How To Get A 1099-g Form Online

To view your 1099 from any year even if you exhausted your benefits you must register to access the MyBenefits portal. The gov means its official.

Getting Your 1099-G Tax Form Log in to your IDES account.

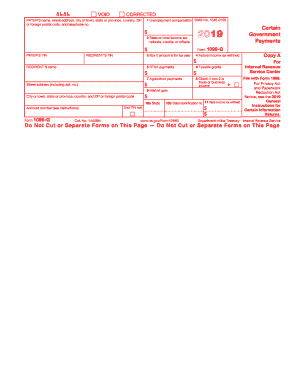

How to get a 1099-g form online. A 1099-G is a tax form from the IRS showing the amount of refund credit or interest issued to you in the calendar year filing from your individual income tax returns. Form 1099-G for New Jersey Income Tax refunds is only accessible online. Select Unemployment Services and ViewPrint 1099-G.

These forms are available online from the NC DES or in the mail. To access this form please follow these instructions. Federal state or local governments file Form 1099-G if they made certain payments or if they received Commodity Credit Corporation loan payments.

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. Follow this link to go directly to the TSC to view and print your Form 1099-G information prior years available in most cases Visit the Form 1099-G Informational Page for tips on using the TSC to access your Form 1099-G information. That we paid to you in a tax year if you itemized your federal deductions.

1099Gs are available to view and print online through our Individual Online Services. The department is now providing Form 1099-G online instead of mailing them. You can elect to be removed from the next years mailing by signing up for email notification.

Taxpayers and practitioners can access an electronic version of Forms 1099-G via the Personal Income Tax e-Services Center. These forms will be mailed to the address that DES has on file for you. This 1099-G does not include any information on unemployment benefits received last year.

Information about Form 1099-G Certain Government Payments Info Copy Only including recent updates related forms and instructions on how to file. Pacific time except on state holidays. You may owe Uncle Sam if you didnt withhold taxes.

To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return. We will mail you a paper Form 1099G if you do. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. 31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security.

How to Get Your 1099-G online. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. Your Form 1099-G information can be accessed on-line using the Departments Taxpayer Service Center TSC.

Answer the security questions. After you have successfully logged into your IDES account navigate to the dropdown menu titled Individual Home in. To view and print your statement login below.

You can access your Form 1099G information in your UI Online SM account. To access a Form 1099-G electronically a taxpayer must first register for an e-signature account by establishing a User ID and Password. If your responses are verified you will be able to view your.

For more information about Form 1099-G review the Frequently Asked Questions. We do not mail these forms. Federal Form 1099-G Certain Government Payments is filed with the Internal Revenue Service IRS by New York State for each recipient of a New York State income tax refund of 10 or more.

What is the IRS Form 1099-G for unemployment benefits. Look for the 1099-G form youll be getting online or in the mail. Local state and federal government websites often end in gov.

From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099-G section select the year you want in the NYS 1099-G drop-down menu box with an arrow and then select the Get Your NYS 1099-G button. 1099-G forms are delivered by email or mail and are also available through a claimants DES online. For Pandemic Unemployment Assistance PUA claimants the.

If you get a file titled null after you click the 1099-G button click on that file. Log in to your NYGov ID account. To determine if you are required to report this information on a federal income tax return see the federal income tax instructions contact the IRS or contact your tax professional.

The lookup service option is only available for taxpayers with United States addresses.

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

1099 G 2018 Public Documents 1099 Pro Wiki

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

1099 Form 2016 Understanding Your Tax Forms 2016 1099 G Certain Tax Forms Employment Form Job Application Form

1099 Form 2016 Understanding Your Tax Forms 2016 1099 G Certain Tax Forms Employment Form Job Application Form

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 G Form Copy B Recipient Discount Tax Forms

1099 G Form Copy B Recipient Discount Tax Forms

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Arizona Form 1099 G Vincegray2014

Arizona Form 1099 G Vincegray2014

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Va Refund 1099g Taxes Zip Code Schedule Northern Virginia Virginia City Data Forum

Va Refund 1099g Taxes Zip Code Schedule Northern Virginia Virginia City Data Forum

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Florida Residents Report Problems Accessing 1099 G Form Youtube

Florida Residents Report Problems Accessing 1099 G Form Youtube

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G Fill Online Printable Fillable Blank Pdffiller