Business Mileage Tax Relief Form

Add up the Mileage Allowance Payments you have received throughout the year. _____ Business is not currently in bankruptcy.

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

4 rows Claiming tax relief on expenses you have to pay for your work.

Business mileage tax relief form. Small Business and Self-Employed Tax Center. If you have more than one job with two or more employers who arent connected the 10000-mile limit can apply to. This means you claim relief on all mileage incurred since 6 th April 2015 but not anything prior to that.

To calculate how much tax relief you can claim add up your business mileage for the tax year and multiply it by the applicable rate. Drawer 70 14010 Boydton Plank Road Dinwiddie VA 23841 Phone. For 2020 tax filings the self-employed can claim a 575 cent deduction per business.

With regards to previous years expenses for mileage you would do one of the following 1Fill in a P87 form for the years in question if the expense claim for the year is. The Act added a temporary exception to the 50 limit on the amount that businesses may deduct for food or. Effective January 1 2015 for income tax filers of 2015 taxes where a resident of the City of Portsmouth Ohio is subject to a municipal income tax in another municipality he shall receive a credit of the tax paid to another municipalitys up to fifty-percent 50 of the amount owed to the City of Portsmouth Ohio.

Businesses can temporarily deduct 100 beginning January 1 2021. There are a few nuances with this though. Click here for specific instructions regarding opening and using any of our pdf fill-in forms if you are a Windows 10 user.

You can complete your P87 form online or by completing a postal form. Enter a full or partial form number or description into the Title or Number box optionally select a tax year and type from the. City of Portsmouth Small Business Relief Program Application _____ Business location is in Portsmouth Ohio and the grant funding will be used for expenses for that business.

To claim Mileage Allowance Relief as an employee youll need to either fill out your usual annual self-assessment tax return or complete form P87. You can claim even if you are no longer at the same employer. Filing and Paying Business Taxes.

Total Mileage Allowance Relief 4000 Total tax rebate. Online resources for taxpayers who file Form 1040 or 1040-SR Schedules C E F or Form 2106 as well as small businesses with assets under 10 million. Business Personal Property Return 2021 PDF Business Personal Property Return 2020.

When it comes to mileage tax deductions the self-employed mileage deduction is the largest one available. The P87 form allows you to claim income tax relief against your employment expenses including business mileage. Be advised this is a.

You will need a new P87 form for each job you need to request relief from the assignment of miles this form can also be used to claim other business expenses such as union fees lodging and other travel expenses. Subtract the received MAP from the approved amount you should have received. Are there time limits for claiming.

Claiming your business miles is a form of tax relief meaning the cost of your mileage will reduce your tax bill at the end of the year. This means you may be able to claim for your mileage at HMRCs approved mileage rate. If you usually do not need to complete a tax return you can use form P87 on HMRCs website to claim MAR.

You can only claim tax relief if your employer hasnt reimbursed you for your expenses. The claims for reimbursement of NIC effectively provide for a mirroring of the tax relief enjoyed by the driver. _____Business has not received more than 20000 in other federal assistance for lost revenue or.

You may be able to claim. Add up your business mileage for the whole year. If you use a vehicle for your business the cost of owning and running it might be classed as a business expense.

Disabled Veteran Real Estate Tax Relief Filing Form PDF Freedom of Information Act PDF High Mileage Discount - 2021 PDF Property Tax Exemption Application PDF Real Estate Tax Relief Application PDF Tax Prepayment Coupons PDF Business Property Forms. 5000 x 20 800. IR-2021-79 April 8 2021.

The level of Mileage Allowance Relief a driver can claim for tax purposes cannot exceed 45p per business mile 25p per mile if the mileage exceeds 10000 less any amount already paid tax free to the driver. If youve received partial reimbursementfor instance you receive 25p per mile rather than HMRCs approved mileage rate of 45p per mileyou can claim tax relief on the difference. WASHINGTON The Treasury Department and the Internal Revenue Service today issued Notice 2021-25 PDF providing guidance under the Taxpayer Certainty and Disaster Relief Act of 2020.

You must claim within 4 years after the end of the tax year. The maximum relief for NIC is always 45p per business mile.

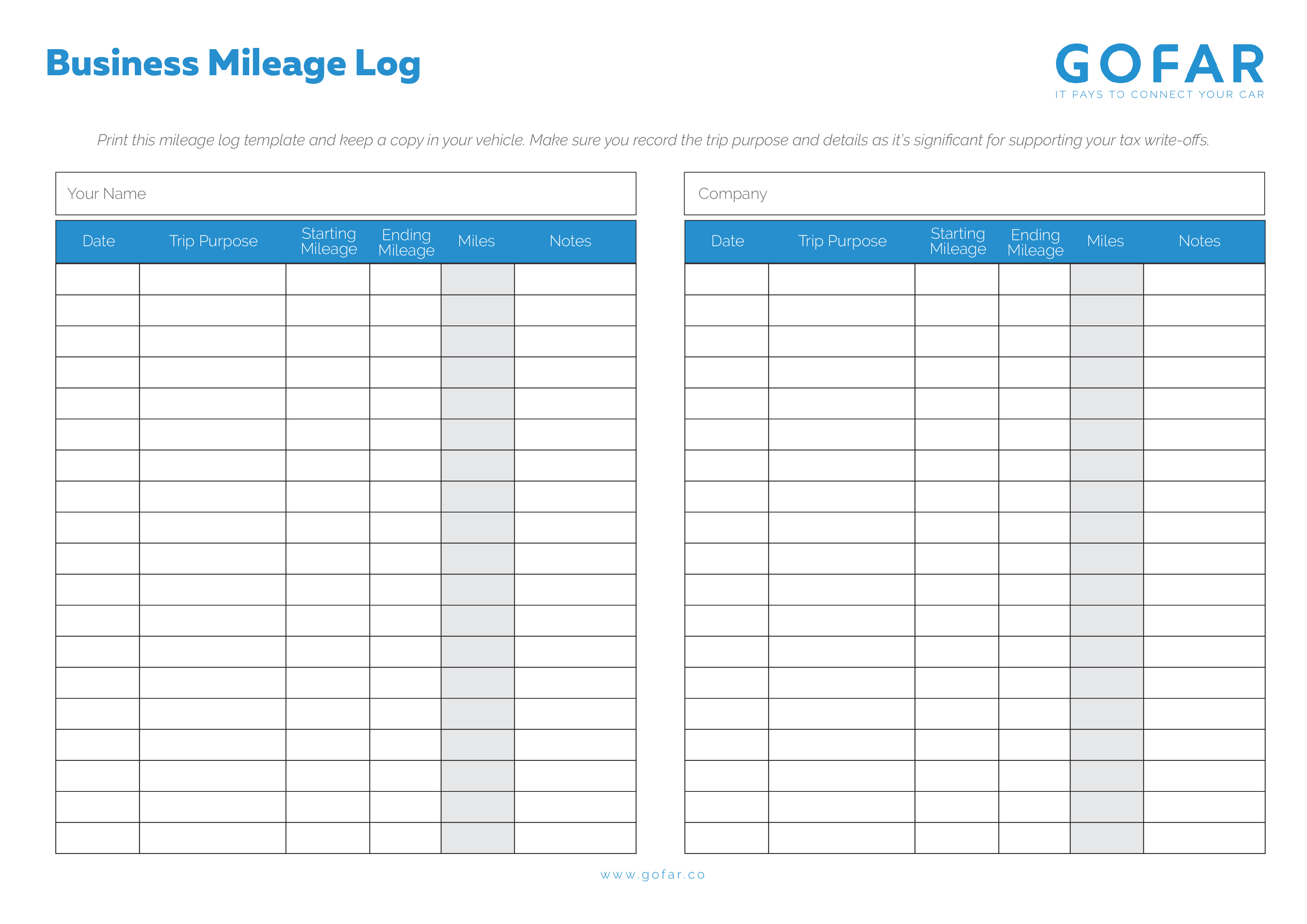

25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

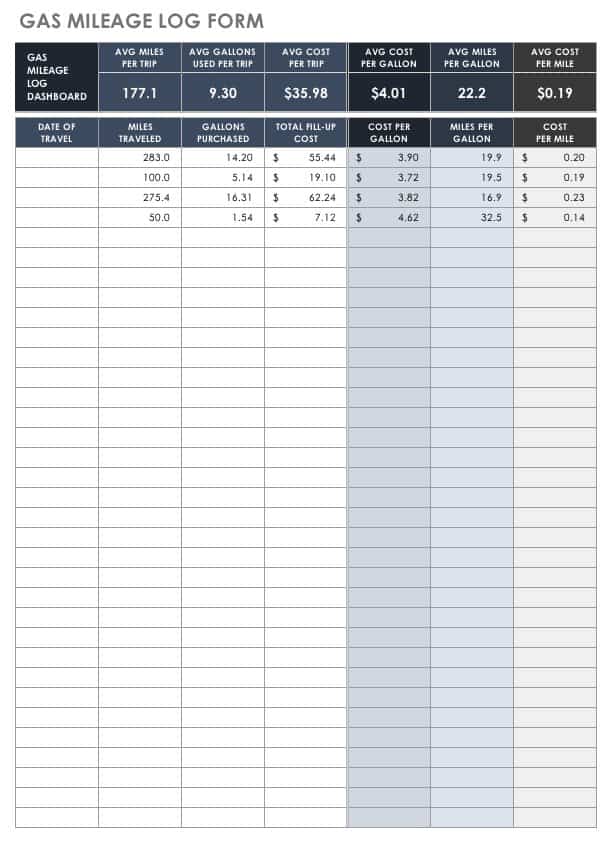

Free Printable Vehicle Expense Calculator Microsoft Excel Templates Printable Free Business Tax Deductions Mileage Log Printable

Free Printable Vehicle Expense Calculator Microsoft Excel Templates Printable Free Business Tax Deductions Mileage Log Printable

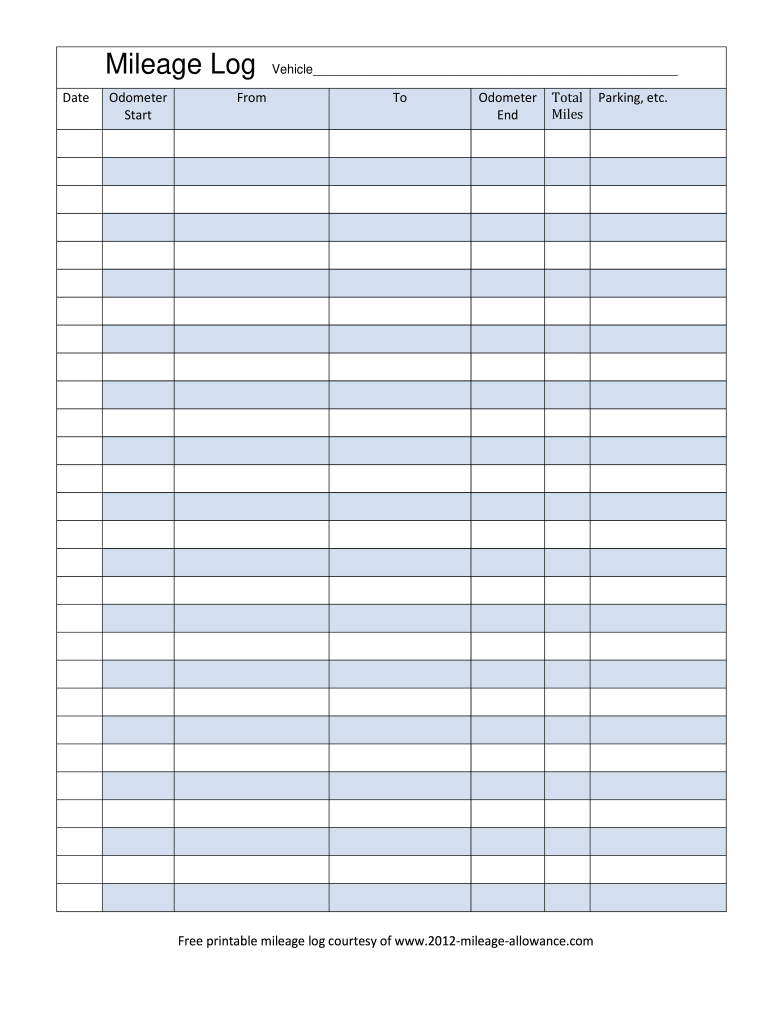

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

Medical Mileage Expense Form Mileage Expensive Medical

Medical Mileage Expense Form Mileage Expensive Medical

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Mileage Log Form For Taxes Lovely Mileage Log For Tax Deduction Template Party Invite Template Sign Up Sheets Templates

Mileage Log Form For Taxes Lovely Mileage Log For Tax Deduction Template Party Invite Template Sign Up Sheets Templates

![]() Free Mileage Tracking Log And Mileage Reimbursement Form

Free Mileage Tracking Log And Mileage Reimbursement Form

Small Business Tax Prep Kit Tax Forms Tax Logs Tax Cheat Etsy Small Business Tax Tax Prep Business Tax

Small Business Tax Prep Kit Tax Forms Tax Logs Tax Cheat Etsy Small Business Tax Tax Prep Business Tax

![]() Free Mileage Tracking Log And Mileage Reimbursement Form

Free Mileage Tracking Log And Mileage Reimbursement Form

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage Tracker Printable Mileage Tracker App

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage Tracker Printable Mileage Tracker App

2012 Form Mileage Allowance Free Printable Mileage Log Fill Online Printable Fillable Blank Pdffiller

2012 Form Mileage Allowance Free Printable Mileage Log Fill Online Printable Fillable Blank Pdffiller

Home Business Worksheet Template Business Worksheet Small Business Tax Deductions Business Tax Deductions

Home Business Worksheet Template Business Worksheet Small Business Tax Deductions Business Tax Deductions

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Home Business Tax Deductions Are Just One Reason Of Many That A Home Based Business Is So Attractive Small Business Tax Business Tax Deductions Business Tax

Home Business Tax Deductions Are Just One Reason Of Many That A Home Based Business Is So Attractive Small Business Tax Business Tax Deductions Business Tax

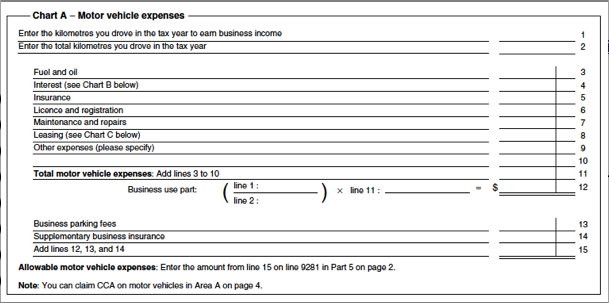

Business Vehicle Expenses Focus On Tax

Business Vehicle Expenses Focus On Tax

Form 2106 Instructions Information On Irs Form 2106

Form 2106 Instructions Information On Irs Form 2106