Shelby County Business License Application Online

If you are subject to the business tax you must register to pay the tax. Section 84 County Business License from the State of Alabama contact your local county business revenue license office State of Alabama General Contractors License Alabama Licensing Board for General Contractors at 800 356-6361 if contract exceeds 5000.

Name Reservation Request Form Corporations Limited Partnerships And Limited Liability Companies Limited Liability Company Form Limited Partnership

Name Reservation Request Form Corporations Limited Partnerships And Limited Liability Companies Limited Liability Company Form Limited Partnership

The application and a 75 fee is required for each separate business before commencement of business activity or in the event of.

Shelby county business license application online. Vendor Online Application Process. The office address is found below. The state administered business tax is a tax based upon business gross receipts which is due annually.

Elected to a four-year term the clerks biggest job is selling more than 650000 vehicle license plates annually. Some licenses require State Regulatory Permits in order to issue such as auto dealers food establishments and air conditioning contractors. Shelby County Clerk License Information httpwwwshelbycountytngov559Business-Tax-Division View Shelby County Clerk business license information including application requirements and fees.

2021 Business Information Systems. You can still renew by mail or online at. County Administration Building 160 N Main Street Memphis TN 38103 Phone.

The office address is found below. Room 115 Columbiana AL 35051 Driving Directions Ph. Shelby County Register of Deeds County Records httpregistershelbytnusindexphp Search Shelby County Register of Deeds public records database by individual and company name date and.

Prior to accessing the application please read the application instructions in its entirety to make sure that you completely understand all of the information that will be required on the application. If your business is a rental business see Section F. Located within Shelby County or operating a place of amusement.

Additional information is available on the Tennessee Department of Revenue website or by contacting them directly at 800 342-1003. Kimberlee Jernigan Supervisor Administration Building 200 W. Online Plate Renewals Responsibilities Services The Shelby County Clerks Office is one with which nearly everyone in Shelby County has done business.

This application can be submitted electronically using the Tennessee Taxpayer Access Point TNTAP. Please submit an online application as described below. County Administration Building 160 N Main Street Memphis TN 38103 Phone.

Call 901 545-4249 if you have an inquiry specific to hotels and motels. Httpwwwshelbycountytngov559Business-Tax-Division This license may be obtained from the Shelby County Clerks Office Business Tax Division. If your business is located outside of Shelby County you will be subject to Sellers Use Tax instead of Sales Tax.

Provide the date you will begin or have begun making retail sales of tangible personal property within Shelby County. The cost of the combined license is 3000. Applications are now accepted online.

To view a list of all applicable licensing forms and printable information sheets visit our business tax forms page. If your business is within the municipal boundaries of Memphis you must purchase a combined City of Memphis and Shelby County Business License. All current and future vendors wanting to do business with Shelby County government will be required to have a Vendor number after getting their EOC number.

In addition to vehicle licenses the clerk. County Administration Building 160 N Main Street Memphis TN 38103 Phone. For further assistance with the specific license needs of your business or to purchase your State of Alabama Business License you may come into any of our three Shelby County License Offices.

Shelby County Wanda Halbert 150 Washington Avenue Memphis TN 38103 Phone. Each entity conducting business in Shelby County outside the city limits must apply for an occupational business license. Your business tax due date is the 15th day of the fourth month after your fiscal year ends.

You may apply online with Shelby County at httpwwwshelbycountytngovindexaspxNID559 or you may apply in person.

Can The Bank Take My Home In Bankruptcy Divorce Attorney Divorce Lawyers Family Law Attorney

Can The Bank Take My Home In Bankruptcy Divorce Attorney Divorce Lawyers Family Law Attorney

Tigers Tennessee State Background Novelty License Plate Novelty License Plates License Plate Tennessee

Tigers Tennessee State Background Novelty License Plate Novelty License Plates License Plate Tennessee

Abstract And Notice Of Lis Pendens Lis Pendens Tennessee Form

Abstract And Notice Of Lis Pendens Lis Pendens Tennessee Form

Notary Public Services 309 Auto Tags Notary Public Notary Notary Service

Notary Public Services 309 Auto Tags Notary Public Notary Notary Service

Notice Of Transfer Of Name Reservation Limited Partnership Limited Partnership Names Reserved

Notice Of Transfer Of Name Reservation Limited Partnership Limited Partnership Names Reserved

Standard Media Release Form Template Best Of 28 Of Media Release Form Template Media Release Template Scholarship Thank You Letter Social Media

Standard Media Release Form Template Best Of 28 Of Media Release Form Template Media Release Template Scholarship Thank You Letter Social Media

Lasertag Paintball Field Trip Spring Break 2017 Things To Do At Home

Lasertag Paintball Field Trip Spring Break 2017 Things To Do At Home

Client Briefing Checklist For Planners Graphic Design Humor Business Design Small Business Branding

Client Briefing Checklist For Planners Graphic Design Humor Business Design Small Business Branding

Stipulation And Order To Pay Lien Claimant California Planner Printables Free California State

Stipulation And Order To Pay Lien Claimant California Planner Printables Free California State

Attorney Licensed Representative Request To Withdraw From Representation Attorneys Withdrawn Representation

Attorney Licensed Representative Request To Withdraw From Representation Attorneys Withdrawn Representation

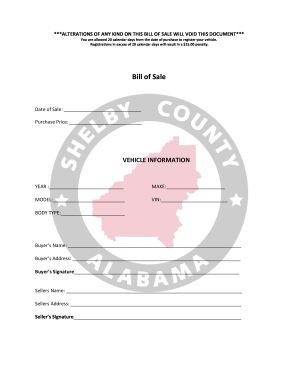

Alabama Auto Bill Of Sale Fill Out And Sign Printable Pdf Template Signnow

Alabama Auto Bill Of Sale Fill Out And Sign Printable Pdf Template Signnow

Business Home Insurance Companies Provided Miami Dade County Home Business License Work From Home Jobs Work From Home Opportunities Working From Home

Business Home Insurance Companies Provided Miami Dade County Home Business License Work From Home Jobs Work From Home Opportunities Working From Home

Citizen Form N 400 Form N 400 Application For Naturalization Arabic Version Doctors Note Template Printable Job Applications Job Application Form

Citizen Form N 400 Form N 400 Application For Naturalization Arabic Version Doctors Note Template Printable Job Applications Job Application Form

Cover Letter For Java Developer Elegant Java Developer Resume Java Developer Sample Rumes Download Resume Examples Resume Services Professional Resume Writers

Cover Letter For Java Developer Elegant Java Developer Resume Java Developer Sample Rumes Download Resume Examples Resume Services Professional Resume Writers

2013 2021 Form Tn Ed 5175 Fill Online Printable Fillable Blank Pdffiller

2013 2021 Form Tn Ed 5175 Fill Online Printable Fillable Blank Pdffiller

Statement Of Information Domestic Nonprofit Corporation California Non Profit Corporate

Statement Of Information Domestic Nonprofit Corporation California Non Profit Corporate

Agreement Between Employer Employee Choice Of Physician Form Tennessee Form State Of Tennessee

Agreement Between Employer Employee Choice Of Physician Form Tennessee Form State Of Tennessee