Quickbooks How To Send 1099 To Vendor

From the 1099 E-File Service page log in to your or sign up for your account. Time to start thinking about the end of the year.

Turn on the 1099 feature.

Quickbooks how to send 1099 to vendor. The is also an option to print your own forms and send them manually. This can be either SSN or FEIN and select Save. Select the contractors name.

How do I ca. Remove Business ID No. Prepping the vendors in QuickBooks Online so they show up on your 1099 Summary Report.

Enter your contractor information and values for. Select Ok to save the settings. QuickBooks Help Questions How to send 1099 to a vendor paid by a credit card.

If you want to sort the report by 1099 vendors. - Click the Tax Settings tab on the left click the radio button Vendor eligible for 1099 and input the social security or tax ID number into the Vendor Tax ID box Work Before Printing and Filing 1099s - Before you file your 1099s in QuickBooks ensure that youve. Find your 1099 eligible vendors in the Vendor Center and double click them to edit.

Select the Sort drop-down menu. If you submit early the price was 1299. After enough of you asked I created a mini co.

Check on box Track Payments for 1099 Save. This way the system will be triggered to provide a new invite option. From the Sort by drop-down menu select Track 1099.

On the left panel hover your mouse on Workers and click on Contractors. Make sure your vendors are set up properly. Remove Business ID No.

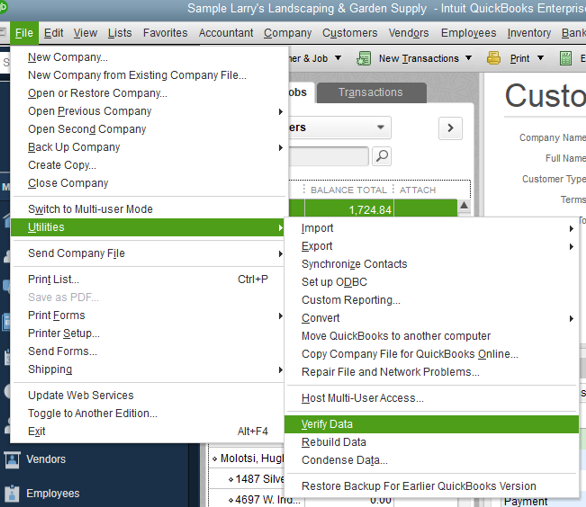

Map the 1099 accounts and vendors. Open QuickBooks Desktop go to Edit tab and select Preferences. Start asking your Independent Contractorsvendors for 1099s.

Select the Track 1099 checkbox. Click on Get started and select 1099-NEC or 1099-MISC depending upon the type of your contractors. Check Vendor eligible for 1099 Verify the tax.

Click Yes to filing 1099-MISC forms option. Switch your settings to HD so the image is clear. Click on PrintE-File 1099 Forms.

Enter your company information then tap Continue. In 2020 the price was 1599 for three contractors and 5 for each additional. Start QuickBooks and go to Vendors.

Hover your mouse on Workers click on. To change whether you track a vendor for 1099s update the vendor on your vendor list. Select the contractors name.

Choose 1099 Wizard then select Get Started. Fill in Vendor information from the W-9 Form. Choose Company Preferences tab.

1 Vote Up Vote Down Jolyne asked 3 years ago I paid a vendor for professional fees by credit card. Select the contractors name. Type in your tax information then click OK.

Verify the names and addresses. - Picked up the 1099-MISC packet from an office supply store. This can be either SSN or FEIN.

Continuing down the window fill out the Address If you have an email address feel free to enter that as well. Choose Vendor Details tab. Select Expenses Vendors.

This tutorial explains how to set up 1099 vendors and print 1099 forms in QuickBooks. Click on the Tax Settings tab and enter the contractors tax identification number or Social Security number if the vendor is a sole proprietor. Click on Edit.

Click on 1099 Vendor. Select anywhere to refresh the report. The benefit to filling that out is that ifwhen you file your 1099s through Quickbooks Online Quickbooks will send an electronic copy of the 1099 directly through email to your vendor in addition to mailing a paper copy.

How to prepare and file 1099s with QuickBooks Desktop Go to Vendors and select PrintE-file 1099s. You can e-file your 1099-MISC Forms right in QBO send copies of 1099s to subcontractors in the mail and submit forms to the IRS.

How To Utilize Quickbooks Unscheduled Payroll Checks

How To Utilize Quickbooks Unscheduled Payroll Checks

How To Pay Multiple Bills Using A Check In Quickbooks Online Quickbooks Online Quickbooks Online

How To Pay Multiple Bills Using A Check In Quickbooks Online Quickbooks Online Quickbooks Online

Explore Our Example Of Payroll Direct Deposit Authorization Form Template Quickbooks Payroll Quickbooks Templates

Explore Our Example Of Payroll Direct Deposit Authorization Form Template Quickbooks Payroll Quickbooks Templates

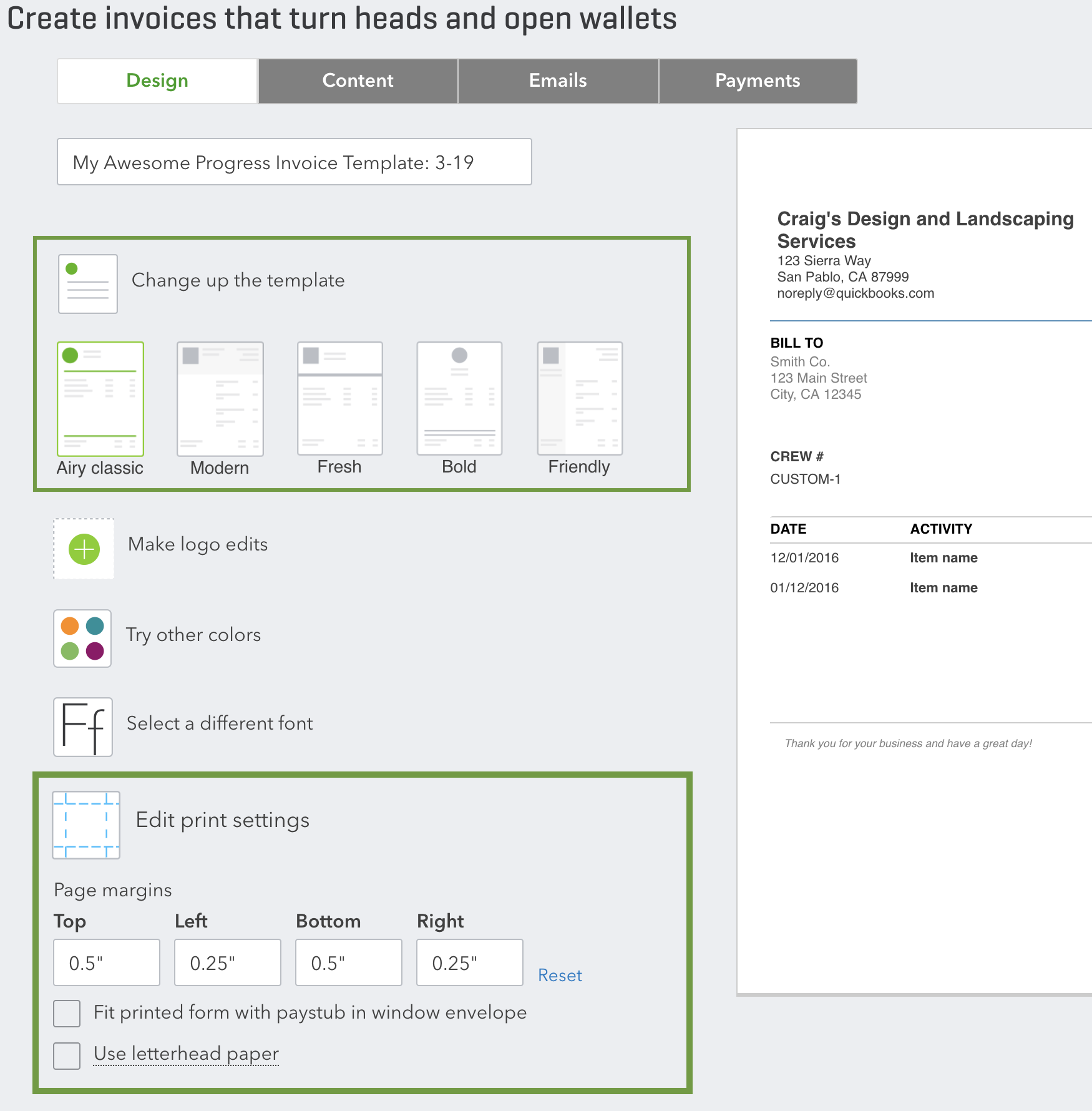

Set Up And Send Progress Invoices In Quickbooks On

Set Up And Send Progress Invoices In Quickbooks On

Change Ein Number In Quickbooks Online Quickbooks Quickbooks Online Online Tutorials

Change Ein Number In Quickbooks Online Quickbooks Quickbooks Online Online Tutorials

Open The Company File From Which You Created The Accountant S Copy Choose File Accountant S Copy Client Activi Quickbooks How To Use Quickbooks Accounting

Open The Company File From Which You Created The Accountant S Copy Choose File Accountant S Copy Client Activi Quickbooks How To Use Quickbooks Accounting

10 Electronic Pay Stub Dragon Fire Defense Quickbooks Simple Budget Certificate Format

10 Electronic Pay Stub Dragon Fire Defense Quickbooks Simple Budget Certificate Format

1099 Forms Made Easy In Quickbooks Quickbooks Make It Simple 1099 Tax Form

1099 Forms Made Easy In Quickbooks Quickbooks Make It Simple 1099 Tax Form

Qb 941 Printing Error Tax Forms Quickbooks Quickbooks Payroll

Qb 941 Printing Error Tax Forms Quickbooks Quickbooks Payroll