Principal Business Code 1099 Misc

I was a building contractor hired in to handle maintenance and remodel. Miscellaneous Income is completed and sent out by someone who has paid at least 10 in royalties or broker payments instead of dividends or tax-exempt interest to another individual.

Tax Time For Writers How To Report Your Writing Income Nathaniel Tower

Tax Time For Writers How To Report Your Writing Income Nathaniel Tower

I WENT TO THE IRS WEBSITE AND NOTHING MATCHES FOR FREELANCE CONTRACTING.

Principal business code 1099 misc. I received a 1099 misc form for washing cloths for the kitchen where i work. Compensation paid to a minister or clergy member typically is reported to them on Form W-2 if the minister is an employee of the church or Form 1099-MISC if the minister performed services such as weddings and baptisms. You may be subject to state and local taxes and other requirements such as business licenses and fees.

If your son isnt a direct seller and isnt engaged in a trade or business he may be an employee whose wages are subject to income tax withholding and social security and Medicare taxes. The principal business code is a 6 digit business code that describes the kind of work that you do. Check with your state and local governments for more information.

Most ministers are treated as dual-status taxpayers. 1099 MISC Independent Contractors and Self-Employed 2 Question. Report on Form 1099-MISC only when payments are made in the course of your trade or business.

Same or her address. The intent is to determine if a taxpayer truly has a Schedule C in which the income would then qualify them for the EITC. The following scenarios address 1099-Misc issues that frequently occur where taxpayers may be unaware of their reporting requirementsresponsibilities.

It is used for filing federal tax returns with the Internal Revenue Service IRS applying for loans with the US. If she make over 400 she also has to do Sch-SE. WHERE DO I FIND CODEDOES ANYONE KNW THE CODE.

Some of the scenarios might erroneously qualify a user for EITC. Turbotax called that correctly. Depends what she does.

The 1099-misc income goes on a Sch-C. Trade or business reporting only. I AM TRYING TO FILE ON TURBO TAX AND IT KEEPS ASKING ME PRINCIPAL BUSINESS CODE.

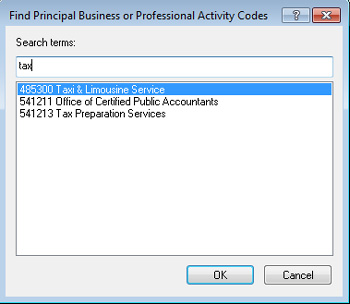

You can look up your principal business code by clicking on this link and navigating to pages 17 and 18. A principal business code is a six-digit number that classifies the main type of product you sell or main type of service you offer. Can you help me.

Principal Business or Professional Activity Codes. Reporting your 2020 Dividend of 992 for Federal Tax Purposes Dividends for Adults are taxable for federal income tax purposes. It is used as a method for the IRS to classify what type of business you have.

These Principal Business Activity Codes are based on. To print or view your 1099-MISC income tax statement visit myPFD. I received a 1099-misc.

Personal payments are not reportable. Self or her name. I dont have one or know what this is.

See the instructions on your Form 1099 for more information about what to report on Schedule C. However nonprofit organizations are considered to be engaged in a trade or business and are. Small Business Administration SBA and other US.

You are engaged in a trade or business if you operate for gain or profit. Amounts shown on a Form 1099 such as Form 1099-MISC Form 1099-NEC and Form 1099-K. On a 1099 misc what is a principal code.

If principal source of income is from farming activities file Schedule F Form 1040 and enter code on line B Schedule F Form 1040. This list of Principal Business Activities and their associated codes is designed to classify an enterprise by the type of activity in which it is engaged to facilitate the administration of the Internal Revenue Code. It is asking for a principal business code.

Assigned to this activity for example 531210 the code for offices of real estate agents and brokers and enter it on Schedule C Form 1040.

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Will The Irs Know If I Don T File A 1099

Will The Irs Know If I Don T File A 1099

Https Inserocpa Com Wp Content Uploads Insero Whitepaper Form 1099 Nec Vs 1099 Misc Ct 4644 Pdf

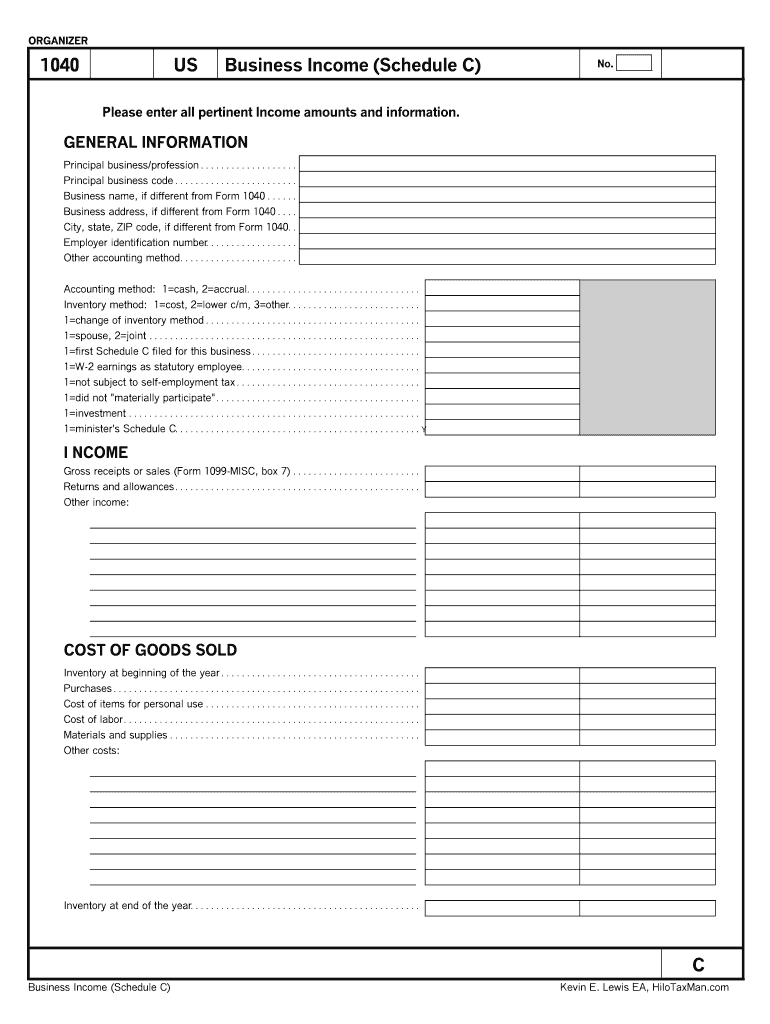

What Is An Irs Schedule C Form And What You Need To Know About It

What Is An Irs Schedule C Form And What You Need To Know About It

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

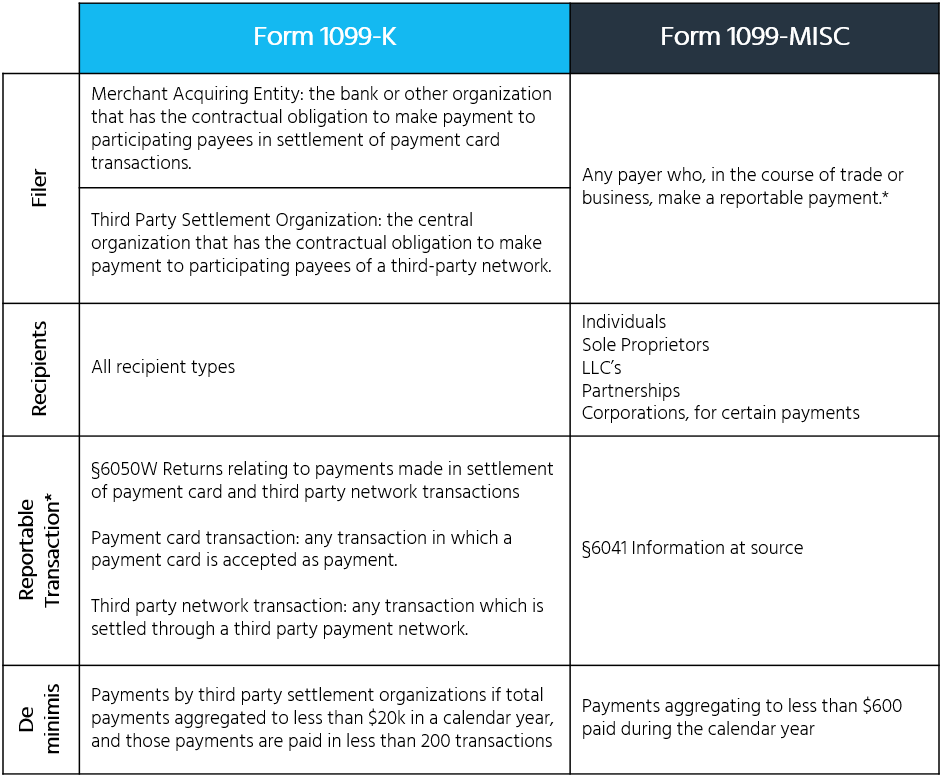

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Irs Business Code For Property Management Property Walls

Irs Business Code For Property Management Property Walls

1099 K On 1040 Page 2 Line 17qq Com

1099 K On 1040 Page 2 Line 17qq Com

Understanding Your Instacart 1099

Understanding Your Instacart 1099

Do Brokers Need To Issue A 1099 For Commission Paid To A Llc Berkshirerealtors

Understanding Taxes Simulation Using Form 1099 Misc To Complete Schedule C Ez Schedule Se And Form 1040

Understanding Taxes Simulation Using Form 1099 Misc To Complete Schedule C Ez Schedule Se And Form 1040

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Freelance Taxes Income Taxes Arcticllama Com

Freelance Taxes Income Taxes Arcticllama Com

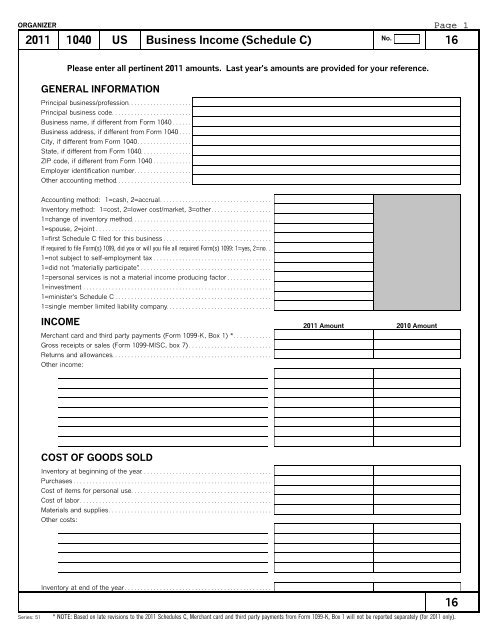

Schedule C Business Codes Fill Online Printable Fillable Blank Pdffiller

Schedule C Business Codes Fill Online Printable Fillable Blank Pdffiller

Solved Principal Business Code For 1099

Solved Principal Business Code For 1099

Irs Business Code For Property Management Property Walls

Irs Business Code For Property Management Property Walls