How To Suspend Installment Agreement With Irs

For the over 1 million taxpayers who have their payment directly debited from their. If you have a Direct Debit Installment Agreement which authorize the IRS to deduct your monthly payment automatically from a bank account.

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

Written by Steve Rhode.

How to suspend installment agreement with irs. How to Suspend Payments Regular Installment Agreements IAs where you send payments directly to the IRS. IRSs People First Initiative includes sweeping changes to installment agreements of taxes due offers in compromise changes to audit activity and. However in some cases if you incur additional tax liability you can roll those amounts into your existing installment agreement.

Taxpayers who are currently unable to comply with the terms of an Installment Payment Agreement including a Direct Debit installment agreement may suspend payments during this period if they prefer. For taxpayers with an existing installment agreement the IRS is suspending installment agreement payments during the suspension period. If your account is automatically debited each month then to suspend direct debit you need to.

For taxpayers under an existing Installment Agreement payments due between April 1 and July 15 2020 are suspended. There is no need to inform the IRS. This may not be an option at all banks.

You have several options available if your ability to pay has changed and you are unable to make payments on your installment agreement or your offer in compromise agreement with the IRS. The IRS will not let the agreement go into default. If you believe that you meet the requirements for low income taxpayer status but the IRS did not identify you as a low-income taxpayer please review Form 13844.

You can choose to simply not make payments through July 15. Taxpayers who are currently unable to comply with the terms of an Installment Payment Agreement including a Direct Debit Installment Agreement may suspend payments during this period if they prefer. In addition the IRS will not default any installment agreements for nonpayment between April 1 2020 and July 15 2020.

My CPA tax guru friend Jim Buttonow told me If a taxpayer is in an installment agreement with the IRS they can suspend payments through July 15th. If you miss a payment or if you fall behind on other taxes that you owe the IRS may terminate your installment agreement. However if you want to suspend all of their direct debit payments during the suspension period you should contact your bank to stop the payments.

The IRS only lets you do that if the new amounts dont add much time or money to the agreement. Regular Installment Agreements IAs where you send payments directly to the IRS. If the taxpayer has recovered fully or merely wishes to begin the payments again one option is to simply ask the bank to resume the direct debit.

A condition of the agreement was no new tax debts and the new liability caused the IRS to consider your agreement in default and now they want to terminate it. The IRS will not let the agreement go into default. You can request an amendment to the installment agreement by.

To help people facing the challenges of COVID-19 issues the IRS through the People First Initiative will temporarily adjust and suspend key compliance programs. Furthermore IRS will not default any installment agreements during this period. Existing Installment Agreements For taxpayers under an existing Installment Agreement payments due between April 1 and July 15 2020 are suspended.

You can choose to simply not make payments through July 15. How to suspend installment agreement payments. IRS will continue to deduct payments for Direct Debit agreements.

By Steve Rhode. If you cant pay the terms of an Installment Payment Agreement you may suspend payments during this period. Taxpayers who are currently unable to comply with the terms of an Installment Payment Agreement including a Direct.

However interest will continue to accrue on any unpaid balances. Options could include reducing the monthly payment to reflect your current financial condition. By law interest will continue to accrue on any unpaid balances.

If a taxpayers financial situation has changed permanently it may take a bit of renegotiating the installment agreement. You may be asked to provide. The IRS billed you for the new tax debt and sent you a Notice of Intent to Terminate Installment Agreement identified in the upper-right hand corner as IRS letter CP523.

Applicants should submit the form to the IRS within 30 days from the date of their installment agreement acceptance letter to request the IRS to reconsider their. Taxpayers who are currently unable to comply with the terms of an Installment Agreement may suspend payments during this period. How to Suspend Payments.

For taxpayers under an existing Installment Agreement payments due between April 1 and July 15 2020 are suspended. If someone cant meet their current installment agreement terms because of a COVID-related hardship they can revise the agreement or call the number on their IRS notice if they have a Direct Debit Installment Agreement. Application for Reduced User Fee for Installment Agreements PDF for guidance.

The IRS has announced some important adjustments to current policies to assist debtors with financial difficulties. Call the IRS immediately at 800-829-1040. There is no need to inform the IRS.

However by law interest continues to accrue on any unpaid balances. Calling the IRS at 1-800-829-7650 Visiting a local IRS office Completing Form 9465 with information about both the original agreement balance and the expected new balance. Furthermore the IRS will not default any installment agreements during the suspension period.

IRS will not default an Installment Agreement for nonpayment during.

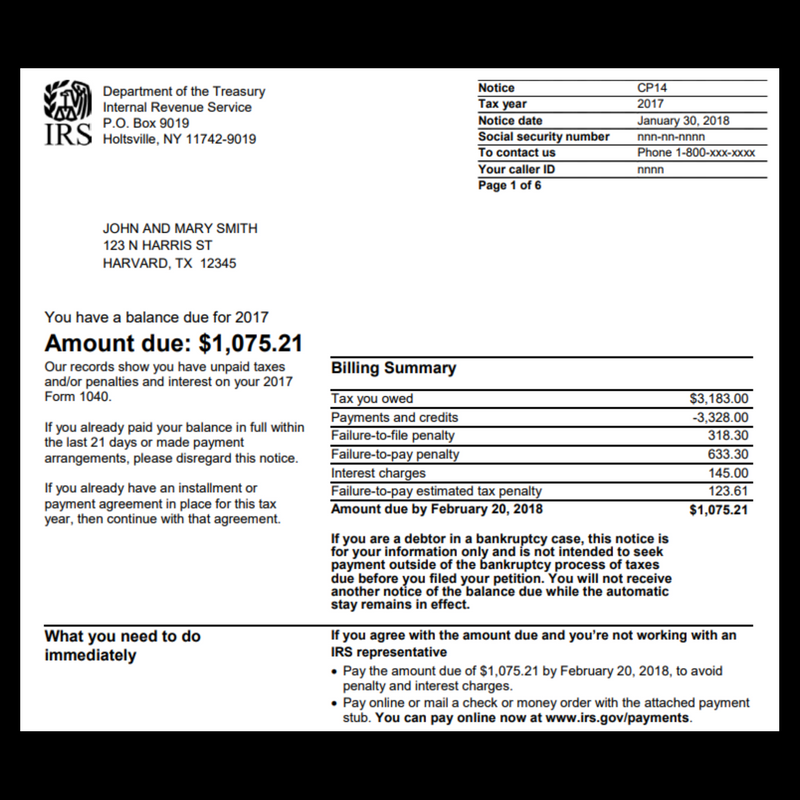

Tax Balance Due 3 Steps To Address Irs Notice Cp14 Moneysolver

Tax Balance Due 3 Steps To Address Irs Notice Cp14 Moneysolver

Https Www Irs Gov Pub Irs News Ir 09 035 Pdf

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Statute Of Limitations On Irs Collections Atlanta Tax Attorney Wiggam Geer

Statute Of Limitations On Irs Collections Atlanta Tax Attorney Wiggam Geer

Account Suspended Accounting Tax Preparation Finance

Account Suspended Accounting Tax Preparation Finance

Account Suspended Tax Extension Business Tax Tax Prep

Account Suspended Tax Extension Business Tax Tax Prep

Unfiled Tax Returns 101 Tax Return Income Tax Return Tax Help

Unfiled Tax Returns 101 Tax Return Income Tax Return Tax Help

Get Control Of Your Tax Debt Owe Taxes Irs Payment Plan Tax Help

Get Control Of Your Tax Debt Owe Taxes Irs Payment Plan Tax Help

Unfiled Tax Returns 101 Tax Return Tax Help Tax

Unfiled Tax Returns 101 Tax Return Tax Help Tax

Second Opinion Free Review Of Previously Filed Tax Returns Tax Return Tax Help Income Tax Return

Second Opinion Free Review Of Previously Filed Tax Returns Tax Return Tax Help Income Tax Return

Sales Tax Tips For Authors By Carla King For Bookworks Com Book Publishing Accounting Sales Tax

Sales Tax Tips For Authors By Carla King For Bookworks Com Book Publishing Accounting Sales Tax

20 1 9 International Penalties Internal Revenue Service

20 1 9 International Penalties Internal Revenue Service

Supremecapitalgroup On Twitter Irs Private Foundation Cafeteria Plan

Supremecapitalgroup On Twitter Irs Private Foundation Cafeteria Plan

Https Www Irs Gov Pub Irs Utl Oc Theirsfreshstartprogramcanhelpyoupayyourtaxesfinal Pdf

Instructions For Form 9465 10 2020 Internal Revenue Service

Instructions For Form 9465 10 2020 Internal Revenue Service

Irs Clarifies On Crypto Taxes Customers Search Tax Software Program For Simplification Tax Debt Tax Extension Filing Taxes

Irs Clarifies On Crypto Taxes Customers Search Tax Software Program For Simplification Tax Debt Tax Extension Filing Taxes

If Someone Calls And Threatens To Cancel Your Ssn Over A Tax Bill Hang Up Itunes Gift Cards Freelance Hung Up

If Someone Calls And Threatens To Cancel Your Ssn Over A Tax Bill Hang Up Itunes Gift Cards Freelance Hung Up

Alizio Law Pllc Tax Attorney Attorneys Tax Lawyer

Alizio Law Pllc Tax Attorney Attorneys Tax Lawyer

Tax Balance Due 3 Steps To Address Irs Notice Cp14 Moneysolver

Tax Balance Due 3 Steps To Address Irs Notice Cp14 Moneysolver