How To Fill Crs Self Certification Form

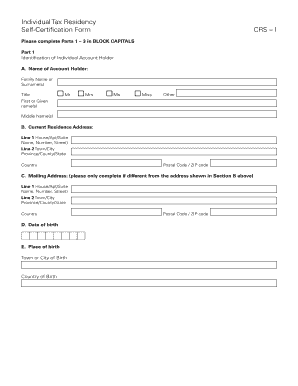

Must contain the Account Holders i name ii residenceaddress iii jurisdictions of residence for tax purposes iv tax identifying number for each Reportable Jurisdiction and v date of birth. Tax resident under US.

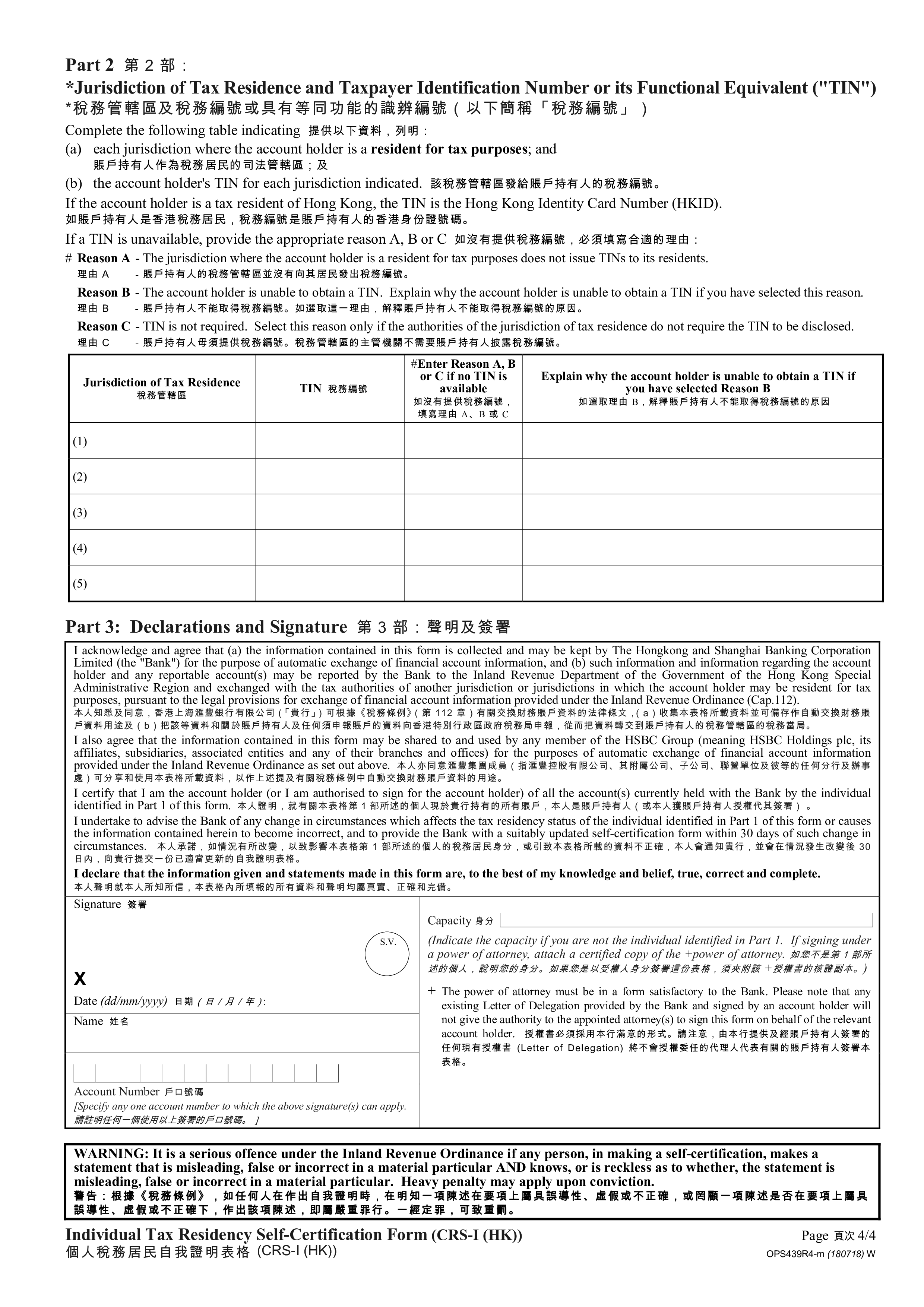

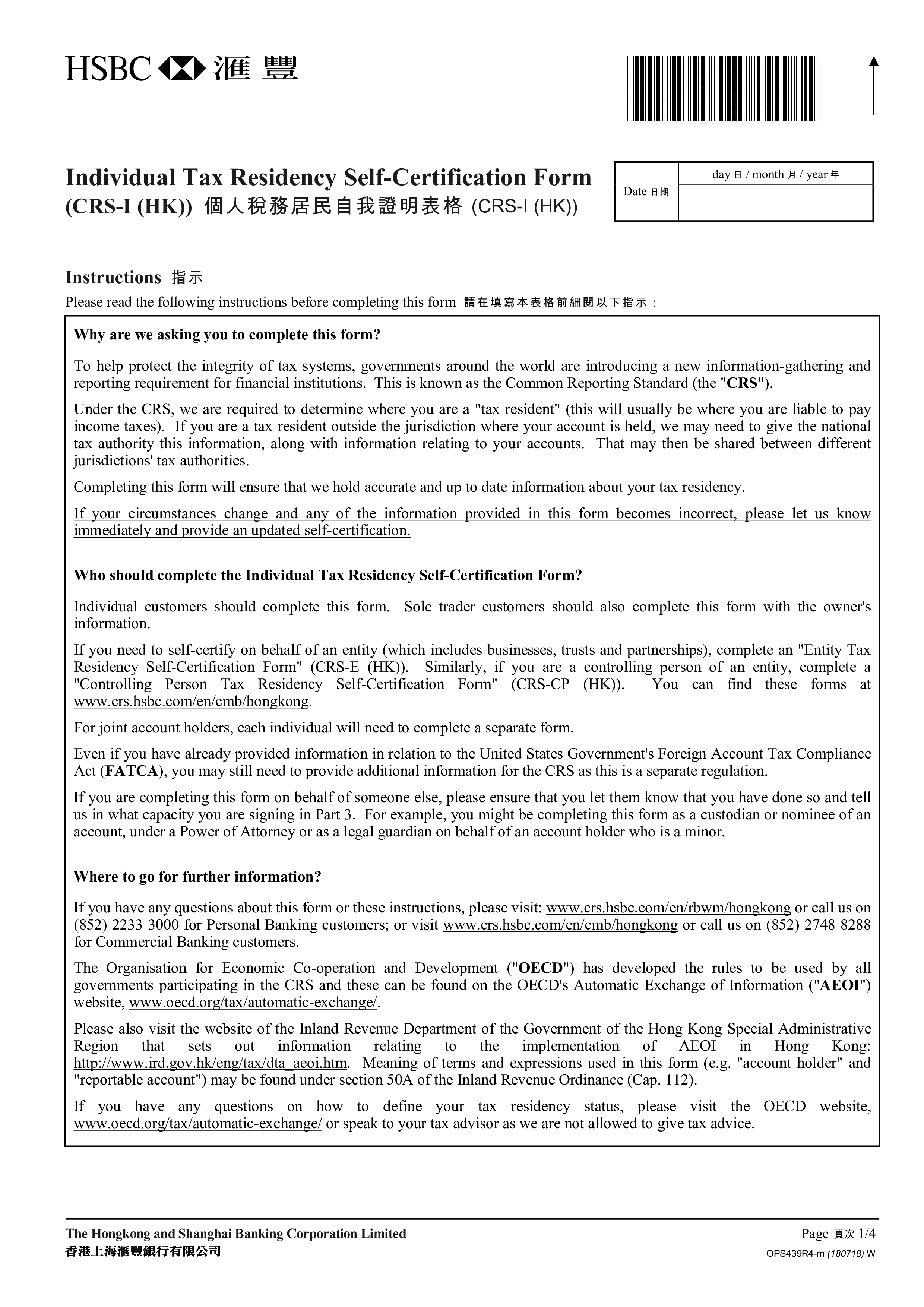

Telecharger Gratuit Crs Individual Tax Residency Hong Kong

Telecharger Gratuit Crs Individual Tax Residency Hong Kong

If the entity has a custodial account holding.

How to fill crs self certification form. They might need to fill in a form or send details of their sick leave by email. Complete a Controlling Person Self -Certification Form CRS -CP for each controlling person named above. I declare that all statements made in this declaration are to the best of my knowledge and belief correct and complete.

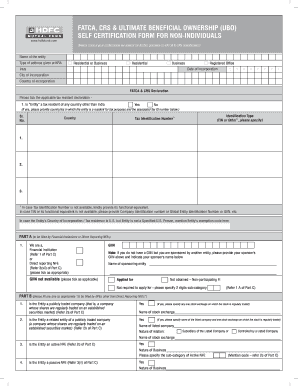

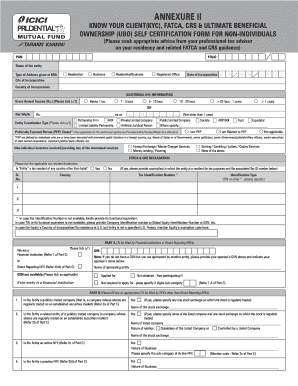

CRS and FATCA IGA Entity Tax Residency Self-Certification Form. CRS Entity Self-Certification Form. Whether you are a.

Please instead complete the OCBC Individual Self-Certification Form. _ For joint or multiple account holders please complete a separate form for each account holder. As a financial institution Citi does not provide tax advice to.

Forjoint account holders a copy of the form should be completed for each account holder. On average this form takes 9 minutes to complete. All forms are printable and downloadable.

CRS SELF-CERTIFICATION FORM FOR INDIVIDUALS. This form is intended to request information consistent with local law requirements. Use Fill to complete blank online OTHERS pdf forms for free.

Individual tax residency self-certification form. The employer and employee will agree on how the employee should do this. Tax resident on this form and you may also need to fill in an IRS W-9 form.

CRS Self-certication Form for Individuals Part 3 Declarations and Signature 1. Weve produced this guide to help you fill in the CRS Entity self-certification form. Easily fill out PDF blank edit and sign them.

Once completed you can sign your fillable form or send for signing. Fill Online Printable Fillable Blank CRS SELF-CERTIFICATION FORM FOR INDIVIDUALS Form. If the form asks about FATCA classification tick the box marked Active NFFE.

If you are sole-proprietorship owned by individual there is no requirement to complete this form. Country of incorporation or organization. If the Account Holder is a US.

If the form asks whether you are a registered charity and you are one fill in your charity registration number where asked. For the purpose of this selfcertification an Account Holder may refer to the following persons. Entities having all other FATCA statuses must complete the appropriate Form W-8.

You are not required to complete a CRS -CP for the controlling person if such controlling person is or is a majority owned subsidiary of a company that is publicly traded. Weve based it on the information thats currently available. Your country towncity of birth.

What information will I need to provide in the self-certification form. The form may ask about both FATCA and CRS classifications. You can photocopy the form but please return documents dated with an original signature.

If you have received a request to complete a Tax Residency Self-Certification form simply complete date and return the form using the prepaid envelope provided. Your date of birth. Save or instantly send your ready documents.

2 I acknowledge that the information provided on this Form regarding the Account Holder as well as financial information eg. Even if you have already provided information in relation to the United States. No Form W-8BEN-E will be required from such entity.

What is FATCA CRS. In that case you must notify us and provide an updated self-certification. The CRS FATCA Self-certification form will ask you to confirm the following.

Please note that this self-certification form is for CRS purposes only. For a self-certification to be valid however it generally. Its completion is not a substitute for the completion of any IRS Form W-9 Form W-8 or self-certification that may otherwise be required for FATCA or other US.

Its a guide not a substitute for taking a detailed look at the Common Reporting Standard CRS and it doesnt constitute tax advice. This is called self-certification. Jurisdictions adopting the wider approach may require that the self-certification include a tax identifying number for each jurisdiction of residence rather than for.

FATCA AND CRS SELF-CERTIFICATION FORM FOR INDIVIDUAL ACCOUNT HOLDER. Please read the following instruction before you proceed to complete the form. If the form asks about CRS classification tick the box marked Active NFE.

Law you should indicate that the account holder is a US. Information that makes this form incorrect or incomplete. Additionally if you are acontrolling person of an entity complete a Controlling Person Tax Residency Self-Certification Form CRS-CP.

Your current residence and if applicable mailing address. Securities the entity must complete the appropriate Form W-8 and CRS Self-Certification instead and should not complete this Form. Complete Form CRS-E - CRS Entity Self-Certification Form online with US Legal Forms.

Proposer eventually the Policyowner Controlling Person Beneficial Owner Assignee Trustee Beneficiary under a Trust or a Trust Nominee. How to Fill FATCACRS Self Certification Form.

Https Static1 Squarespace Com Static 601738b5cbc71f649dad41e2 T 6017cb48bf7edd00ec92d7ff 1612172105859 Dumimel Pdf

Https Www Scotiabank Com Ca En Files 18 05 Taxresidencyself Certbusinesses20180503 Pdf

Fillable Online Instructions Crs Individual Self Certification Form Hsbc Bahrain Fax Email Print Pdffiller

Fillable Online Instructions Crs Individual Self Certification Form Hsbc Bahrain Fax Email Print Pdffiller

Https Www Crs Hsbc Com Media Crs Pdfs Australia Rbwm Crs I Individual Self Cert Form Australia Pdf

Https Www Truffle Co Za Docs Tax Residency Self Certification Form Entity Pdf

Fatca Crs Declaration Form Individual Fatca Crs Fatca Crs Declaration Form Individual Fatca Crs Pdf Pdf4pro

Fatca Crs Declaration Form Individual Fatca Crs Fatca Crs Declaration Form Individual Fatca Crs Pdf Pdf4pro

Https Download Dws Com Download Elib Assetguid B42be115f8bb47ce9c5b59ba063350ae

Https Craigsip Com Media Craigsip Files Other Tax Residency Self Certification Entities Pdf La En Hash 34785c5969fd4199e01d1e5600dedf01449c0b5a

Fillable Online Fatca Foreign Tax Laws Information Non Individual Form Editable Fax Email Print Pdffiller

Fillable Online Fatca Foreign Tax Laws Information Non Individual Form Editable Fax Email Print Pdffiller

Tax Residency Self Certification For Individuals And Sole Traders Halifax Fill Online Printable Fillable Blank Pdffiller

Tax Residency Self Certification For Individuals And Sole Traders Halifax Fill Online Printable Fillable Blank Pdffiller

Sample Fatca Form Page 2 Line 17qq Com

Sample Fatca Form Page 2 Line 17qq Com

Https Www Firstbanknigeria Com Controlling Person Tax Residency Self Certification Form Pdf

Https Www Hangseng Com Content Dam Hase Config Bde Pws Crs Pdf Crs Entity Self Certification Form Pdf

Https Www Bankhapoalim Co Il Sites Default Files Media Pdfs D7 90 D7 97 D7 95 D7 96 D7 99 D7 9d 20 D7 90 D7 97 D7 99 D7 93 D7 99 D7 9d 14 Pdf

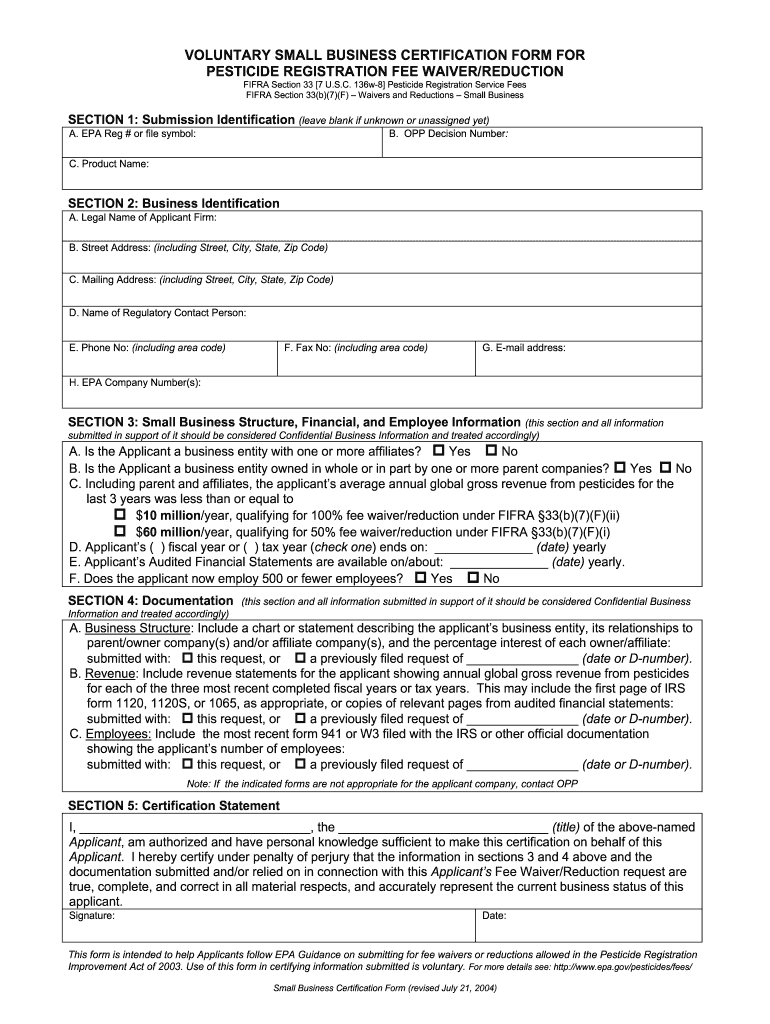

Small Business Self Certification Form Fill Online Printable Fillable Blank Pdffiller

Small Business Self Certification Form Fill Online Printable Fillable Blank Pdffiller

Fillable Online Fatca Non Individual Form New Cdr Hdfc Mutual Fund Fax Email Print Pdffiller

Fillable Online Fatca Non Individual Form New Cdr Hdfc Mutual Fund Fax Email Print Pdffiller

Telecharger Gratuit Crs Individual Tax Residency Hong Kong

Telecharger Gratuit Crs Individual Tax Residency Hong Kong

Self Certification Sick Form Template Page 1 Line 17qq Com

Self Certification Sick Form Template Page 1 Line 17qq Com