Can You Withdraw Money From A Deceased Parents Bank Account

If you wish to have the deceased individuals name removed from the account this is simple to do with a death certificate. Go to the bank and request the money if it was a jointly held account.

An Old Lady Went To A Bank To Withdraw Some Money Elite Readers

An Old Lady Went To A Bank To Withdraw Some Money Elite Readers

This is the case even if you need to access some of the money to pay for the funeral.

Can you withdraw money from a deceased parents bank account. Children and other heirs are not authorized to withdraw funds or otherwise tamper with such accounts even if the will entitles them to a share of the funds unless they themselves have been named as. If someone did make such a withdrawal after the death of the parent without informing the bank but later informed the bank about the persons death what criminal punishment would it draw. This amount can range from 15000 to 50000.

It is not legal to withdraw money from a deceased parents bank account using atm card and pin. Once youve opened the account you can request to transfer the funds from the deceaseds bank accounts to it. If the decedent mom was the sole owner of the bank account then the answer is no you cannot legally use that ATM card and should not.

Even if you are a signer on the account then your right to withdraw funds from the bank account terminates upon your mothers death. And if you are really the only owner of it still better to follow a legal procedure to withdraw the money. After that the financial.

You can claim the money by presenting the bank with your parents death certificates and proof of your identity. In recent months many high street banks have increased how much they will release from the deceaseds account without probate being required. If you are conducting a probate court proceeding then youll have written authorization usually called Letters of Administration or something similar from the probate court which will open doors for you.

Remember it is illegal to withdraw money from an open account of someone who has died unless you are the other person named on a joint account before you have informed the bank of the death and been granted probate. If youre the other named account holder you can simply access the money as you would in a standard situation since you have equal rights to the money. If not the bank account is closed and its balance will be divided up according to the deceaseds will or the intestate succession laws of the state.

Only the title holder owner to a bank account has the authority to use the ATM card. You can do it by filling out and submitting a form that the bank supplies. The money is not part of your probate estate assets that cant be transferred without the probate courts approval so it can be quickly and easily transferred to POD beneficiary.

If the account holder established someone as a beneficiary or POD the bank will release the funds to the named person once it learns of the account holders death. ATM use is just use or one way of operating the bank account. Bottom line If someone has a named beneficiary on their account that person can withdraw money after the account owner dies.

For more instruction see our article on claiming money in a POD bank account. Can you withdraw money from a deceased persons account. Withdrawing money from the deceaseds bank account before getting a grant Even if you are waiting for a grant of representation most banks will still allow you to use funds in the account of the person who has died to cover some immediate expenses related to settling their estate.

In Tennessee the states banking code enables your bank to let your family or creditors make a withdrawal of up. Remember it is illegal to withdraw money from an open account of someone who has died unless you are the other person named on a joint account before you have informed the bank of the death and been granted probate. While morally it is not fair to withdraw the money of a deceased account holder when you are not necessarily the whole owner of the money held in that account.

While federal banking laws have no provisions for covering final expenses many states have laws that do allow for withdrawals from the accounts of the deceased. Implementing the amendment introduced by the Train Law the Bureau of Internal Revenue BIR issued Revenue Memorandum Circular RMC 62- 2018 on June 28 2018 which states that the executor administrator or any of the legal heirs of a decedent who prior to death maintained bank deposits may be allowed withdrawal from the said bank deposit accounts within one year from. After your death and not before the beneficiary can claim the money by going to the bank with a death certificate and identification.

Youll use the estate account as a central repository to gather cash pay taxes settle bills and start making transfers to the deceaseds beneficiaries. To pay for a funeral from a deceased persons bank account while the account is frozen as described above as executor or administrator youll need to contact the bank to. Once a Grant of Probate has been awarded the executor or administrator will be able to take this document to any banks where the person who has died held an account.

This is the case even if you need to access some of the money to pay for the funeral. Whoever decides to present themselves at the bank with the death certificate whether they are the personal representative or not will be able to close the account and receive the closing balance personally. There is no dispute or claim regarding the account or legal heirs.

They will then be given permission to withdraw any money from the accounts and distribute it as per instructions in the Will. The law grants immediate access to the bank accounts of deceased parents only to the executor of the will.

What Happens To Your Bank Account When You Die Finder Com

What Happens To Your Bank Account When You Die Finder Com

Funds Availability And Your Bank Account What You Need To Know Forbes Advisor

Funds Availability And Your Bank Account What You Need To Know Forbes Advisor

Banking And Money Dramatic Play Pack Dramatic Play Dramatic Play Themes Dramatic Play Activities

Banking And Money Dramatic Play Pack Dramatic Play Dramatic Play Themes Dramatic Play Activities

Sallie Mae Bank Review Smartasset Com

Sallie Mae Bank Review Smartasset Com

General Power Attorney Form Sample General Power Of Attorney Form 10 Free Documents Power Of Attorney Form Power Of Attorney Attorneys

General Power Attorney Form Sample General Power Of Attorney Form 10 Free Documents Power Of Attorney Form Power Of Attorney Attorneys

A Bank Passbook Our Record Of The Money We Had Placed Into Our Bank Accounts Used For Smaller Savings Account Tr I Dream Of Genie Savings Account Bank Teller

A Bank Passbook Our Record Of The Money We Had Placed Into Our Bank Accounts Used For Smaller Savings Account Tr I Dream Of Genie Savings Account Bank Teller

Family Law And Divorce Divorce Lawyers Divorce Attorney Estate Lawyer

Family Law And Divorce Divorce Lawyers Divorce Attorney Estate Lawyer

How To Close A Bank Account After A Death Beyond

How To Close A Bank Account After A Death Beyond

How To Withdraw Funds From Paypal In South Africa 2020 Update Tech Girl Financial Advice Fund Online Banking

How To Withdraw Funds From Paypal In South Africa 2020 Update Tech Girl Financial Advice Fund Online Banking

Can You Withdraw Money From Your Parents Account If They Are Unable To Quora

Earnin App Withdraw From Your Salary Without Fees Best Mobile Apps App App Reviews

Earnin App Withdraw From Your Salary Without Fees Best Mobile Apps App App Reviews

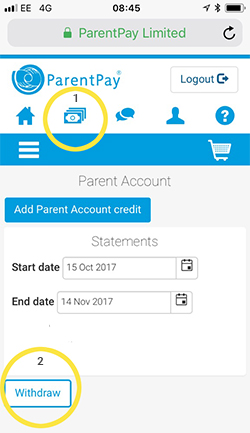

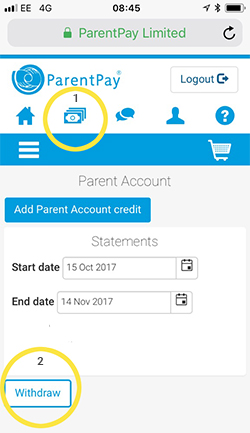

How Do I Withdraw Money From Parent Account Parentpay

How Do I Withdraw Money From Parent Account Parentpay

27 Titus Andromedon Quotes That Will Make You Say Same Tbh Unbreakable Kimmy Schmidt New Girl Quotes Kimmy Schmidt

27 Titus Andromedon Quotes That Will Make You Say Same Tbh Unbreakable Kimmy Schmidt New Girl Quotes Kimmy Schmidt

Can Life Insurance Be Cashed In Before Death Life Ant

Can Life Insurance Be Cashed In Before Death Life Ant

Is It Illegal To Withdraw Money From A Deceased Person S Account

Is It Illegal To Withdraw Money From A Deceased Person S Account

How Bank Transactions Are Processed M T Bank

How Bank Transactions Are Processed M T Bank

Can You Withdraw Money From A Dead Person S Account Roche Legal

Can You Withdraw Money From A Dead Person S Account Roche Legal

People Waiting In Line At Bank Revocable Trust Bank Closed Waiting In Line

People Waiting In Line At Bank Revocable Trust Bank Closed Waiting In Line

![]() Is It Illegal To Withdraw Money From A Deceased Person S Account

Is It Illegal To Withdraw Money From A Deceased Person S Account