How To Inform Irs Of Name Change

There are several ways to tell us your address has changed. I was instructed by an IRS service representative over the phone on how to change the trustee for a trust EIN.

Change Your Business Name With The Irs Harvard Business Services

Change Your Business Name With The Irs Harvard Business Services

How to change names with the SSA.

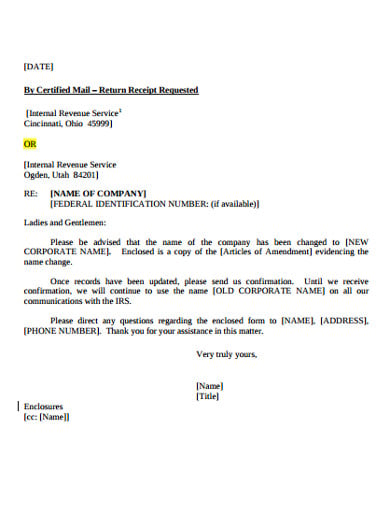

How to inform irs of name change. The letter must include an explanation of the name change including marriage divorce etc a copy of the marriage license divorce certificate or any other court related documents validating the name change. Deliver a filed copy of this Certificate of Amendment along with a letter informing the IRS of the company name change to the address where you filed your return. A partner of the business must sign the notification.

If you are filing a current year return mark the appropriate name change box of the Form 1120 type you are using. Fill out Social Security Administration form SS-5Fs which is an application for a Social Security card. Just print it out fill it in and send it on.

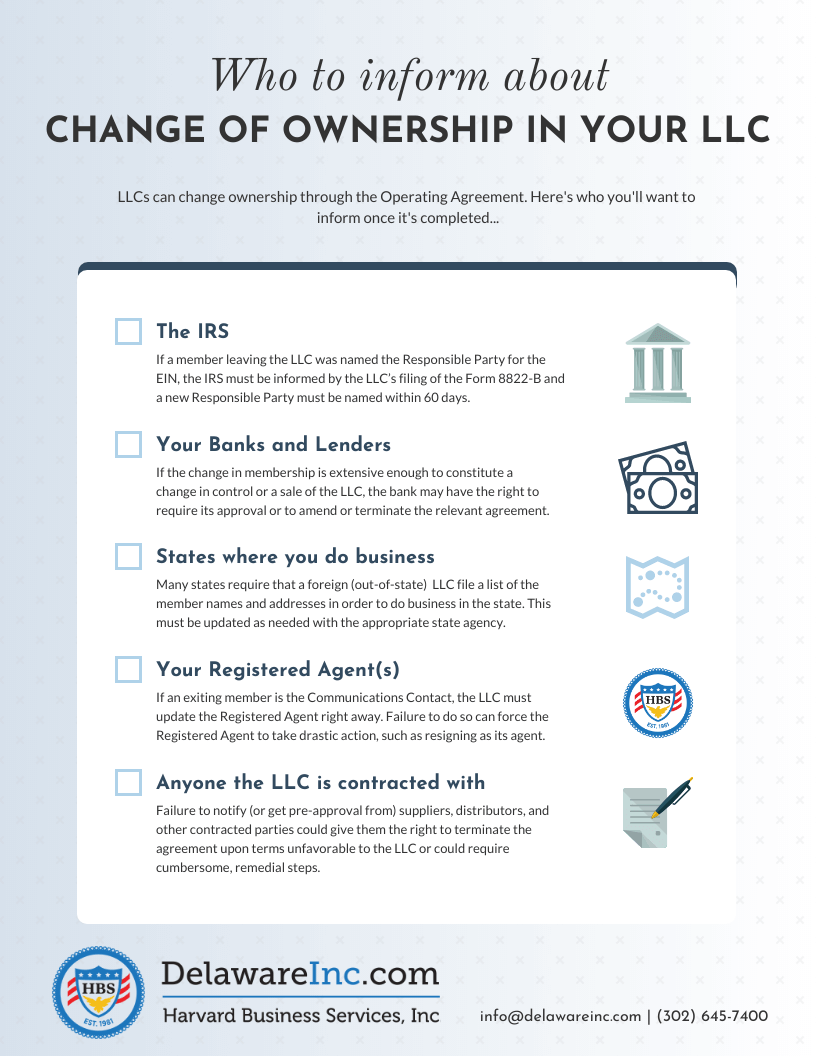

When filing for a change of company name with the IRS you have to send a copy of the certificate of amendment with a letter to the IRS address where you filed your annual return to inform the IRS of the name change. You Need to Inform Others. To change the name of your LLC you need to file a certificate of amendment with the original home state or country of your company.

Send a letter signed by the business owner or an authorized representative to the same address where you file your tax returns notifying them of your. When filing W-4 at the end of the year clearly indicate your marital status as it may have changed during the year. When filing a current year return mark the Name Change box on the US.

Corporations must have the letter signed by a corporate officer while LLCs must have the letter signed by a member. This is good news for newlyweds. If you have already filed the current years taxes write the IRS at the filing address to inform them of the name change.

The IRS must be informed of any change in address - download the Change of Address form here. Return of Partnership Income Form 1065 found on Page 1 Line G Box 3. How you give notice depends on your business type.

Make sure to include a stampedapproved copy of your LLCs name change Amendment form with the letter that you mail to the IRS. The easiest thing to do when sending notification of an address change to the IRS is to use their change of address document called Form 8822-B. A name change can have an impact on taxes.

Just write a letter on business letterhead to the IRS at the appropriate address noted in the instructions to the 1065 explaining that you changed from a. Write to us at the address where you filed your return informing the Internal Revenue Service IRS of the name change. In order to change your LLC name in most states youll file an Amendment often called Certificate of Amendment or Articles of Amendment with the Secretary of State or similar agency.

Submit all this. Disregard the Form Name Ignore the fact that Form 8822 is titled as Change of Address. To request a name change send a letter to the IRS Processing Center ITIN Operation PO Box 149342 Austin TX 78714-9342.

How to Notify the IRS of a Name Change Step 1. You can change your name with the IRS when you file taxes by including the change on your tax forms or through other written correspondence. Determine where to mail your correspondence.

To change the trustee you need to submit IRS form 8822-B Change of Address or Responsible Party naming yourself as the New responsible party. When you read the purpose of the form on the second page it states that it can be used to notify the IRS of a name change. You should indicate your marital status as of the last day of the year.

The notification must be signed by the business owner or authorized representative. Prove your identity by submitting identifying documents that have your previous name with one that has your new. All the names on a taxpayers tax return must match Social Security Administration records.

A name mismatch can delay a tax refund. If your address has changed you need to notify the IRS to ensure you receive any IRS refunds or correspondence.

10 Company Name Change Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

10 Company Name Change Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

How To Change Your Llc Name With The Irs Llc University

How To Change Your Llc Name With The Irs Llc University

My Business Name Changed How Do I Notify The Irs Bhandlaw

My Business Name Changed How Do I Notify The Irs Bhandlaw

Lovely Irs Ein Name Change Form Models Form Ideas

Lovely Irs Ein Name Change Form Models Form Ideas

Lovely Irs Ein Name Change Form Models Form Ideas

Lovely Irs Ein Name Change Form Models Form Ideas

3 21 263 Irs Individual Taxpayer Identification Number Itin Real Time System Rts Internal Revenue Service

3 21 263 Irs Individual Taxpayer Identification Number Itin Real Time System Rts Internal Revenue Service

10 Company Name Change Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

10 Company Name Change Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

How To Change The Name Of Your Llc Incfile

How To Change The Name Of Your Llc Incfile

How To Change Your Business Name Or Rebrand Including Checklist Mycompanyworks

How To Change Your Business Name Or Rebrand Including Checklist Mycompanyworks

Lovely Irs Ein Name Change Form Models Form Ideas

Lovely Irs Ein Name Change Form Models Form Ideas

Https Www Irs Gov Pub Irs News At 04 15 Pdf

10 Company Name Change Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

10 Company Name Change Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

Company Name Change Letter Page 1 Line 17qq Com

Company Name Change Letter Page 1 Line 17qq Com

Irs Instructions For A Business Name Change Legalzoom Com

Irs Instructions For A Business Name Change Legalzoom Com

32 3 2 Letter Rulings Internal Revenue Service

32 3 2 Letter Rulings Internal Revenue Service

3 13 2 Bmf Account Numbers Internal Revenue Service

3 13 2 Bmf Account Numbers Internal Revenue Service

Lovely Irs Ein Name Change Form Models Form Ideas

Lovely Irs Ein Name Change Form Models Form Ideas

Lovely Irs Ein Name Change Form Models Form Ideas

Lovely Irs Ein Name Change Form Models Form Ideas