Small Business Form 941

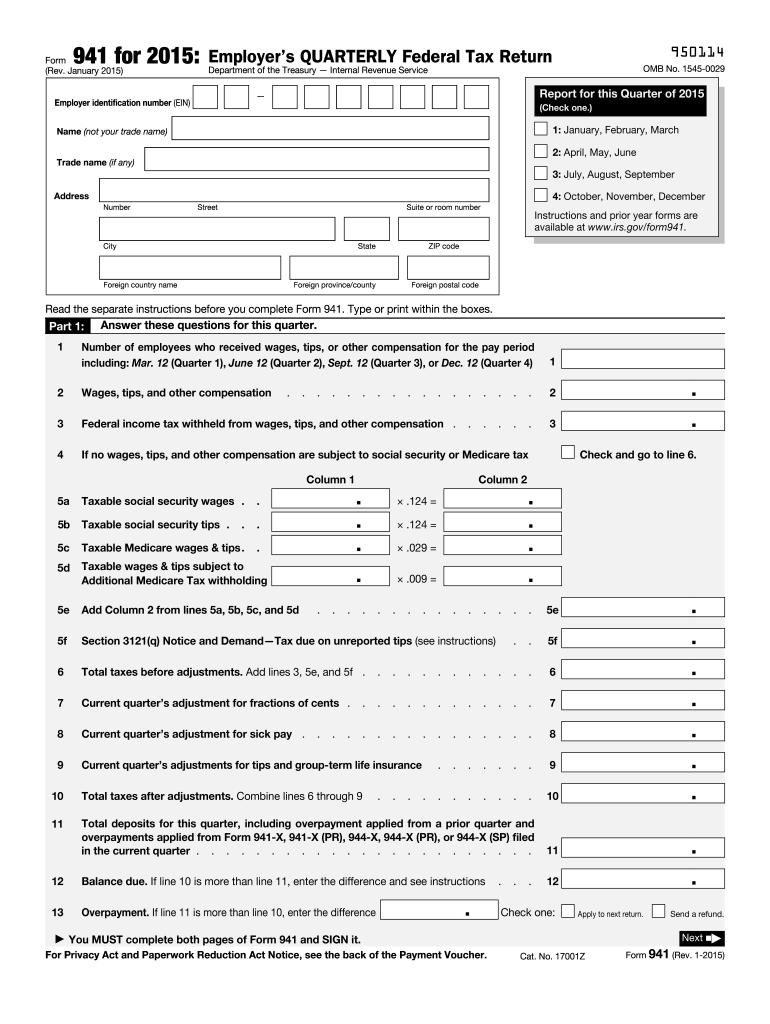

Form 941 also known as Schedule B reports how much federal income tax and payroll taxes youve withheld from employee paychecks. Employers use Form 941 to.

3 11 13 Employment Tax Returns Internal Revenue Service

Information about Form 941 Employers Quarterly Federal Tax Return including recent updates related forms and instructions on how to file.

Small business form 941. Dont confuse Form 940 which is an annual employer return for unemployment tax purposes with other employer returns such as. Small business owners who prepare payroll checks for employment will need to file IRS Form 941 four times a year. This form is only required for businesses with employees.

Form 941 the Employers Quarterly Federal Tax Return is a tax form that brings employers together all year long. Services cover Employer Identification Numbers EINs 94x returns 1041 1065 1120S Excise Returns Estate and Gift Returns as well as issues related to Federal tax deposits. Procedures for getting out of business including what forms to.

Employers use this form to report income taxes social security tax or Medicare tax deducted from employee paychecks. As a small business owner you will need to withhold federal taxes social security tax and Medicare tax from your employees paychecks. Subtitle C Employment Taxes of the Internal Revenue Code imposes employment taxes on wages and provides for income tax withholding.

Form 941 Employers Quarterly Federal Tax Return which is used to report wage withholding for income taxes as well as the employees share of Social Security and Medicare FICA taxes plus the employers. April 30 July 31 October 31 and January 31 but only if the liability for unpaid tax is more than 50000 Filing information returns for payments to nonemployees and transactions. We ask for the information on Form 941 to carry out the Internal Revenue laws of the United States.

What is IRS Form 941. What it is. What is the difference between a 940 and a 941 form.

Form 941 must be filed on a quarterly basis. Federal Unemployment FUTA tax 940 e-file January 31. Small Business and Self-Employed Tax Center.

Form 941 or 944. Form 941 is used to determine. Facts and Filing Tips for Small Businesses.

We need it to figure and collect the right amount of tax. Certain employers whose annual payroll tax and withholding liabilities are less than 1000 might get approval to file the annual versionForm 944. Phew now thats already a lot of forms to think about.

For Businesses Corporations Partnerships and Trusts who need information andor help regarding their Business Returns or Business BMF Accounts. At the end of each quarter you will need to use Form 941 the Employers Quarterly Federal Tax Return to report. Employers use Form 941 to report withholdings from employees paychecks for income.

Online resources for taxpayers who file Form 1040 or 1040-SR Schedules C E F or Form 2106 as well as small businesses with assets under 10 million. Form 941 is a Internal Revenue Service IRS tax form for employers in the US. You must file IRS Form 941 if you operate a business and have employees working for you.

It is filed quarterly. Last day of February March 31 if filing electronically. Form 941 is also used to pay an employers part of Medicare tax or social security according to the IRS.

The Employers Quarterly Federal Tax Return 941 Form is used to report employment taxes to the Internal Revenue Service. Filing and Paying Business Taxes. If your business is liable for Social Security and Medicare taxes withheld from employee income you will need to file Form 941 or 944 due April 30th October 31st and January 31st.

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or Medicare tax.

What Is Form 941 And How Do I File It Ask Gusto

Draft Of Revised Form 941 Released By Irs Includes Ffcra And Cares Provisions Current Federal Tax Developments

2015 Form Irs 941 Fill Online Printable Fillable Blank Pdffiller

What Is Form 941 And How Do I File It Ask Gusto

What Is Form 941 And How Do I File It Ask Gusto

Fillable Irs Form 941 Free Printable Pdf Sample Formswift

How To Complete Form 941 In 5 Simple Steps

What Is Form 941 And How Do I File It Ask Gusto

2015 Form Irs 941 Fill Online Printable Fillable Blank Pdffiller

Form 941 Instructions How To File It Bench Accounting

Updated Form 941 Irs The Latest Changes For Q2 Q4 2020

3 11 13 Employment Tax Returns Internal Revenue Service

Completing Your Small Business Taxes With Irs Form 941 The Blueprint

3 11 13 Employment Tax Returns Internal Revenue Service

Irs Form 941 Employer S Quarterly Federal Tax Return Plianced Inc

Completing Your Small Business Taxes With Irs Form 941 The Blueprint