What Does Nec Mean On 1099 Form

In the context of 1099 tax filing NEC stands for Nonemployee Compensation the first letters of the three words None Employee and Compensation. Businesses are required to send to people they paid more than 600 for services during the last calendar year.

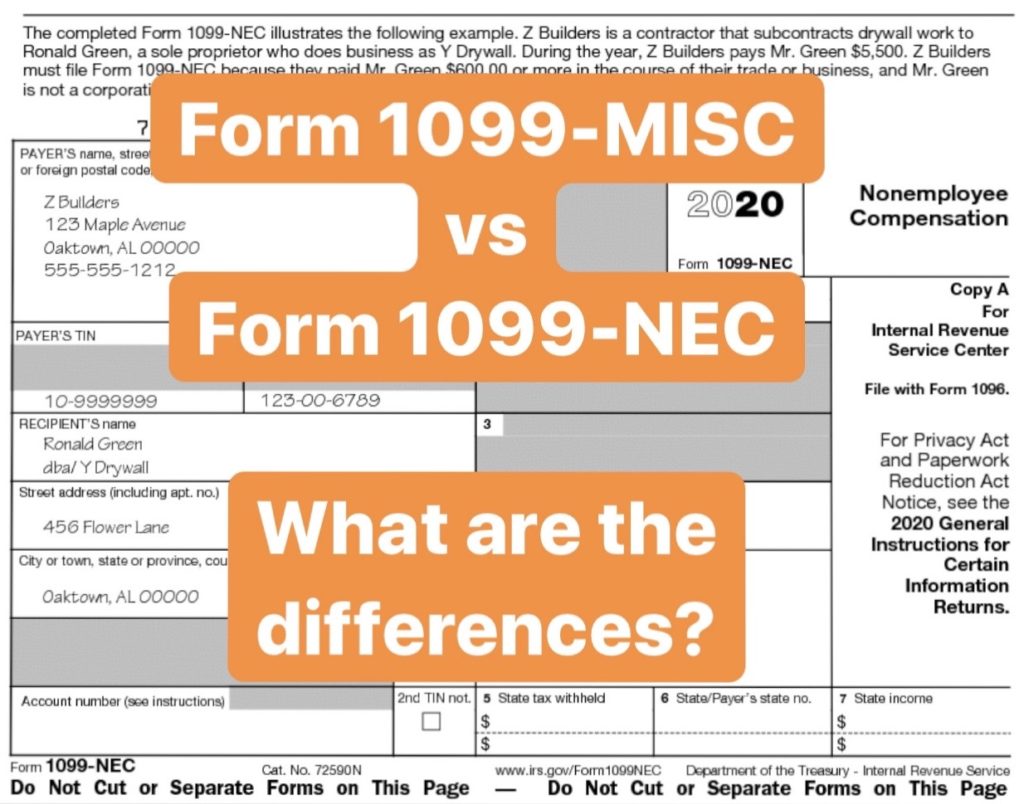

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Misc Vs Form 1099 Nec How Are They Different

The odd thing about Form 1099-NEC is that its not a new form at all.

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

What does nec mean on 1099 form. A 1099 form is a record of income. Since it is self-employment or non-employee compensation it must be associated with a Schedule C even if there are no expenses being claimed. This is considered as Form 1099 NEC Due Date.

Since this type of income is considered self-employment non-employee compensation it must be linked to a Schedule C even if there are no expenses being claimed. According to the IRS. And the 1099-NEC is actually not a new form.

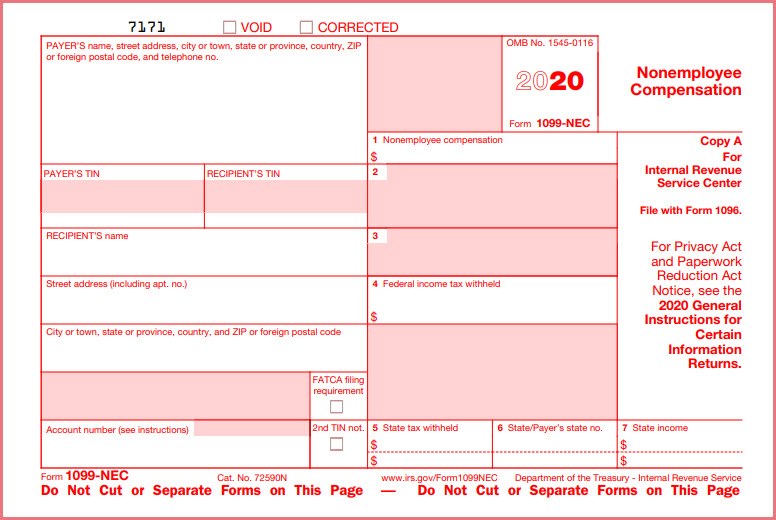

This form solely reports Non-Employee Compensation NEC. Form 1099-NEC isnt a new form but it hasnt been in use since 1982. Starting in tax year 2020 businesses that pay at least 600 for business-related services performed by someone who is not their employee must file Form 1099-NEC.

Just entering the information on that form is only one step. Any income reported on Form 1099-NEC is not reportable directly on your tax return. Its just a minor paperwork change.

It was last used in 1982 but was retired. Examples of this include freelance work or driving for DoorDash or Uber. The rules for Form 1099-NEC are the same as they were for Form 1099-MISC with non-employee compensation in Box 7.

The IRS is bringing it back as a dedicated form for reporting self-employment income. All kinds of people can get a 1099 form for different reasons. The PATH Act PL.

Form 1099-NEC Nonemployee Compensation is a form that solely reports nonemployee compensation. Previously companies reported this income information on Form 1099-MISC Box 7. Most tax payers recognize NEC as box 1 on form 1099-NEC or in the past as box 7 on form 1099-MISC.

This is considered as Deadline. Generally you need to issue a Form 1099-NEC if you pay an independent contractor 600 or more during the year and the payment is not reportable on a Form 1099-K. Form 1099-NEC is only replacing the use of Form 1099-MISC for reporting independent contractor payments.

Beginning with tax year 2020 use Form 1099-NEC to report nonemployee compensation. 201 accelerated the due date for filing Form 1099 that includes nonemployee compensation NEC from February 28 to January 31 and eliminated the automatic 30-day extension for forms that include NEC. In addition businesses must also file Form 1099-NEC for each person theyve withheld any federal income tax from regardless of the amount.

The 1099-NEC is the new form to report nonemployee compensationthat is pay from independent contractor jobs also sometimes referred to as self-employment income. Income reported on Form 1099-NEC is not reportable directly on your tax return. Youll use it this year instead of.

IRS has officially unveiled the new Form 1099-NEC which your finance staff will use to report nonemployee compensation. In the recently released Tax Tip 2020-80 the Service explained that the reinstated 1099-NEC will be used in tax year 2020 to report any payment of 600 or more to payees. The 1099-NEC Nonemployee Income is an informational form that US.

Form 1099-NEC is not a replacement for Form 1099-MISC. If youre an independent contractor who has received that. For example freelancers and independent contractors often get a.

If your return does not include a Schedule C then TurboTax is trying to get you to fix this issue. You need to complete the filing of the form 1099 online and send it to the IRS by e-filing or paper filing at the end of January 31 st. You do not necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.

It replaces the use of Form 1099-MISC for reporting non-employee compensation formerly Box 7. If you are filing a 1099 NEC form then you need to send your Form 1099 NEC copy B to the payee on or before January 31 st.

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Freelancers Independent Contractors Archives Taxgirl

Freelancers Independent Contractors Archives Taxgirl

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

1099 Nec The Dancing Accountant

1099 Nec The Dancing Accountant

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Form 1099 Nec Vs 1099 Misc For Tax Year 2020 Blog Taxbandits

Form 1099 Nec Vs 1099 Misc For Tax Year 2020 Blog Taxbandits