How To Report 1099-q

You can enter the Form 1099-Q in either the Wages Income section or the Deductions Credits section of Federal Taxes. Form 1099-Q and these instructions have been converted from an annual revision to continuous use.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Finally box 3 reports your basis in the distribution.

How to report 1099-q. To report an education distribution payment from a Form 1099-Q. Follow the screens to enter your info. On smaller devices click in the upper left-hand corner then Federal.

Heres how to enter your 1099-Q in TurboTax. Form 1099-Q is an IRS form for an individual that receives distributions from a Qualified Education Program. See part M in the current General Instructions for Certain Information Returns.

The full amount of earnings as reported on Form 1099-Q is taxable if. Income Select My Forms Less Common Income. Gross distributions from a qualified tuition program 529 plan or from a Coverdell Education Savings Account reported in Box 1 include both earnings reported in box.

We use cookies to give you the best possible experience on our website. Scroll down to the Education Distributions 1099-Q section. The person who receives the funds whose SSN is on the 1099-Q has to report the Form 1099-Q on their tax return If the money went straight to the school it is treated as going to the student.

Schedule 1 line 8 starting in Drake19. Box 2 reports the portion of the distribution that represents account earnings while Box 3 reports the portion representing the. To enter Form 1099-Q data in your TaxAct return.

Multiply the total distributed earnings shown on Form 1099-Q box 2 by a fraction. Dave received a 1099-Q for a distribution that he received from his QTP Qualified Tuition Program. Check the Spouse box if applicable.

Divide the AQEE by the total 529 plan distribution Form 1099-Q Box 1 Multiply the answer by the earnings portion of the total distribution Form 1099-Q Box 2. If part of the distribution is taxable you will need to enter that portion in your account as taxable income. Box 1 reports your annual distributions or withdrawals from the account.

For more information see. To enter go to. You have two options with how to report your Qualified Education Expenses on Form 1099-Q.

Click Education under Federal Quick QA Topics to expand that category then click Education program payments Form 1099-Q scroll down if necessary. How to report a taxable 529 plan distribution on federal income tax returns. Form 1099-Q must include the payertrustees name address telephone number and tax identification number TIN along with the recipients name address account number and TIN which for.

Both the form and instructions will be updated as needed. Open or continue your return. Just file your 1099-Q with your tax records.

Select Show more and select Start or Revisit next to ESA and 529 qualified tuition programs Form 1099-Q. If there is a taxable distribution the taxable amount flows to Form 5329 line 5 and to. Subtract the amount figured in 1 from the total distributed earnings.

Scroll down to the Education section under All tax breaks. Go to Screen 143 Education Distributions ESAs QTPs. This form is used to prepare both the federal and state tax returns.

Form 1099-Q - Payments from Qualified Education Programs. To demonstrate we will use the following example. His gross distribution box 1 was 5000 and his earnings box 2 were 1500.

Payments from Qualified Education Programs 1099-Q. If I receive 1099Q where do I report and how can I claim the expenses paid for - Answered by a verified Tax Professional. The 1099-Q provides three key pieces of information.

Due to the very low volume of paper Forms 1099-Q received and processed by the IRS each year this form has been converted to an online fillable. Complete Part II Education and ABLE Accounts on screen 5329. An early withdrawal penalty of 10 applies.

The numerator top part is the adjusted qualified education expenses AQEE paid during the year and the denominator bottom part is the total amount distributed during the year. If you withdrew from your 529 college-savings plan during 2015 you will have received Form 1099-Q from the plan administrator for tax reporting purposes. From within your TaxAct return Online or Desktop click Federal.

Box 1 of your 1099-Q will report the total distribution from your education program for the year regardless of whether the funds are sent directly to the school. The software will compute the amount of distribution that is taxable. Furnish a copy of Form 1099-Q or an acceptable substitute statement to each recipient.

Select Federal and then Deductions Credits. Under Qualified Expenses enter the Higher education net of nontaxable benefits. You didnt use the funds for your own qualified education expenses.

Should I report 1099 Q on to 1040. The second box reports the portion of the distribution that represents the income or earnings of your initial investment. If you are required to file Form 1099-Q you also must furnish a statement to the recipient.

The penalty is reported on Form 5329. If you used all the money you withdrew from your QTP or Coverdell ESA to pay for qualified education expenses and meet other IRS requirements the distributions arent taxable and you dont need to report them as income. For the most recent version go to IRSgovForm1099Q.

Youre the designated beneficiary. Schedule 1 line 21 in Drake18.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

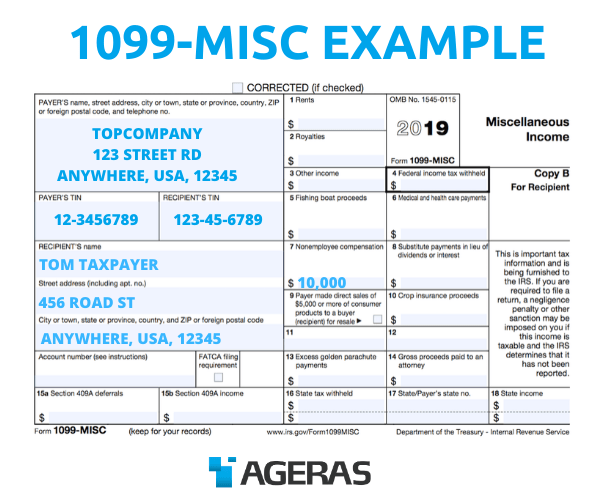

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

A Complete Breakdown Of The 1099 Q Form

A Complete Breakdown Of The 1099 Q Form

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Guide To Irs Form 1099 Q Payments From Qualified Education Programs Turbotax Tax Tips Videos

Guide To Irs Form 1099 Q Payments From Qualified Education Programs Turbotax Tax Tips Videos

Irs Approved 1099 Q Tax Forms File Form 1099 Q Payments From Qualified Education Programs Under Secti Employee Tax Forms Tax Forms Education Savings Account

Irs Approved 1099 Q Tax Forms File Form 1099 Q Payments From Qualified Education Programs Under Secti Employee Tax Forms Tax Forms Education Savings Account

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

Form 1099 Q What To Know Credit Karma Tax

Form 1099 Q What To Know Credit Karma Tax

Irs 1099 Q 2019 Fill And Sign Printable Template Online Us Legal Forms

Irs 1099 Q 2019 Fill And Sign Printable Template Online Us Legal Forms

Https Cdn Unite529 Com Jcdn Files Ssgav2 Pdfs 1099qfaq Pdf

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What Is Irs Form 1099 Q Zipbooks

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Irs Form 1099 R Box 7 Distribution Codes Ascensus