W8 Form Canada Business

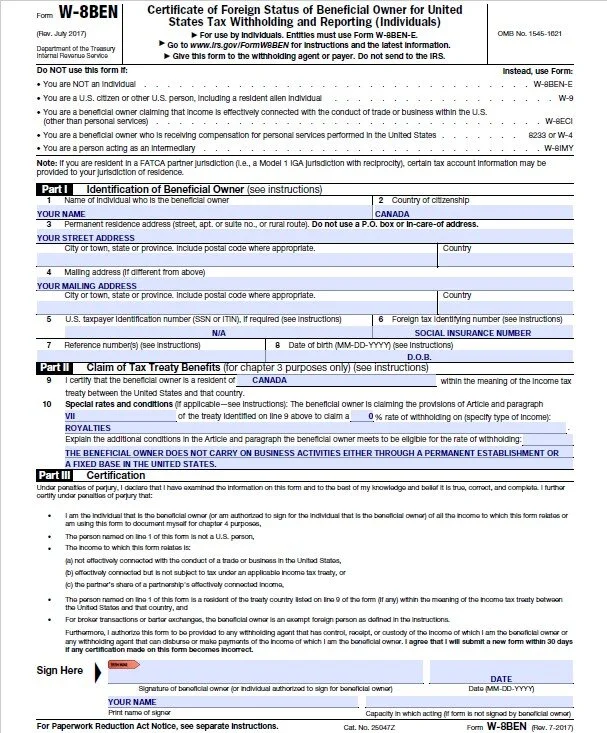

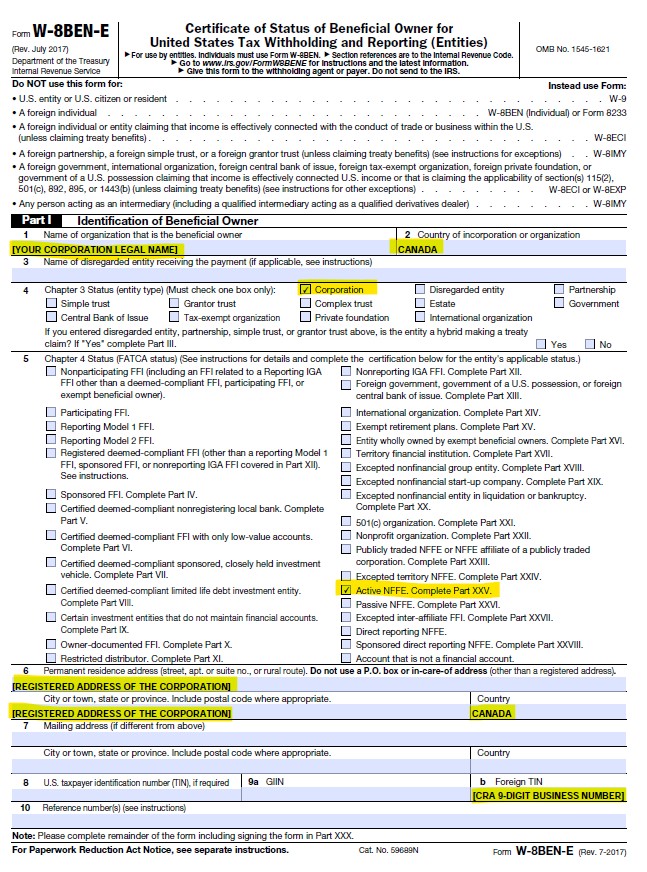

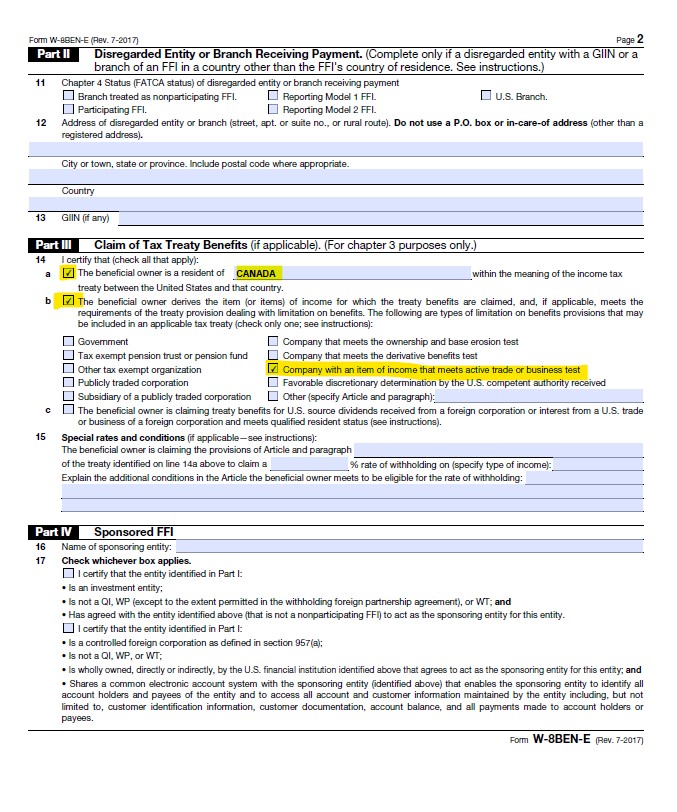

These instructions supplement the instructions for Forms W-8 BEN W-8 BEN-E W-8 ECI W-8 EXP and W-8 IMY. An example of completed form W-8BEN-E by an active business operating from Canada that is satisfying mentioned requirements providing its services to US client is displayed below.

If a taxpayer identification number or Form W-8 or substitute form is not provided or the wrong taxpayer identification number is provided these payers may have to withhold 20 of each payment or transaction.

W8 form canada business. Form W-8BEN is a tax form that US. Nonresidents must fill out when they earn income from US. Filling out Form W-8BEN is fairly straightforward.

Heres what to expect. Note that this is a sample only and the actual form must be prepared by professional taking into account all aspects of current tax legislation. Mailing address if different from above.

The primary purpose of such laws was to track transactions between financial institutions and to crack down on suspicious arrangements in the fields of finance insurance government investment etc. This works because the US and Canada have a tax treaty which is in place to stop double taxation². W8 forms have been created to rigorously document such transactions.

W-8 forms are Internal Revenue Service IRS forms that foreign individuals and businesses must file to verify their country of residence for tax purposes and certify that they qualify for a lower. Canadian independent contractors earning income from US. You should provide the following no credit score or tax returns needed- Employment verification letter- Two recent pay stubs that verify the salary claims in the EV letter- Two most recent bank statements that show a reasonable amount of cash- Photo ID in the form of a passport or visaGenerally the above should be plenty but it does depend on the landlordThe landlord will likely have you fill out a W8 form.

Vendors will collect and keep the form on file. Who is not a US. What are W-8 series tax ID forms.

Sources in order to determine their required tax withholdings. Form W-8BEN-E helps reduce that withholding tax rate from 30 to 0 based on the provision in the US-Canada Tax Treaty. Name of individual who is the beneficial owner.

A W-8 form is a tax form that tells organizations and people doing business within the United States that the person they are doing business with is not a US. A W-8 form identifies a person working in the US. As you can see the US tax code system certainly has its complexities.

Notice of Expatriation and Waiver of Treaty Benefits 1109 07172012 Form W. To make things more confusing the W-8 series contains five different forms that can be used to manage tax requirements for entities that are claiming foreign tax ID status. Has no fixed place of business outside such country for this purpose a fixed place of business does not include a location that is not advertised to the public and from which the FFI performs solely administrative support functions.

However if youre already paying tax on your income to the Canadian Revenue Agency CRA you can complete the W8-BEN form and give it to your client to confirm that they should release your full payment with nothing withheld. How Do I Fill Out Form W-8BEN in Canada. International vendors must submit a US withholding certificate W-8 series of forms with an Employer Identification Number EIN Individual Taxpayer Identification Number ITIN or Social Security Number SSN in order to claim an exemption from or reduction in withholding.

If youre a Canadian business with a customer in the US you may have been asked to fill out a W8-BEN-E form. The form exempts the. Before retaining a US tax specialist or planning your getaway from the IRS there are a few things you should know about the form.

For general information and the purpose of each of the forms described in these instructions see those forms and their accompanying instructions About Form W-8 BEN Certificate of Foreign. 13 rows Form W-8CE. Form W-8 or substitute form must be given to the payers of certain income.

This is called backup withholding. Sources must fill out the form but they can use it to claim exemption from withholdings due to income tax agreements between the US.

W 8ben E Form Instructions For Canadian Corporations Cansumer

W 8ben E Form Instructions For Canadian Corporations Cansumer

How To Complete W 8ben E Form For Business Entities Youtube

How To Complete W 8ben E Form For Business Entities Youtube

How To Complete The W 8ben Form For Canadian Beachbody Coaches Beachbody Coach Irs Gov Coaching

How To Complete The W 8ben Form For Canadian Beachbody Coaches Beachbody Coach Irs Gov Coaching

W 8ben Fill Out And Sign Printable Pdf Template Signnow

W 8ben Fill Out And Sign Printable Pdf Template Signnow

What Is A W 8 Form The Dough Roller

What Is A W 8 Form The Dough Roller

Why Have I Been Asked To Fill Out A W 8 Ben E Form Virtual Heights Accounting

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

W 8ben Form Instructions For Canadians Cansumer

W 8ben Form Instructions For Canadians Cansumer

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8 Forms Collected By Stripe Stripe Help Support

W 8 Forms Collected By Stripe Stripe Help Support

W8 Form 2020 Fill Online Printable Fillable Blank Pdffiller

W8 Form 2020 Fill Online Printable Fillable Blank Pdffiller