How To File Llc Taxes In Ny

You will also need to file annual state income tax as well as other tax documents depending on the. Single Member LLC filing requirements Single member LLCs are treated just like a sole proprietorship.

![]() Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

Return of Partnership Income.

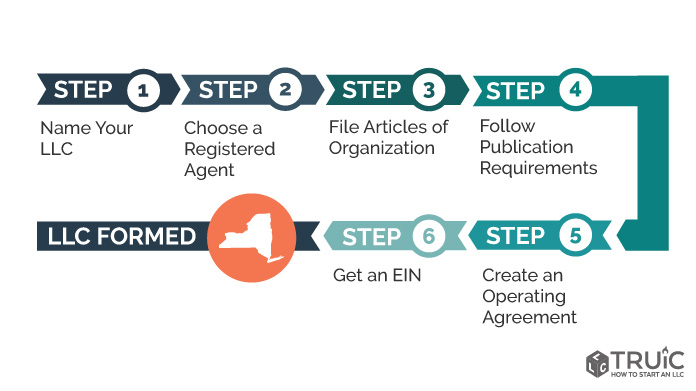

How to file llc taxes in ny. You are required to file Schedule C if your LLCs income exceeded 400 for the year. For additional tools see Filing season resource center for additional filing information. An LLC or LLP that is treated as a partnership may be required to file a Form IT-204 Partnership Return.

If the LLC is a partnership normal partnership tax rules will apply to the LLC and it should file a Form 1065 US. Depending on your type of business you will likely need to register with the New York State Department of Taxation and Finance. Northwest 39 state fee or LegalZoom 149 state fee Check out Northwest vs LegalZoom.

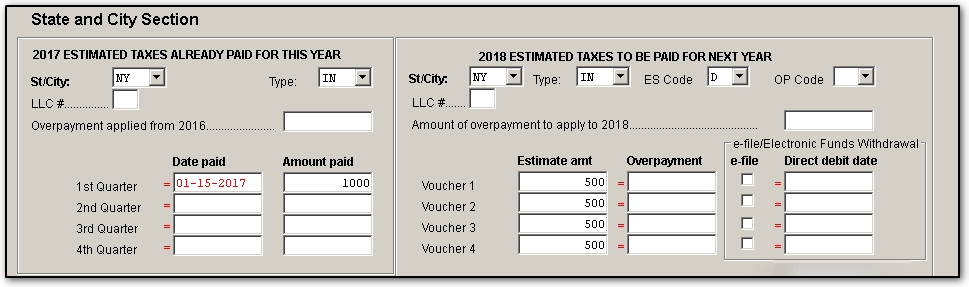

Form IT-203-GR Group Return for Nonresident Partners Note. The amount of the filing fee will be based on the New York source gross income for the tax year immediately preceding the tax year for which the fee is due preceding tax year. New York LLC owners pay self-employment tax on business profits.

To file taxes as a partnership you must complete Return of Partnership Income Form 1065 and file it with the IRS. An LLC or LLP that has elected to be treated as a corporation for federal income tax purposes. Hire a professional to form your LLC in New York.

If an LLC or LLP did not have any New York Source gross income for the preceding tax year the filing. An LLC or LLP that is treated as a corporation for federal income tax purposes may be required to file a New York State corporation franchise tax. Form IT-203 Nonresident and Part-Year Resident Income Tax Return.

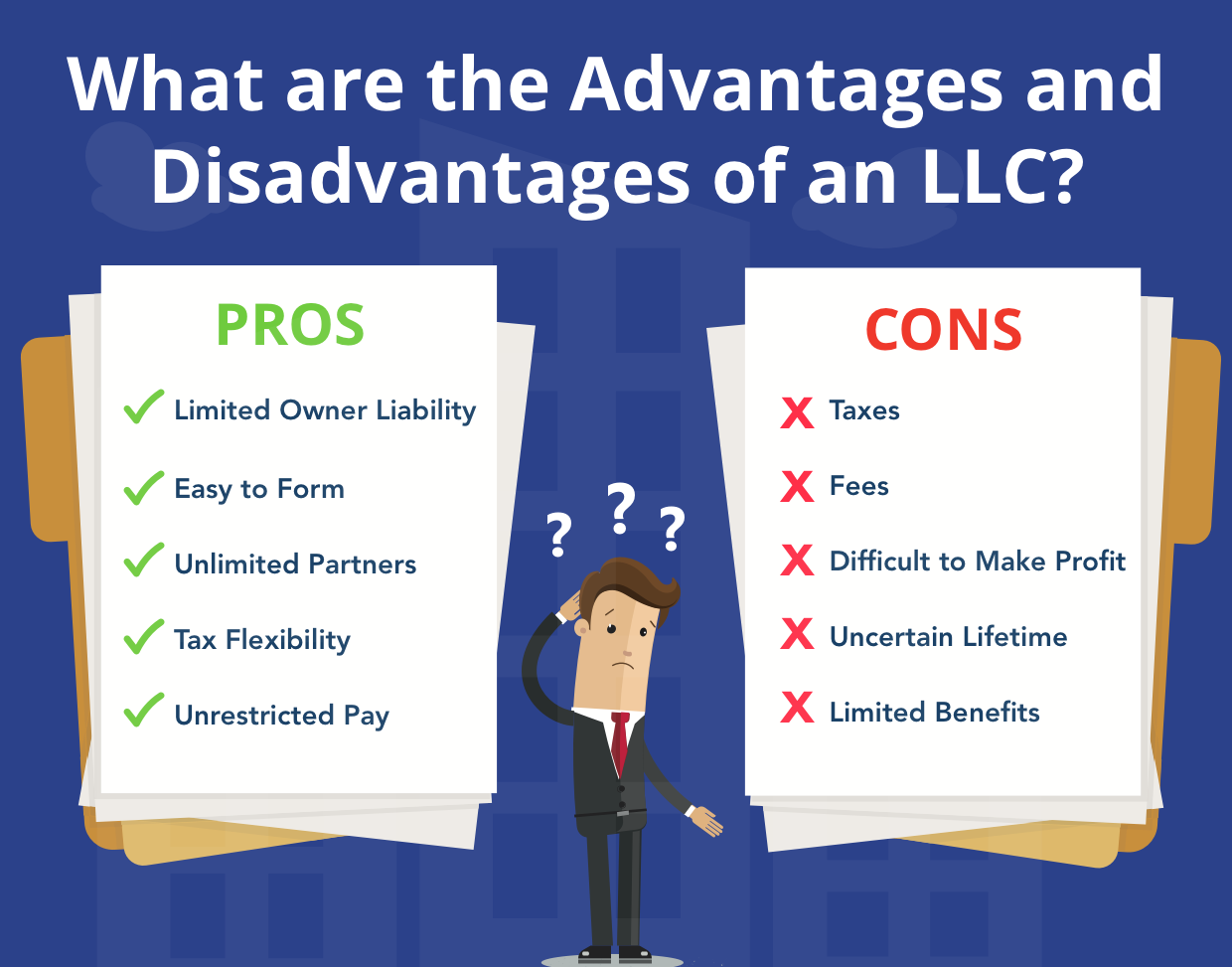

Amount of annual filing fee. Most states do not restrict ownership so members may include individuals corporations other LLCs and foreign entities. The LLCs income and expenses are reported as self-employment income on Schedule C of the members personal tax return.

Make the election using Entity Classification Election Form 8823. A Limited Liability Company LLC is a business structure allowed by state statute. Though the standard multi-owner LLC pays tax through its owners the LLC files Form 1065 an information return that details earnings.

The first level of tax occurs when the LLC files a corporate tax return and the second is imposed on the owners when they receive a dividend. The profits of a New York LLC are not taxed at the business level like those of C Corporations. Each owner should show their pro-rata share of partnership income.

Filing Taxes as a Partnership If your LLC has more than one member you can be taxed as either a partnership or a corporation. For example lets say an. Thus an LLC that has been treated as a partnership for several years may be able to prospectively change its classification to be treated as a corporation by filing Form 8832.

Instead tax for a New York LLC works as follows. For everything youll need to choose the right software and prepare your return see Get ready to e-file your income tax return. If you make this election youll file taxes using Form 1120.

If your business is incorporated in New York State or does business or participates in certain other activities in New York State you may have to file an annual New York State corporation tax return to pay a franchise tax under the New York State Tax Law. Learn how small businesses are taxed in New York and understand how tax rates vary based on whether the business is an S corporation LLC or partnership. New York LLC owners pay state tax on any profits less state allowances or deductions.

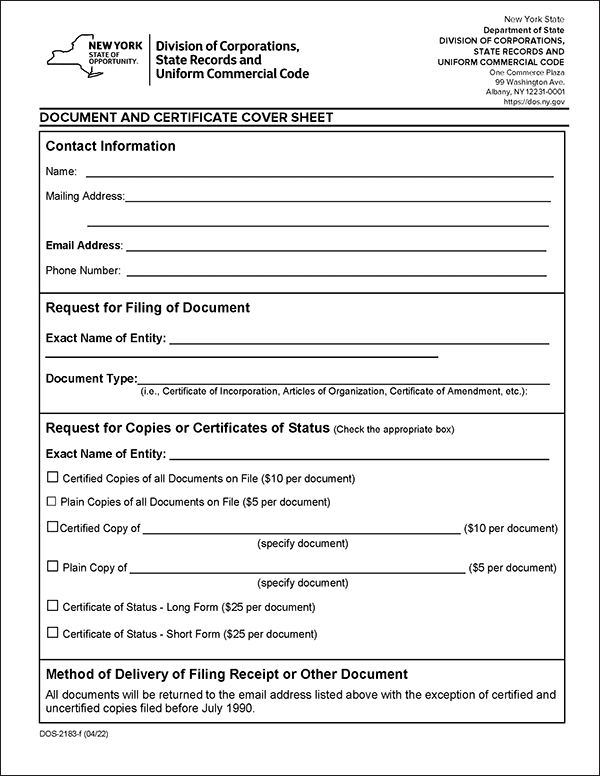

Information on this page relates to a tax year that began on or after January 1 2020 and before January 1 2021. Filing the Articles of Organization By mail send the completed Articles of Organization with the filing fee of 200 to the New York State Department of State Division of Corporations State Records and Uniform Commercial Code One Commerce Plaza 99 Washington Avenue Albany New York 12231. An LLC that is treated as a sole proprietorship must report its business income and expenses on the individuals New York State personal income tax returns.

You may choose to be taxed like a corporation in which case youll file Form 883 2 to make this election. You need to file your LLC taxes when your business brings in money either through revenue or a loan or when it is eligible for a deduction or tax credit. Each state may use different regulations you should check with your state if you are interested in starting a Limited Liability Company.

The completed application together with the filing fee of 250 should be forwarded to the New York Department of State Division of Corporations One Commerce Plaza 99 Washington Avenue Albany NY 12231. An LLC that is not considered a separate entity for federal income tax purposes is taxed in the same way as a sole proprietor. Your business will still be an LLC but youll be taxed at the corporate rate and subject to double taxation.

If you earned more than 72000 in 2020 see Other e-file options to learn about your electronic filing options. Fillable Application for Authority Form. Each owner must report the dividend as taxable income on their personal Form 1040s and pay tax on it.

Group agents must enter the special identification number assigned to the partnership ie group ID 80081XXXX in the Full Social Security number field. By filing annual. Owners of an LLC are called members.

Income Tax Flyer Templates Flyer Template Corporate Flyer Flyer

Income Tax Flyer Templates Flyer Template Corporate Flyer Flyer

How Should You Register Your Company Incorporated Vs Limited Liability Company Business Finance Llc Business Accounting Classes

How Should You Register Your Company Incorporated Vs Limited Liability Company Business Finance Llc Business Accounting Classes

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

Nys Sales Tax Returns Poeriod Ended November 30th 2017 Tax Return Finance Sample Resume

Nys Sales Tax Returns Poeriod Ended November 30th 2017 Tax Return Finance Sample Resume

What Is The Llc Tax Rate In New York Gouchev Law

What Is The Llc Tax Rate In New York Gouchev Law

Llc In Nyc Real Estate Pros And Cons Nestapple New York

Llc In Nyc Real Estate Pros And Cons Nestapple New York

Tax Preparer Resume Sample Job Resume Samples Resume Accountant Resume

Tax Preparer Resume Sample Job Resume Samples Resume Accountant Resume

Check Your Refund Status Refund Status Finance

Check Your Refund Status Refund Status Finance

Tax Return Template Print Templates Flyers Tagged As Advertise America Business Commercial Corporate Design Tax Return Income Tax Preparation Tax Refund

Tax Return Template Print Templates Flyers Tagged As Advertise America Business Commercial Corporate Design Tax Return Income Tax Preparation Tax Refund

Global Truck Docs Be Safe Truckers Automobile Marketing Automotive Marketing Trucks

Global Truck Docs Be Safe Truckers Automobile Marketing Automotive Marketing Trucks

Documentation Beats Conversation Every Time If You Have Irs Tax Debts Contact Me I Service The Entire U S Business Tax Irs Taxes Tax Debt

Documentation Beats Conversation Every Time If You Have Irs Tax Debts Contact Me I Service The Entire U S Business Tax Irs Taxes Tax Debt

Ny State And City Payment Frequently Asked Questions

Ny State And City Payment Frequently Asked Questions

Where S My Refund Links Financial Analysis Taxes Humor Tax Refund

Where S My Refund Links Financial Analysis Taxes Humor Tax Refund

Ny State And City Payment Frequently Asked Questions

Ny State And City Payment Frequently Asked Questions

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Jr Taxes Tax Income Tax Return Tax Preparation

Jr Taxes Tax Income Tax Return Tax Preparation

Filing Your Own Taxes Lin Pernille Photography Filing Taxes Business Tax Small Business Tax

Filing Your Own Taxes Lin Pernille Photography Filing Taxes Business Tax Small Business Tax

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York