What Form Of Business Organization Is Established As A Legal Entity Separate From Its Owners

Sole proprietors hip B. The answer is - Corporation A corporation is a form of a business organization established as a legal entity separate from its owners by the.

The Types Of Business Ownership Startup Business Plan Bookkeeping Business Business Ownership

The Types Of Business Ownership Startup Business Plan Bookkeeping Business Business Ownership

Become a member and unlock all.

What form of business organization is established as a legal entity separate from its owners. Ability to raise large amount of capital Public limited companies are able to raise large sums of money because there is no limit on the maximum number of members. See full answer below. Which form of business organization is established as a legal entity separate from its owners.

1 A corporation is a legal entity operating under state law whose scope of activity and name are re view the full answer. Sole Proprietorship and Partnership. Which form of business organization is established as a separate legal entity from its owners.

These businesses are owned by one person usually the individual who has day-to-day responsibility for running the business. The owners can lose no more than the amounts they have invested in the business---a concept known as limited liability. Mültiple Choice Sole proprietorship Corporation Partnership None of these COMPANY.

Sole proprietors can be independent contractors freelancers or home-based businesses. Answer to Which form of business organization is established as a legal entity separate from its owners. Which form of business organization is established as a separate legal entity from its owners.

It is a legal entity that provides limited liability to its owners and is organized under state laws. None of these Corporations are owned by shareholders. However firms do not.

Articles of incorporation are legal documents filed with basic information about the. A sole prop on its net in required to B. A _____ is a form of business ownership in which the business is considered a legal entity that is separate and distinct from its owners.

Which form of business organization is established as a separate legal entity from its owners. The vast majority of small businesses start out as sole proprietorships. A sole proprietorship is the simplest form of business where an.

Corporations generate the largest income and the most sales. A corporation is a type of business organization that is recognized under the law as an entity separate from its owners. A sole proprietorship is an accounting entity separate from its owners.

Limited Liability of shareholders The business is viewed as a separate legal entity. A corporation is a legal entity created by the state whose assets and liabilities are separate from its owners. Organization generally refers to businesses that find gains by providing goods or solutions in exchange for payment.

Therefore the owners of a corporation are not personally liable for the debts of the business. This means that even if a shareholder leaves the PLC or dies the business can continue. Corporations file and pay income taxes on their own.

The term double taxation refers to which of the following. A limited liability company LLC is a flexible entity structure that can combine the concepts of sole proprietorships if there is one owner partnerships and or corporate structures. Which form of business organization is established as a legal entity separate from its owners.

Professional Corporation Is It The Best Business Structure Business Law Business Structure Business

Professional Corporation Is It The Best Business Structure Business Law Business Structure Business

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

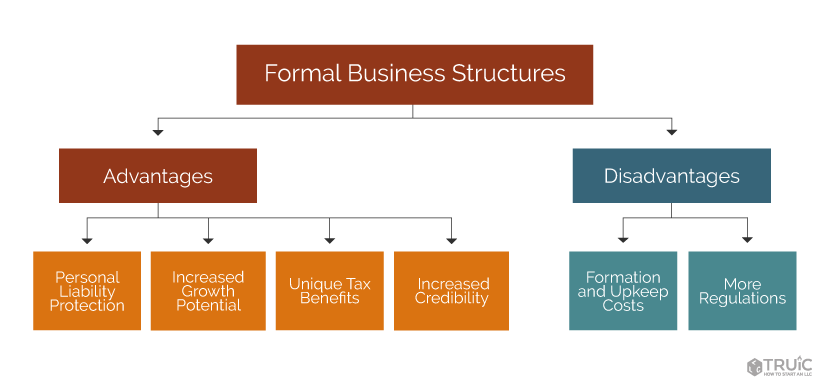

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

C Corporation Formation Services Ez Incorporate C Corporation Corporate Legal Separation

C Corporation Formation Services Ez Incorporate C Corporation Corporate Legal Separation

Legal Forms Of Business Organization

Legal Forms Of Business Organization

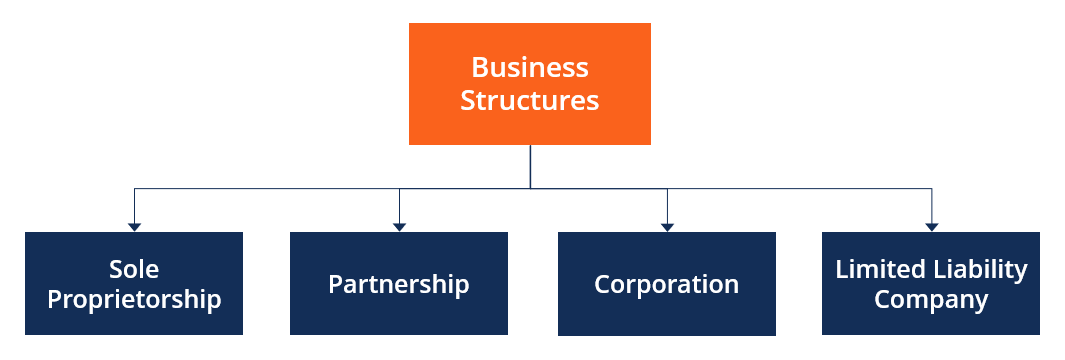

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

Legal Forms Of Business Organization

Legal Forms Of Business Organization

C Corporation Vs S Corporation S Corporation C Corporation Bookkeeping Business

C Corporation Vs S Corporation S Corporation C Corporation Bookkeeping Business

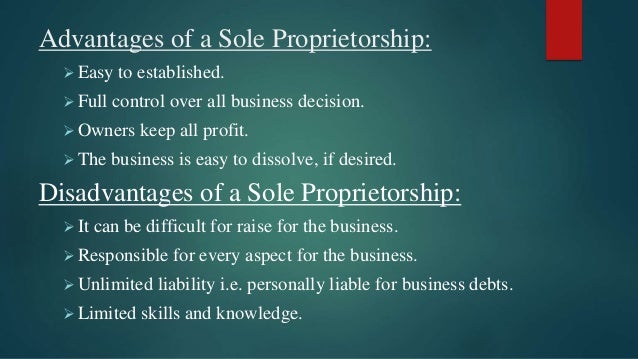

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Pin By Am On Commerce Stuff Legal Business Business Ownership Profit And Loss Statement

Pin By Am On Commerce Stuff Legal Business Business Ownership Profit And Loss Statement

Corporate Entity Types Table Bookkeeping Business C Corporation S Corporation

Corporate Entity Types Table Bookkeeping Business C Corporation S Corporation

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Business Ownership Structure Types Business Structure Business Basics Business Ownership

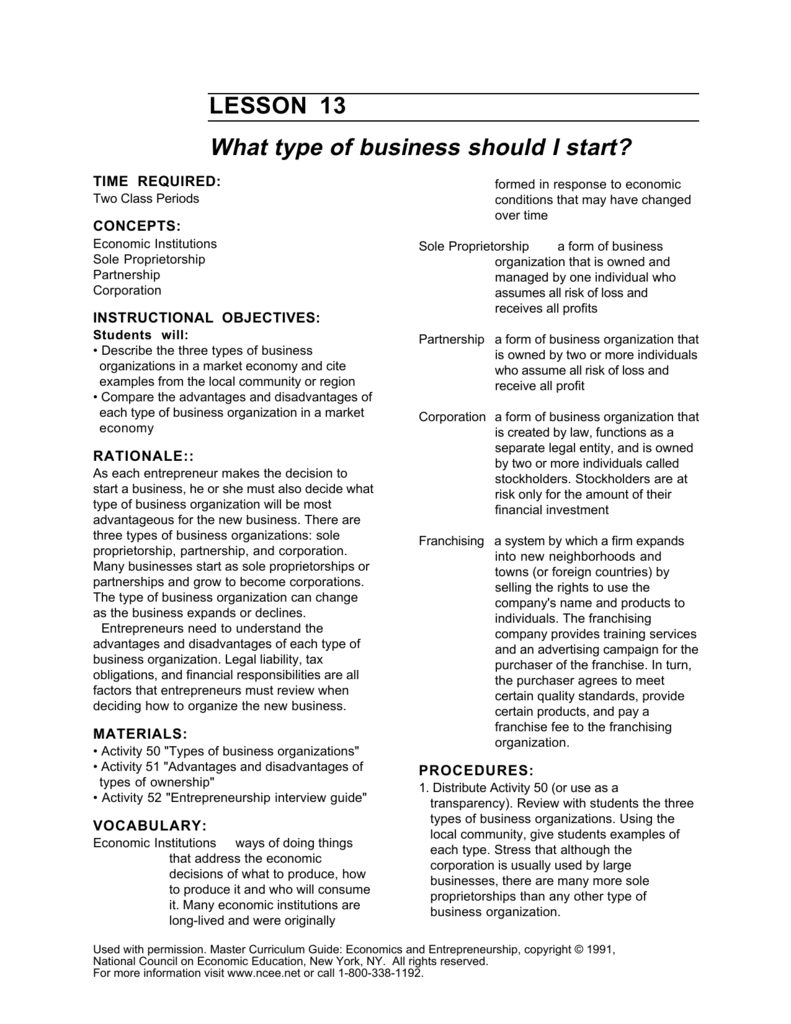

Lesson 13 What Type Of Business Should I Start

Lesson 13 What Type Of Business Should I Start

Apply For Your Limited Liability Partnership Company Legal Business Organization Business

Apply For Your Limited Liability Partnership Company Legal Business Organization Business

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

Business Ownership And It S Different Types

Business Ownership And It S Different Types