How To Request 1099 From Edd

A copy of your Form 1099G will be mailed to you. Be sure to include your Social Security number and explain why you believe the Form 1099G1099INT is incorrect.

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

I was getting around 450week from EDD.

How to request 1099 from edd. The filer suffered a catastrophic event in a federally declared disaster area that made the filer unable to resume operations or. Taxpayers will have to. If we find you were a victim of fraud we will remove the claim from your Social Security number and send you an updated.

Check the applicable boxes that describes your need for an extension. Visit Ask EDD and select the Form 1099G category or call 1-866-401-2849 Monday through Friday from 8 am. To request a duplicate 1099-G for any tax year prior to 2013 you must mail or fax a request to the location below.

How can I get one and how can I certify without a customer acc. I was under the impression only W2 salary is considered by EDD and not 1099 income. Call Tele-Serv at 800-558-8321 and select option 2 to request a duplicate 1099-G.

If you have a Paid Family Leave claim or you are unable to access your information online you can request a copy of your Form 1099G by calling the EDDs Interactive Voice Response IVR system at 1-866-333-4606. Contact a Customer Service representative at 8043678031 or write to us at PO Box 1115 Richmond Virginia 23218-1115 to request a letter of correction. The EDD has one designated phone line you can use to request a corrected 1099.

UI Benefits- Monetary Unit. Call the EDD Interactive Voice Response IVR System at 1-866-333-4606 and follow the instructions to get your Form 1099G information or to request that your 1099G be mailed to you. When tax preparation software is used.

If you are requesting an extension for Forms W-2 or 1099-NEC or if you checked the box on line 5 you must meet one of the following criteria. I am getting UI EDD benefits for 2013. Submit a Fraud Reporting Form online.

Send any fraudulent documents or mail to EDD PO Box 826880 MIC 43 Sacramento CA 94280-0225. During 2013 I did some consulting and earned 6610 paid in increments of mostly 400 or 75 in various dates through out the year. If your SDI benefits are taxable and you dont receive your Form 1099-G by mid-February you may call EDD at 800 795-0193 to get another copy.

Select Unemployment Insurance Benefits then Claim Questions then Backdate the Effective Date of my UI Claim Due to COVID-19. Visit Ask EDD and select the Form 1099G category or call 1-866-401-2849 during regular business hours. If you received only regular state unemployment benefits Pandemic Emergency Unemployment Compensation PEUC or State Extended Benefits SEB during 2020 you should complete the Request Replacement 1099-G Form to request a copy of your 1099-G form by mail.

Report Payroll Tax Fraud. Review IRS tax guidance on benefit identity theft. A 1099-G will be issued for the year the taxpayer receives the refund in this case 2020.

The 1099-G may automatically populate. Businesses that transmit electronically must submit 2 monthly reports that are not less than 12 days and not more than 16 days apart. You can also write Return to Sender on the envelope and provide it to your mail carrier.

Enter your Social Security number and follow the prompts. You will only get a Form 1099-G if all or part of your SDI benefits are taxable. If we find you were a victim of fraud we will remove the claim from your Social Security number and send you an updated 1099G.

Logon to Unemployment Benefits Services select My Contact Information from the Change My Profile menu and update your address. Tax preparation software with a 1099-G. This option is available 24 hours a day 7 days a week.

If you received PUA benefits as well as regular state unemployment benefits PEUC or SEB the 1099-G form in your MyUI. You must report independent contractor information to the EDD within 20 days of either making payments totaling 600 or more or entering into a contract for 600 or more or entering with an independent contractor in any calendar year whichever is earlier. The IVR system is available 24 hours a day 7 days a week.

Visit Ask EDD to request to backdate your claim if you think it has the wrong start date. What is an EDD Customer Account Number and why cant I access my UI Online portal without one. Or you can fill out an online form here.

For more information see IRS Publication 525 Taxable and Nontaxable Income. If required the taxpayer reports the refund in year it was received 2020. Be sure to correct your address before you request the duplicate form.

To 5 pm except on state holidays. Write what needs to be corrected on your Notice of Award and mail it to the EDD address on the notice. Please provide your Claimant ID number or Social Security Number current mailing address and the tax year that is being requested.

Https Www Edd Ca Gov Pdf Pub Ctr De1326er Pdf

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Employment Ka Matlab Kya Hota Hai Employment 08865 Employment 89131 Employment Agencies Near Employment Agency Employment Application Working For Amazon

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Edb General Info Section B11 Required Forms For New Hires Tax Forms Employee Tax Forms Business Letter Template

Faqs Benefits Kansas Department Of Labor

Unemployment Application Form Pdf Fill Out And Sign Printable Pdf Template Signnow

Https Forms In Gov Download Aspx Id 14557

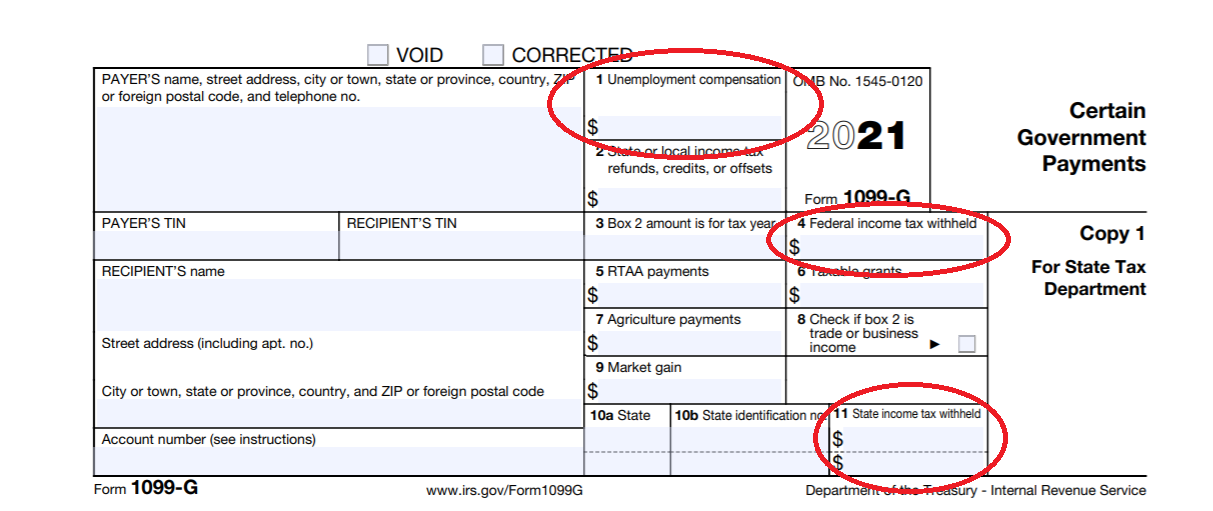

Form 1099 G Certain Government Payments Definition

Https Www Edd Ca Gov Pdf Pub Ctr De1326e Pdf

Https Www Labor Idaho Gov Dnn Portals 0 Publications Ui Benefits And 1099g Form Pdf V 011321

1099 G Fill Online Printable Fillable Blank Pdffiller

2019 2021 Form Ca De 927b Fill Online Printable Fillable Blank Pdffiller

Https Www Edd Ca Gov Unemployment Pdf Unemployment 1099g Info Sheet Pdf

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet