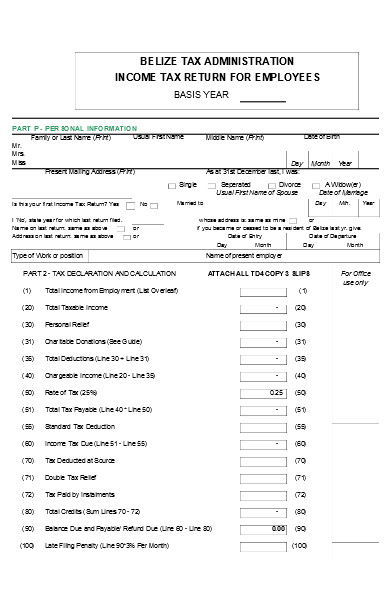

Business Income Tax Form Belize

Persons earning between 2600001 and 27000 personal relief is 24600. Procedure on Business Tax Registration.

Form 13 Vs 13a 13 Taboos About Form 13 Vs 13a You Should Never Share On Twitter Tax Services Filing Taxes Tax Forms

Form 13 Vs 13a 13 Taboos About Form 13 Vs 13a You Should Never Share On Twitter Tax Services Filing Taxes Tax Forms

The Director General of Belize Tax Service Department herby grants a six-month extension for the filling of Annual Business Tax Expression of Interest Security Services and Armoured Deposits for Belize Tax Service Offices BTSD Countrywide.

Business income tax form belize. This form can be obtained from any local BTS Office. Form SS-5 Application for a Social Security Card PDF PDF Form 1045 Application for Tentative Refund. The BTS101 form for new employee along with a copy of their social security card should be attached to the TD4 submitted.

Belize Income and Business Tax Amendment Act 2008. As for Belize Belize International Business Companies are not obliged to prepare or file Annual Return. Form 2553 Election By a Small Business Corporation.

10 CHAPTER 55 INCOME AND BUSINESS TAX 12th December 1923 PART I Preliminary 1. We can be reached during normal business hours at. B Interest on a bond and dividends paid or received by an IBC is tax exempt and free from withholding tax provided it is not paid or received in Belize by a tax resident.

The form BTS101 should be filled out COMPLETELY for any employee who does not have a TIN. Tax returns There is no requirement for Belize IBCs to file a tax. July 31 unless extended by the government.

Belize Petroleum Exploration Blocks and Subblocks Base Map. For salaried individuals the form can be submitted beforeat the time of ITR filing even if ITR is filed after the due date Remember that under the new tax regime the. To register an Application for Registration Form needs to be filled out.

Feel free to call us at any time. For companies the applicant completes and submits the TR121A Business Registration for Non-Individual application form to the officer at the front desk of the Income Tax Department along with. Belize as a Tax Haven.

The Foreign Income Tax Exclusion shields up to 100000 of offshore earned income for those who qualify. Income Tax was enacted in Belize in 1924 and remained in that basic form up to July 1998 when Business Tax was introduced. 55 Income and Business Tax THE SUBSTANTIVE LAWS OF BELIZE REVISED EDITION 2000 Printed by the Government Printer No.

As per the income tax laws an individual having business income shall submit this form before the due date of filing ITR ie. A tape or excel spreadsheet that shows the total emolument and taxes withheld should be attached to the TD4 Summary. In particular it is exempted from corporate tax or any form of Belize tax income tax business tax withholding tax asset tax gift tax capital gains tax distributions tax inheritance tax estate duty on assets or income generated from outside of Belize.

In addition to tax benefits Belize LLC also gets exemption from duties and exchange control in Belize except for the case of transfer of property located in Belize. The contract tax withheld must be paid over to the Government of Belize Income Tax Department by the 15th of every month for the previous month using Form TD 25 Gross Contract Payments Remittance of Tax Withheld From Contract Payments. Belize Production Sharing Agreement Application Form.

When you are applying for registration to prevent delay it is necessary to submit copies of the relevant documents mentioned below with the Application for Registration form to the Belize Tax Service. Persons earning between 2700001 and 29000 personal relief is 22600. 800 AM - 430 PM Saturday Sunday.

Persons earning below 26000 personal relief is 25600. Persons earning less than this are exempted from the tax. Form 8829 Expenses for Business Use of Your Home.

Calculate your take home pay in Belize thats your salary after tax with the Belize Salary Calculator. Tour Operators Travel Agents. Form 6252 Installment Sale Income.

The Legislation is now called The Income And Business Tax Act with an effective date of January 1999 in its current form. Certificate of Incorporation copy of Articles of Association copy of Memorandum of Association copy of Trade License and TR111 Individual Registration form for each. Belize Income Tax Commissioners Bulletin.

Income Tax is payable at a rate of 25 on taxable income for all employed persons resident in Belize earning over BZ26000 US13000 per annum. 175 for chargeable income exceeding 3mil BZD. 1 Power Lane Belmopan by the authority of the Government of Belize.

Belize has a territorial tax system. Petroleum Companies Operating in Belize. Importantly where a company is engaged in a trade business or profession where the revenue or income is derived outside of Belize the company shall not be liable for payment of income tax in Belize.

A A Tax exemption on income below USD37500 per year. An Overview Belize is. Belize Tax Administration BUSINESS TAX MONTHLY FORM BT135 Part 1 Taxpayer.

A quick and efficient way to compare salaries in Belize review income tax deductions for income in Belize and estimate your tax returns for your Salary in BelizeThe Belize Tax Calculator is a diverse tool and we may refer to it as the Belize wage calculator salary calculator or Belize. Below is information related to earning brackets. Belize Environmental Protection Act.

State Tax Forms and Information. 800 AM - 500 PM Friday. The Belize Income and Business Tax Act Cap55 IBTA provides.

The Employee Income Tax is a tax that must be filled by all persons receiving an income. This Act may be cited as the Income and Business Tax Act. View Calculate MONTHLY BUS tax BUSINESS_TAX_FORM1xls from BUSINESS 346 at University of Belize - Belmopan.

Form 8822-B Change of Address. Form 2848 Power of Attorney and Declaration of Representative. 3 for chargeable income less than 3mil BZD.

Form 12 12a Five Ways On How To Prepare For Form 12 12a Tax Forms Federal Income Tax Income Tax

Form 12 12a Five Ways On How To Prepare For Form 12 12a Tax Forms Federal Income Tax Income Tax

Free 6 Income Tax Forms In Pdf Excel

Free 6 Income Tax Forms In Pdf Excel

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Free 6 Income Tax Forms In Pdf Excel

Free 6 Income Tax Forms In Pdf Excel

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Us Federal Income Tax Forms 3 Five Things You Probably Didn T Know About Us Federal Income T In 2021 Income Tax Income Tax Return Federal Income Tax

Us Federal Income Tax Forms 3 Five Things You Probably Didn T Know About Us Federal Income T In 2021 Income Tax Income Tax Return Federal Income Tax

Income Tax Form Download In Excel Format Why You Must Experience Income Tax Form Download In Tax Forms Income Tax Signs Youre In Love

Income Tax Form Download In Excel Format Why You Must Experience Income Tax Form Download In Tax Forms Income Tax Signs Youre In Love

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions Tax Forms Estimated Tax Payments Income Tax Return

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions Tax Forms Estimated Tax Payments Income Tax Return

Timely Filing The Feie Form 2555 Expat Tax Professionals

America S First Income Tax Form Tax Foundation

America S First Income Tax Form Tax Foundation

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Fillable Online Bws Application For Employment Belize Water Services Bws Fax Email Print Pdffiller Employment Application Employment News Employment

Fillable Online Bws Application For Employment Belize Water Services Bws Fax Email Print Pdffiller Employment Application Employment News Employment

Copy Of Irs Tax Form 1040 For 1913 Income Tax 4 Pages Ebay

Copy Of Irs Tax Form 1040 For 1913 Income Tax 4 Pages Ebay

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

How To Fill Out Tax Form 7004 Tax Forms Irs Tax Forms Income

How To Fill Out Tax Form 7004 Tax Forms Irs Tax Forms Income

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

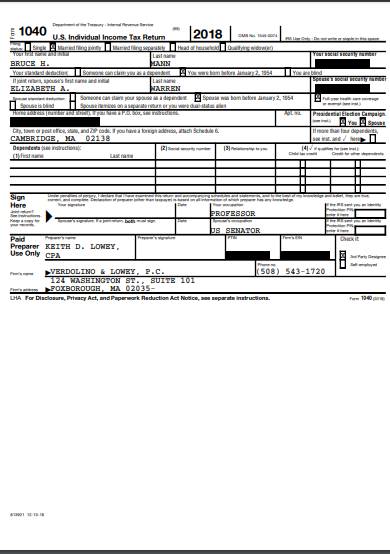

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes