How Do I Get My 1099-g From Virginia

Ive been able to pay all my bills off through June as well as get my car paid off halfway. I hated my old super toxic job and its made me realize that I never want to work somewhere for the money again.

Https Www Vec Virginia Gov Printpdf 1099

It is likely that it is still on the way.

How do i get my 1099-g from virginia. Virginia Relay call 711 or 800-828-1120. Follow the instructions to enter your unemployment. To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return.

State or local income tax refunds If you received a refund of state or local income taxes of 10 or more on a prior years return the state or local taxing authority should send you a 1099-G form showing the refund amount in Box 2. 31 there is a chance your copy was lost in transit. We will mail you a paper Form 1099G if you.

Call your local unemployment office to request a copy of your 1099-G by mail or fax. The amount that was withheld will appear in Box 4 if you asked to have income tax withheld from your benefits. Then you will be able to file a complete and accurate tax return.

To look up your Form 1099-G1099-INT online youll need the following information from your most recently filed Virginia tax return. If you cannot access your 1099-G form you may need to reset your password within IDESs secure website. If you have the total of amount received you can calculate similar to the method the original poster described from the prior tax year.

My credit score has gone up to over 700. You can view or print your forms for the past seven years. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays.

This is the fastest option to get your form. However you dont necessarily have to report this amount on your federal tax return or pay additional federal taxes. Virginia How do I obtain my 1099-G form for receiving unemployment in 2020.

The 1099-G tax form is commonly used to report unemployment compensation. It is not necessary to attach the 1099-G to your tax return. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits.

This 1099-G does not include any information on unemployment benefits received last year. If the amount is for a tax year other the prior year the appropriate tax year will be is reported in Box 3. You can access your Form 1099G information in your UI Online SM account.

Pacific time except on state holidays. You should be receiving a 1099-G from the government entity that paid you the benefit. Request Your 1099 By Phone To request a copy of your 1099-G or 1099-INT by phone please call 304 558-3333.

Once there you may be able to sign in to your account and view it or request another one be sent to you. Any advice would be appreciated. The tax year of your return.

It doesnt look like the new unemployment website has it. Please provide one of. Instructions for the form can be found on the IRS website.

Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020. There is a selection oval on your individual income tax form to opt out of receiving a paper Form 1099G.

Select the appropriate year and click View 1099G. If you havent received your 1099-G copy in the mail by Jan. When you receive a refund offset or credit of state or local income tax that amount appears in box 2 of the 1099-G form.

Your local office will be able to send a replacement copy in the mail. If youve lost or cant find your 1099-G select your state below to go to your local unemployment website. Your adjusted gross income Line 1 If you filed a part-year return add together the amounts from both columns Line 1.

To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. The Form 1099G is a report of the income you received from the Virginia Department of Taxation. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am.

However they do not have to be sent to you until January 31. Im trying to file my taxes and have no idea where to get it. If you received a 1099-G from the Virginia Employment Commission for the tax year 2020 and want to request a corrected form 1099-G be sent to you and the IRS you will need to submit your request in writing to the address listed below.

I am single with no kids and all I do is hang out with friends and play video games all day. If your responses are verified you will be able to view your 1099-G form.

Prepare And Efile Your 2020 2021 Virginia Income Tax Return

Prepare And Efile Your 2020 2021 Virginia Income Tax Return

Https Www Tax Virginia Gov Sites Default Files Inline Files 2020 Software Provider Letter Of Intent Pdf

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Divorce In Virginia Fill Online Printable Fillable Blank Pdffiller

Divorce In Virginia Fill Online Printable Fillable Blank Pdffiller

Https Www Vhda Com Businesspartners Propertyownersmanagers Rmrpdocuments Rmrp Program Details Landlords Pdf

Printable General Power Of Attorney Form Virginia Fill Online Printable Fillable Blank Pdffiller

Printable General Power Of Attorney Form Virginia Fill Online Printable Fillable Blank Pdffiller

Va Refund 1099g Taxes Zip Code Schedule Northern Virginia Virginia City Data Forum

Va Refund 1099g Taxes Zip Code Schedule Northern Virginia Virginia City Data Forum

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

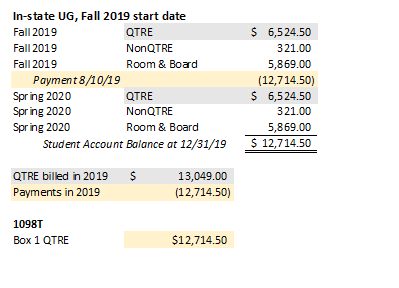

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Https Www Vec Virginia Gov Printpdf 377 Mini 2013 05

Https Www Tax Virginia Gov Sites Default Files Vatax Pdf 2019 763 Instructions Pdf

Faq S General Unemployment Insurance Virginia Employment Commission

Faq S General Unemployment Insurance Virginia Employment Commission