Can An Agent Register A Client For Vat

Once they get their code you can enter it in and you can then file VAT returns for them through your agent account. Businesses that pay VAT by Direct Debit cannot sign up in the 7 working days leading up to or the 5 working days after sending a VAT Return.

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Follow the procedure and you can register the partnership for VAT.

Can an agent register a client for vat. An organisation can only VAT register and recover VAT if they make VATable supplies and the VAT that they seek to recover is incurred for the purposes of making VATable supplies. In terms of section 162e of the VAT Act if the agent bought goods or services for. Your existing Agent Services account s some firms have multiple ones still shows your SA CT VAT etc clients allows you to act as a delegate etc.

Go into your agent account and click on register for HMRC Taxes. The ASA is for Making VAT Digital and a few other services. Once set up you then go into this to link up to.

So suppose that the transaction involved the sale of goods from A Ltd to B Ltd for 200 plus VAT. Agent signs up clients for Making Tax Digital MTD for VAT Before signing up clients to MTD for VAT agents must first create a relationship by linking clients to their agent services account. Statement can also constitute the tax invoice for the agents commission.

An example would be where a firm of engineers obtain a demolition certificate on behalf of their clients or where a firm of buyers source goods on behalf of their retailer client. To enrol for VAT you will need your own companys VAT Number to hand. However in order to submit the VAT returns for your client under Making Tax Digital youll require the following.

VAT - to submit VAT returns and change clients registration details. 1An agent services account - this is different to your HMRC online services for. In such case it must state statement for agency salespurchases and tax invoice It must also show the VAT registration numbers of the agent and the principal.

Once they have their VAT number go back into Agent account and authorise client for VAT. A Ltd B Ltd and C Ltd are registered for VAT. Once youve set up your VAT for Agents service you will then be sent an activation code in the post within 10 working days.

You can appoint an accountant or agent to submit your VAT Returns and deal with HMRC on your behalf. Rather the VAT problem referenced here is where an agent would act and contract on its VAT registered clients or principals. Use the same process as VAT for Agents to register and set up authorisation to act for individual clients.

The VAT accounting is. If youre VAT registered youll need to use your VAT number to set up agent authorisation for. However both the client and the agent can sign the client up to.

The link for agents to sign up clients. If youre not VAT registered youll need to follow the steps online to get a VAT Agent Reference Number and then wait up to 24 hours for it to work. When you receive your VAT number from HMRC.

Issues that arise when a trader is acting as a principal or an agent. Can I register a client for VAT eventhough Im not a VAT agentI cant register as a VAT agent as I am not registered for VATThank you. The agent C Ltd has arranged the sale for its client A Ltd in return for a fee or commission of 15 of the net value.

You can use the VAT EU Refunds for Agents to do this on behalf of your clients. If the agent signs the client up to MTD only the agent can submit the VAT and do all other VAT related tasks.

Set Up Vat Mtd End To End Service Guide Hmrc Developer Hub

Set Up Vat Mtd End To End Service Guide Hmrc Developer Hub

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

Set Up Vat Mtd End To End Service Guide Hmrc Developer Hub

Agents Becoming Mtd For Vat Compliant With Hmrc Step By Step Guide Knowledge Base

Agents Becoming Mtd For Vat Compliant With Hmrc Step By Step Guide Knowledge Base

Set Up Vat Mtd End To End Service Guide Hmrc Developer Hub

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

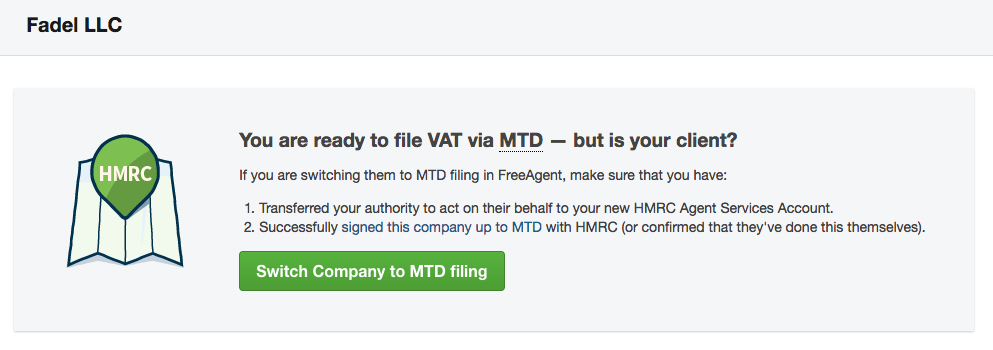

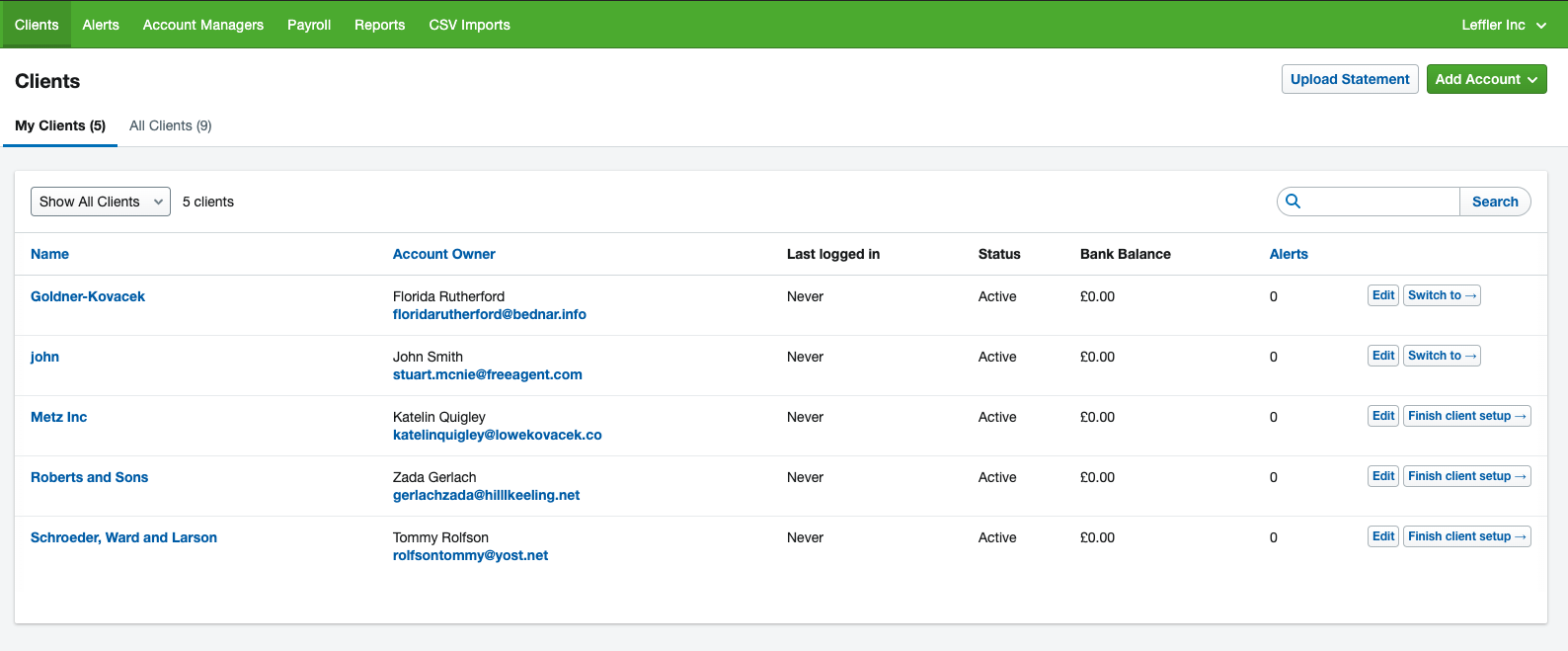

How To Sign Up Your Clients For Making Tax Digital Freeagent

How To Sign Up Your Clients For Making Tax Digital Freeagent

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

Billing Your Clients For Vat On Expenses

Billing Your Clients For Vat On Expenses

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Set Up Vat Mtd End To End Service Guide Hmrc Developer Hub

Set Up Vat Mtd End To End Service Guide Hmrc Developer Hub

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

How To Sign Up Your Clients For Making Tax Digital Freeagent

How To Sign Up Your Clients For Making Tax Digital Freeagent

Agents Becoming Mtd For Vat Compliant With Hmrc Step By Step Guide Knowledge Base

Agents Becoming Mtd For Vat Compliant With Hmrc Step By Step Guide Knowledge Base

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

Sales Tax 101 What S A Registered Agent And Does Your Client Need One Cpa Practice Advisor

Sales Tax 101 What S A Registered Agent And Does Your Client Need One Cpa Practice Advisor

Close Down Vat Mtd End To End Service Guide Hmrc Developer Hub