should.

Grant recipients will be asked to complete a W-9 IRS Form. The following items are reported on Form 1099-G. KFW does not withhold taxes from grant awards or other taxable income but is required to report all grant awards as other income to the IRS on the form 1099-MISC.

Grant recipients are responsible for including. Dont use Form 1099-MISC to report payments to employees. The grant qualifies as a prize or award that is excludible from gross income under Internal Revenue Code section 74b if the recipient is selected from the general public.

However although you must pay ordinary income taxes on this income you do not have to pay Social Security and Medicare taxes on it as well as you would if this were instead self-employment income. Contractors sole proprietors and 1099 earners are eligible for PPP loans up to 100000 in annual income. The IRS Form 1099-G is generated by the Financial and Business Management System FBMS using information received from the System for Award Management SAM.

It cannot be overridden by Interior Business Center IBC staff. County Comptroller John Kennedy had requested an IRS ruling last spring after he was blasted for issuing 1099 tax forms to both the grant recipients and the installers who put in the septic systems. Form 1099-G Certain Government Payments is provided to a taxpayer that received certain kinds of payments from federal state or local governments.

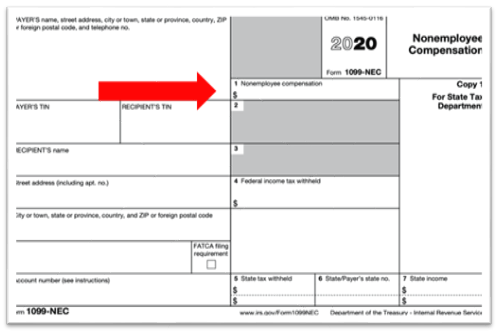

The Art Grant I received was reported by the non-profit charitable organization on a 1099-MISC box 7 Non-Employee Income. Updates are highlighted below. The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments.

KFW does not withhold taxes from grant awards or other taxable income but is required to report all grant awards as other income to the IRS on the form 1099-MISC. This is an automatic process. A recipient may use grant funds for room board travel research clerical help or equipment that are incidental to the purposes of the scholarship or fellowship grant.

Per the IRS website its not taxable. Do business grant recipients receive 1099. Use Form W-2 for all payments to employees including business travel allowances and expense reimbursements.

31 2021 and must be filed with the IRS by March 1 2021. Grant recipients are responsible for including information concerning these funds on their personal income tax statement. Who Should Not Receive a 1099-MISC.

Non-corporate entities that received grant funds of 600 or more should expect to receive a Form 1099-G for the 2020 tax year. This affects all recipients of federal financial assistance except private persons UNLESS they opt to register in SAM. Use form 1099-NEC to report payments to independent contractors.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

The Irs 1099 G Form What It Is And Who Receives

The Irs 1099 G Form What It Is And Who Receives

Grant Bennett Associates The New Form 1099 Nec And The Revised 1099 Misc Are Due To Recipients Soon

Grant Bennett Associates The New Form 1099 Nec And The Revised 1099 Misc Are Due To Recipients Soon

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Federal Form 1099 Misc Deadline Irs Irs Forms 1099 Tax Form

Federal Form 1099 Misc Deadline Irs Irs Forms 1099 Tax Form

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Form 1099 Reporting Tips For Small Business Owners Cpa Practice Advisor

Form 1099 Reporting Tips For Small Business Owners Cpa Practice Advisor

How Do I Understand My 1099 Tax Form From Children S Council Children S Council

How Do I Understand My 1099 Tax Form From Children S Council Children S Council

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients The Southern Maryland Chronicle

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients The Southern Maryland Chronicle

What Is Transmittal Form 1096 Irs Forms 1099 Tax Form Irs

What Is Transmittal Form 1096 Irs Forms 1099 Tax Form Irs

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Form 1099 Nec Is New For 2020 Here S What You Need To Know

Form 1099 Nec Is New For 2020 Here S What You Need To Know

What Is A 1099 Form When Does Your Business Need It Camino Financial

What Is A 1099 Form When Does Your Business Need It Camino Financial