How To Prepare W2 For Household Employee

Set up direct deposit and processes for issuing pay stubs. The IRS assumes that a worker is an employee unless you can prove otherwise and the IRS audits employers to make sure that workers are properly.

A 2021 Employer S Guide To The W 2 Form The Blueprint

A 2021 Employer S Guide To The W 2 Form The Blueprint

You can get one by either.

How to prepare w2 for household employee. The IRS will then send a notice to the family to let them know they need to send you a W-2. If you are filing your W-2 forms online with the Social Security Administration you dont need to include a. Differentiating between employees and contractors is sometimes a difficult task so you might want to consult with an employment attorney or ask the IRS to make a determination by submitting Form SS-8.

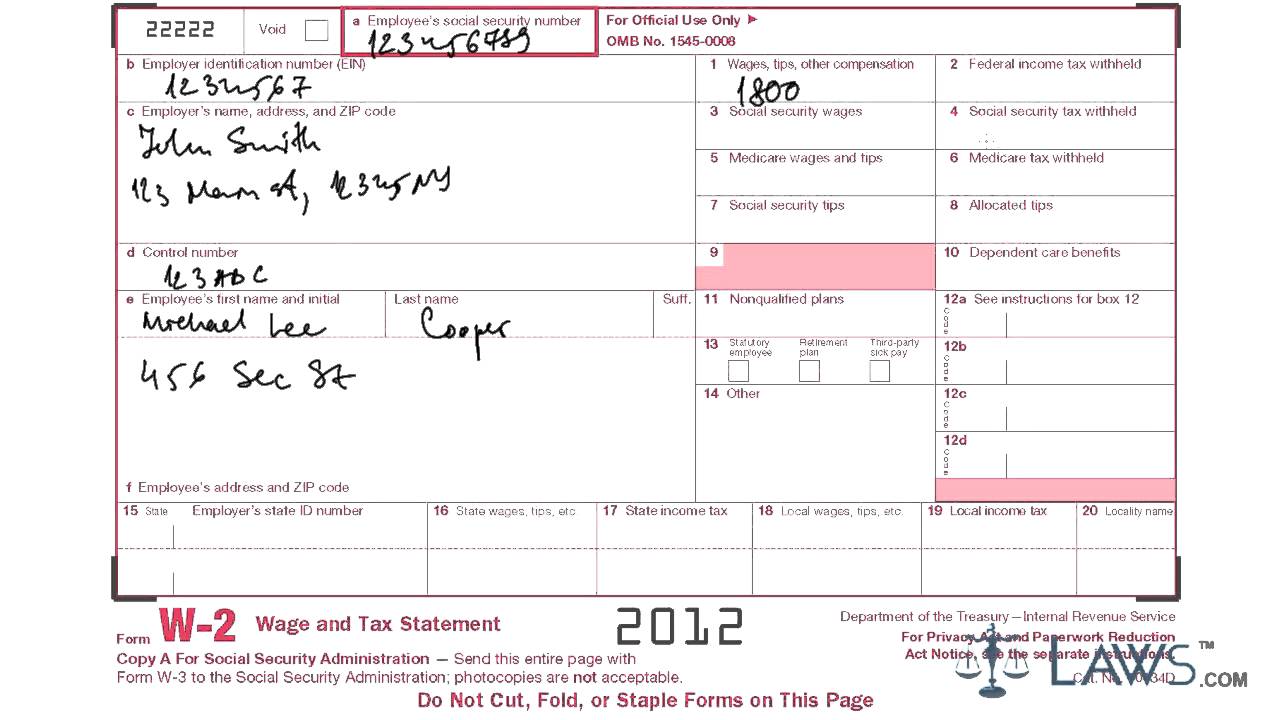

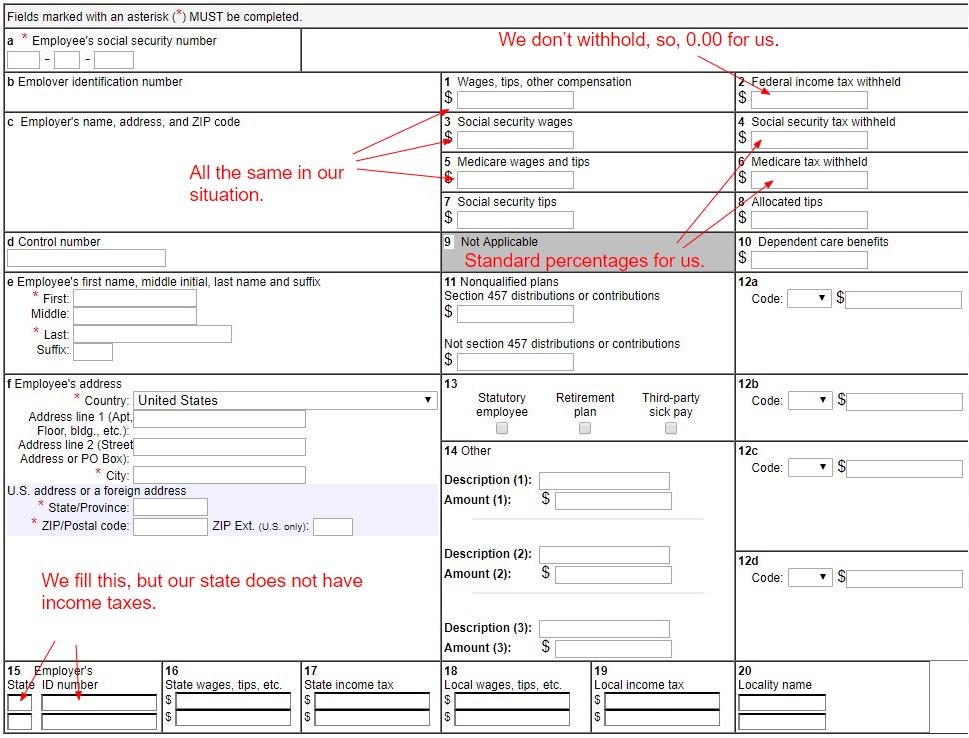

Send copy A of Form W-2 with Form W-3 Transmittal of Wage and Tax Statement to Social Security by the last day of. If you are youll enter your employees wages and calculate what is owed in Social Security and Medicare taxes. Follow the instructions to report.

You can file your W-2 form online with the Social Security Administration by enrolling in the Business Services Online service. Report the social security and Medicare taxes that you paid in boxes 4 and 6 of your employees Form W-2. Household employees in most cases are not independent contractors.

Select payroll accounting softwareits not required but it can be a big help. On the other hand you can make the employee active again if you still have to create a paycheck moving forward. You can keep the W-2 for the household employee who doesnt require the form for your own record.

How do you create W-2s for household employees ie Nannies using Turbotax Self-Employed online. The 124 percent Social Security tax a 29 percent Medicare tax and the 6 percent federal unemployment tax or FUTA. Total wages paid to your household employees.

Wage reports for Tax Year 2020 are now being accepted. Please visit our Whats New for Tax Year 2020 page for important wage reporting updates. What is the deadline for giving the W-2 to my nanny.

The household employment taxes that you may have to account for on Schedule H cover the same three taxes that are withheld from all employment wages. If youre required to file a 2020 Form W-2 for any household employee you must also send Form W-3 with Copy A of Forms W-2 to the SSA. If youre getting close to the April 15th tax filing deadline and nothing else has worked you can report your income using Form 4852 which is a substitute for the W-2.

Attention Tax Year 2020 Wage Filers. Yes you can file a W2 for a household employee who is paid less than 2000 for the year or if you dont need to pay federal unemployment tax because you paid total cash wages less than 1000 in any calendar quarter to household employeesYou dont need to so the Schedule H will not be required or used with your return if you choose to. Total your employees annual income.

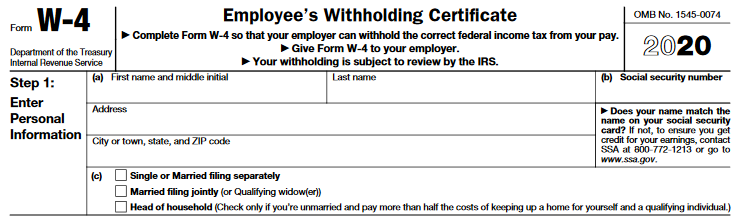

Reminder Tax Year 2020 wage reports must be filed with the Social Security Administration by February 1 2021. Reporting wages to Social Security You must give your household employee copies B C and 2 of IRS Form W-2 Wage and Tax Statement by January 31 after the year the wages were paid. You will need this for your employees SSN and home address.

Go to the Payroll tab and then click Employees. Here are the steps to do so. Applying online at wwwirsgov.

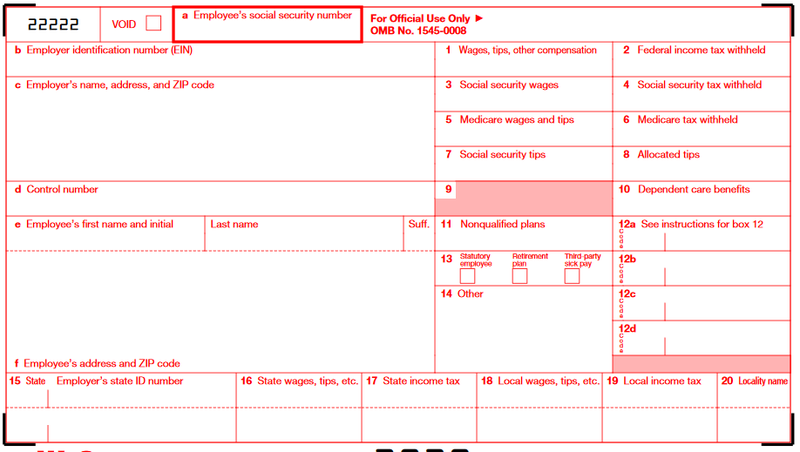

In Box 3 insert the employees total wages subject to the Social Security tax. The QEF page definitely said you cannot create W2s with TurboTax self-employed. For Box 1 you will need to specify the total wages tips and other compensation given to your employee that are subject to federal income tax during the previous year.

In addition to reporting your income and paying the estimated amount of taxes you. Cash wages include money paid directly to the employee but dont include in-kind compensation such as meals or lodging. Wages to household employees you withheld federal income tax from.

In 2021 you hire a household employee who is an unrelated individual over age 18 to care for your child and agree to pay cash wages of 100 every Friday. Gather Form I-9 your nanny completed around first day of employment. In Box 2 identify the total amount withheld in federal income tax.

You MUST file online if you have 250 or more W-2s to file. View more information on this topic. Again direct deposit isnt required but its easier and your employee will thank you for it.

If filing electronically via the SSAs Form W-2 Online service the SSA generates Form W-3 data from the electronic submission of Forms W-2. I paid my nanny directly for the first 4 months of the year. Click on the button to Log in to Business Services Online or Register if you have not done so previously.

The social security tax and medicare tax as. File Form 4852 as a substitute for your W-2 if you never receive it. Steps to Generate a W-2 for your nanny.

Household Employers Tax Guide at wwwirsgov. Application for Employer Identification Number. To learn more see Publication 926.

Also add the taxes to your employees wages reported in box 1 of Form W-2. Youre encouraged to file your Forms W-2 and W-3 electronically. They receive W-2 forms.

Decide how frequently youre going to pay your employee such as weekly biweekly or semimonthly. Go to the online tool found at httpwwwsocialsecuritygovemployer. The form will ask you a series of questions to determine whether you are subject to household employment taxes.

The W-2 form needs to be postmarked by February 1st 2016. If you have to file Schedule H or a W-2 you must have an employer identification number EIN. The W-2 reporter link in 2017 Turbotax Business is not online in 2018.

Federal income tax withheld. You are required to withhold and pay FICA taxes for your household employee if you pay them more than 2100 in cash wages over the course of the year.

W2 Forms Google Search Tax Forms W2 Forms Tax Time

W2 Forms Google Search Tax Forms W2 Forms Tax Time

Getting Your 2015 2016 W 2 Form Online Filing Taxes W2 Forms Income Tax Return

Getting Your 2015 2016 W 2 Form Online Filing Taxes W2 Forms Income Tax Return

Tops W 3 Tax Form 2 Pt Form With Carbons 10 Pk 2203 In 2021 Tax Forms Employment Form Budgeting Money

Tops W 3 Tax Form 2 Pt Form With Carbons 10 Pk 2203 In 2021 Tax Forms Employment Form Budgeting Money

How To Deduct Donations Which Ones Qualify H R Block Business Tax Tax Write Offs Irs Taxes

How To Deduct Donations Which Ones Qualify H R Block Business Tax Tax Write Offs Irs Taxes

Instant W2 Form Generator Create W2 Easily Form Pros

Instant W2 Form Generator Create W2 Easily Form Pros

Getting Ready To File Your Tax Return Be Sure To Have All The Needed Documents Before You File Your Return 2017 Tax Return Year End Forms W 2 From Employers

Getting Ready To File Your Tax Return Be Sure To Have All The Needed Documents Before You File Your Return 2017 Tax Return Year End Forms W 2 From Employers

Reports And Info About W 2 And W 3 Forms

Reports And Info About W 2 And W 3 Forms

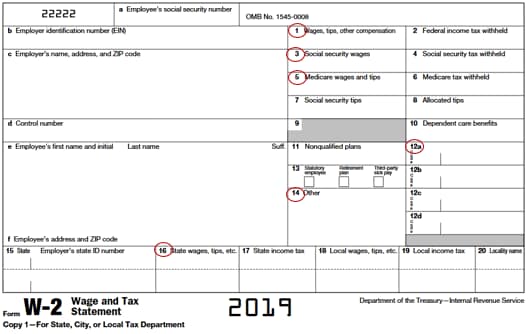

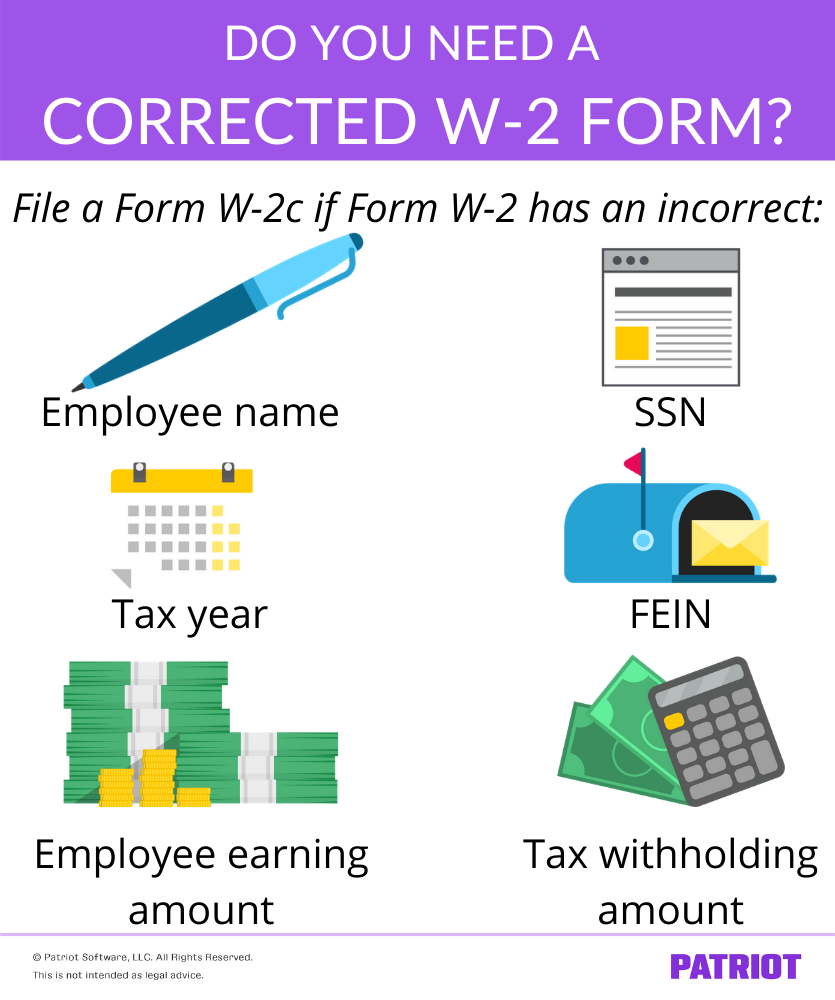

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

Amazon Com Tops W2 Forms 2020 Tax Forms Kit For 26 Employees 6 Part W2 Tax Form Sets With Self Seal W2 Envelopes Includes 3 W3 Forms Tx22904kit 20 Office Products

Amazon Com Tops W2 Forms 2020 Tax Forms Kit For 26 Employees 6 Part W2 Tax Form Sets With Self Seal W2 Envelopes Includes 3 W3 Forms Tx22904kit 20 Office Products

How To Create A W 2 For Your Nanny Nanny Tax Tools

Free W2 Form 2016 3 Ways To Get Copies Of Old W 2 Forms Wikihow Irs Forms W2 Forms Job Application Form

Free W2 Form 2016 3 Ways To Get Copies Of Old W 2 Forms Wikihow Irs Forms W2 Forms Job Application Form

Learn How To Fill W 2 Tax Form Youtube

Learn How To Fill W 2 Tax Form Youtube

How To File Taxes The Easy And Organized Way Filing Taxes Tax Organization Tax Checklist

How To File Taxes The Easy And Organized Way Filing Taxes Tax Organization Tax Checklist

Amazon Com Set Of W 2 4 Up Employee Tax Forms Instructions On Back For 2020 For Laser Inkjet Printer Compatible With Quickbooks And Accounting Software 25 Forms With 25 Self Seal Envelopes Office Products

Amazon Com Set Of W 2 4 Up Employee Tax Forms Instructions On Back For 2020 For Laser Inkjet Printer Compatible With Quickbooks And Accounting Software 25 Forms With 25 Self Seal Envelopes Office Products

How To Create A W 2 For Your Nanny For Free

How To Create A W 2 For Your Nanny For Free

A 2021 Employer S Guide To The W 2 Form The Blueprint

A 2021 Employer S Guide To The W 2 Form The Blueprint

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Household Employers Required To Have Eins Cwu W2

Household Employers Required To Have Eins Cwu W2