Can I Claim Expenses Without Receipts Uk

HMRC offers this guidance in the General guide to keeping records for your tax return Sometimes you may not get evidence such as a receipt for cash expenses especially where the amounts are small. This includes the cost of buying branded uniforms protective gear such as boots or sunglasses and high-visibility clothing.

Free Expenses Claim Form Excel Template Download Excel Templates Templates Spreadsheet Template

Free Expenses Claim Form Excel Template Download Excel Templates Templates Spreadsheet Template

A contractors guide to what you can and cant claim.

Can i claim expenses without receipts uk. Aug 26 2015 If on a consistent basis there are no receipts kept for some rather large items of expenditure such as computer equipment or business travel then there is likely to be more of an issue should there be any investigation into your affairs with the potential for HMRC to disallow these expenses. To help us improve GOVUK. Valid expense claims and receipts HMRC rules state that expenses can be claimed provided they are wholly and exclusively for the purposes of your contract.

The employee was advised that he need to put claims in preferably monthly. However it depends what kind of business youre in. Other home office personal expenses you can claim include phone and broadband service costs.

There are many concessions. Without the evidence from receipts for your claimed business expenses the Canada Revenue Agency CRA may decide to reduce the number of expenses you have deducted. Jan 03 2020 Generally you cant make tax claims without receipts.

25p for every mile thereafter. The answer is ideally yes but you can still claim without one. You just need to be able to satisfy a tax inspector by showing that you did make the purchase.

Jun 29 2017 Approx 3 years ago he put in an expense claim for a period of 3 years which was signed by his Manager but questioned by the Exec. Moreover limited company directors can also claim for heating and lighting costs in case they are operating a business from their home. Apr 06 2021 There is no need to show the receipts to claim the personal expenses.

You can also claim for any dry-cleaning fees youve incurred to keep work-related clothing clean. This article was published on 20102019 One of the main benefits of trading as a Limited Company contractor is that you can claim back business expenses for anything you purchase for your business and in turn claiming for these expenses can lower your tax bill. So the company involved created an unreceipted expense claim policy which was approved by the Directors and said that in exceptional circumstances a maximum claim of 10 per day could be made as reimbursement for travel expenses if receipts were not available.

But you should keep proof and records so you can show them to HM Revenue and Customs HMRC. This could boost your tax refund considerably. Up to 300 is available with no more than 50 being spent on any individual treat for example tickets to sporting events wine a meal out a spa treatment and so on.

You reimburse an employees travel expenses - youll need to keep a record of when and why the employee travelled and where possible keep receipts as evidence. While its always best to hold on to any receipt you may still be able to claim on tax-deductible expenses if you dont have one. Chances are you are eligible to claim more than 300.

So record the details around it. HMRC confirm that for small cash expenses its sometimes OK to claim for a cash receipt that cant be substantiated. Nov 13 2016 Not exactly.

May 16 2018 You can claim up to 150 each year on clothing you buy for work. For the self employed allowing a small weekly deduction for laundry use of home as office etc which do not require receipts - however the amounts involved are small probably. Business expenses you can claim if youre self-employed.

All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. The ATO generally says that if you have no receipts at all but you did buy work-related items then you can claim them up to a maximum value of 300.

Jan 18 2021 As a director you can take small amounts of profit from your company without being concerned about tax and NI with the trivial benefits benefit in kind. 45p for the fist 10000 miles travelled. How much can I claim with no receipts.

However with no receipts its your word against theirs. Any items valued over 150 and youll need a receipt. Note that you have to have actual receipts for your business expenses before you can claim them.

Unless you can prove that you used the full tank of fuel that you purchased with your fuel receipt for business miles say for example you put a tank of fuel in a hire car or perhaps the car is parked at the business premises and is never used for personal mileage then you cannot claim for the fuel receipt. Jun 15 2017 You could of course claim anything without a receipt and simply hope the taxman never asks to see proof. You cant make tax claims without receipts.

3 years later and he has again put in expenses for a 3 year period.

What Are Business Expenses What Expenses Can I Claim

What Are Business Expenses What Expenses Can I Claim

Etsy Seller Spreadsheets Shop Management Tool Financial Tax Reporting Profit And Loss Income Expenses Spreadsheet Excel Google Docs Spreadsheet Business Business Tax Deductions Small Business Tax Deductions

Etsy Seller Spreadsheets Shop Management Tool Financial Tax Reporting Profit And Loss Income Expenses Spreadsheet Excel Google Docs Spreadsheet Business Business Tax Deductions Small Business Tax Deductions

Expenses Claim Form Template Uk Ten Lessons I Ve Learned From Expenses Claim Form Template U Templates Lesson Encouragement

Expenses Claim Form Template Uk Ten Lessons I Ve Learned From Expenses Claim Form Template U Templates Lesson Encouragement

Printable Sample Motorcycle Bill Of Sale Form Bill Of Sale Template Receipt Template Invoice Template

Printable Sample Motorcycle Bill Of Sale Form Bill Of Sale Template Receipt Template Invoice Template

Can Contractors Claim Expenses Without Receipts

Can Contractors Claim Expenses Without Receipts

For The Uk It Canada Must Have Something Similar Teacher Tax Deductions Teacher Organization Teaching

For The Uk It Canada Must Have Something Similar Teacher Tax Deductions Teacher Organization Teaching

Subcontractor Invoice Templates Construction Invoice Templates Construction Invoice Templates Model Invoice Template Invoice Template Word Invoice Layout

Subcontractor Invoice Templates Construction Invoice Templates Construction Invoice Templates Model Invoice Template Invoice Template Word Invoice Layout

The Surprising Mcgill Expense Report Per Diem And Per Diem Request Form In Per Diem Expense Report Template Photo Report Template Templates Statement Template

The Surprising Mcgill Expense Report Per Diem And Per Diem Request Form In Per Diem Expense Report Template Photo Report Template Templates Statement Template

003 Expense Report Template Monthly Fantastic Ideas Free With Regard To Quarterly Report Template Small Business Expenses Spreadsheet Template Business Expense

003 Expense Report Template Monthly Fantastic Ideas Free With Regard To Quarterly Report Template Small Business Expenses Spreadsheet Template Business Expense

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

Self Employed Expenses Explained Goselfemployed Co Small Business Tax Deductions Small Business Tax Business Tax

Self Employed Expenses Explained Goselfemployed Co Small Business Tax Deductions Small Business Tax Business Tax

Tax Deductible Expenses Nimble Jack Accounting Tax Deductions Deduction Accounting

Tax Deductible Expenses Nimble Jack Accounting Tax Deductions Deduction Accounting

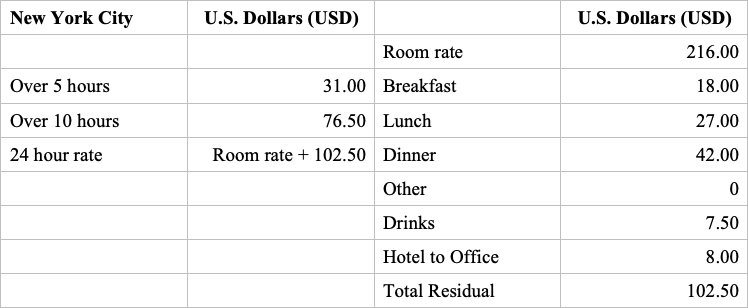

Per Diems For Dummies United Kingdom Rydoo

Per Diems For Dummies United Kingdom Rydoo

Expense Reimbursement Form Template Download Excel Expense Sheet Expenses Printable Printable Invoice

Expense Reimbursement Form Template Download Excel Expense Sheet Expenses Printable Printable Invoice

Expense Reimbursement Form Templates 17 Free Xlsx Docs Pdf Samples Excel Templates Templates Tutoring Flyer

Expense Reimbursement Form Templates 17 Free Xlsx Docs Pdf Samples Excel Templates Templates Tutoring Flyer

How To Claim Expenses When You Re Self Employed Courier

How To Claim Expenses When You Re Self Employed Courier

Do You Need A Travel Expense Voucher Template Download This Professional Travel Expense Voucher Template Template Now Templates Voucher Business Template

Do You Need A Travel Expense Voucher Template Download This Professional Travel Expense Voucher Template Template Now Templates Voucher Business Template

Marketing Project Request Form Template Inspirational Expenses Claim And Reimbursement Form Sample For Excel Excel Templates Templates Invoice Template

Marketing Project Request Form Template Inspirational Expenses Claim And Reimbursement Form Sample For Excel Excel Templates Templates Invoice Template

Charging Client Expenses How To Do It Correctly Rs Accountancy

Charging Client Expenses How To Do It Correctly Rs Accountancy