Do I Need To Give My Caregiver A 1099

Aside from tax forms managing a household employee is a year-round process because there are tax and payroll-related procedures to follow. You only issue this form if you paid someone only when payments are made in the course of your trade or business.

The income you receive from the trust as a caregiver for a family member is taxable income but it is not subject to self-employment tax.

Do i need to give my caregiver a 1099. Independent Caregivers Household Employees. Youll need to file a 1099 form with the IRS on wages over 600 per year and the caregiver will be responsible for her own taxes and benefits. When youre looking for a caregiving job you may hear families or other caregivers say that you should handle your taxes with a 1099 form because youre an independent contractor.

Payments are a personal expense. Your parents gross income for the calendar year was less than 4300. Now while a 1099-MISC is not required to be issued depending upon the situation the caregivers could be considered household employees.

Your parent isnt a qualifying child of another taxpayer. Your parent is a US. If youve hired a home health agency then more than likely the agency itself is the employer and the applicable employee taxes are part of the labor.

If you paid to a caregiver fro services provided to you - you do not need to issue the form1099-misc. The short answer is yes caregivers do pay taxes. You are very welcome.

This is because you arent paying the babysitter in the course of your trade or business. Thats only a requirement for businesses -- when you pay someone. Resident alien or a resident of Canada Mexico the Canal Zone or the Republic of Panama.

You must file Form W-2 for each household employee to whom you paid 2000 or more of cash wages. You will only be required to pay self-employment tax if you conduct other business or trade offering caregiving services. Hiring an independent contractor for personal services doesnt trigger the same requirement no matter how much you pay so you may not need to send a 1099 for a nanny.

If payments of 600 or more are made to any single caregiver the family should prepare Form 1099-MISC Miscellaneous Income and report the amounts paid in box 7 as nonemployee compensation. If you a taxpayer are the sole caregiver for your spouse and report a 1099-MISC income received from an insurance company you dont have to pay taxes from this income received. Who Needs To File Form W-2 and Form W-3.

But a better question is often what kind of taxes need to be paid and whos responsible for withholding and reporting these payroll taxes. The 1099-MISC form is reserved for businesses that hire the self-employed. The babysitters still must report their income to the IRS.

Do I have to issue a 1099 to a caregiver. When the decision has been made to hire an independent in-home caregiver instead of a home care agency it is important to understand the definition of an independent caregiver and a household employee according to the Internal Revenue Service IRS. Families sometimes see household workers like nannies senior caregivers etc as independent contractors not as employees.

The fact of the matter is that information is wrong in most cases when you look at how the IRS defines different types of workers. You should report the income on line 21 of Form 1040. However you dont need to issue a Form 1099-MISC or withhold taxes.

Hiring a babysitter for your kids doesnt require a 1099 form no matter much she charges. Personalpayments are not reportable. Yes the taxpayer owes self-employment tax since the taxpayer is engaged in a trade or business of providing care giving services as a sole proprietor operator of an adult day care.

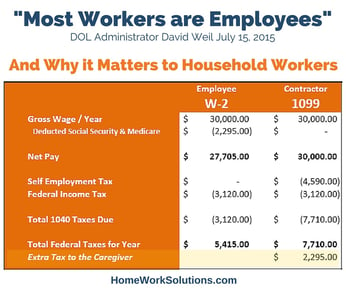

You are engaged in a trade or business if you operate for gain or profit. If you hire a caregiver whos genuinely an independent contractor dont worry about sending a 1099. The family will receive an advantage by giving you a 1099 instead of a W-2 because they will not have to pay the employer side of paycheck liabilities.

Actually you would have needed to create a W-2 for her. Businesses send out a 1099-MISC when they pay a non-employee 600 or more over the course of a year. Independent contractors are given a Form 1099 to handle their taxes.

You paid more than half of your parents support for the calendar year. However the authors recommend the filing of a Form 1099-MISC in order to protect the payers claims for credits or. 1099-MISC for Caregiver paid by a family members irrevocable trust how to declare the income.

The babysitters still must report their income to the IRS. Attempting to classify them as an independent contractor by giving them a Form 1099 is considered tax evasion and does not absolve them of their household employer tax and legal obligations. If this is the case then you will need to issue them a W2 withhold certain taxes if they are paid more than a certain amount etc.

Taxpayer receives Form 1099-MISC from the state agency with the amount paid shown in Box 7 as nonemployee compensation. If the caregiver is an independent contractor and is paid 60000 or more in one calendar year then the employer would be required to give the caregiver a form 1099-MISC which is a miscellaneous income reporting of what has been paid to the caregiver. Filing a Form 1099-MISC is only required of taxpayers engaged in a trade or business.

When you hire a nanny senior caregiver or other household employee you must give them a W-2 to file their personal income tax return. Be sure to perform a thorough background check before hiring a 1099 freelance caregiver and look for previous criminal convictions and other safety concerns.

Don T Miss Out On These Tax Breaks If You Re Taking Care Of Elderly Parents Marketwatch

Don T Miss Out On These Tax Breaks If You Re Taking Care Of Elderly Parents Marketwatch

Free Printable Paycheck Stub Templates Pay Template Canada Inside Free Pay Stub Template Word Cumed Org Payroll Template Templates Words

Free Printable Paycheck Stub Templates Pay Template Canada Inside Free Pay Stub Template Word Cumed Org Payroll Template Templates Words

How Does A Nanny File Taxes As An Independent Contractor

How Does A Nanny File Taxes As An Independent Contractor

Caregiver Tips For Handling Taxes Seniorsmatter Com

Caregiver Tips For Handling Taxes Seniorsmatter Com

Hsn Credit Card Manage Your Account Credit Card Statement Credit Card Website Business Credit Cards

Hsn Credit Card Manage Your Account Credit Card Statement Credit Card Website Business Credit Cards

Veteran W Wedge In Salute Disabled Veterans Veteran Disability

Veteran W Wedge In Salute Disabled Veterans Veteran Disability

Self Employed Caregivers 1099 Taxes

Self Employed Caregivers 1099 Taxes

What Is The Hardest Topics To Discuss With The Parents Job Benefits Parenting Plan Topics

What Is The Hardest Topics To Discuss With The Parents Job Benefits Parenting Plan Topics

Income Taxes Personal Services Contracts Medicaid Caregiver Agreements

Income Taxes Personal Services Contracts Medicaid Caregiver Agreements

How S My Commute A Look At The Cost Of Commuting Commute To Work Commuter Job Interview

How S My Commute A Look At The Cost Of Commuting Commute To Work Commuter Job Interview

What Is The Form 1099 Nec The Turbotax Blog

What Is The Form 1099 Nec The Turbotax Blog

21 Days With The Holy Spirit Holy Spirit Spiritual Attack Spiritual Words

21 Days With The Holy Spirit Holy Spirit Spiritual Attack Spiritual Words

What Every Family Needs In A Nanny Contract Care Com Homepay Nanny Contract Nanny Tax Daycare Costs

What Every Family Needs In A Nanny Contract Care Com Homepay Nanny Contract Nanny Tax Daycare Costs

What Is A 1099 Employee And Should You Hire Them Employers Resource

What Is A 1099 Employee And Should You Hire Them Employers Resource

Why Caregivers Need A W 2 To File Taxes Not A 1099 Care Com Homepay

Why Caregivers Need A W 2 To File Taxes Not A 1099 Care Com Homepay

Dad S Home Health Aide Is An Independent Contractor A Case Study

Dad S Home Health Aide Is An Independent Contractor A Case Study

Pin On Nanny Resources And Training

Pin On Nanny Resources And Training

Give Yourself Some By Practicing These Simple Free Acts Of Self Care Self Compassion Takes Nurturing And Patien Self Compassion Self Wednesday Motivation

Give Yourself Some By Practicing These Simple Free Acts Of Self Care Self Compassion Takes Nurturing And Patien Self Compassion Self Wednesday Motivation

/GettyImages-875247422_1800-5b2ef86953ee459bafe4acda6d31924e.png)